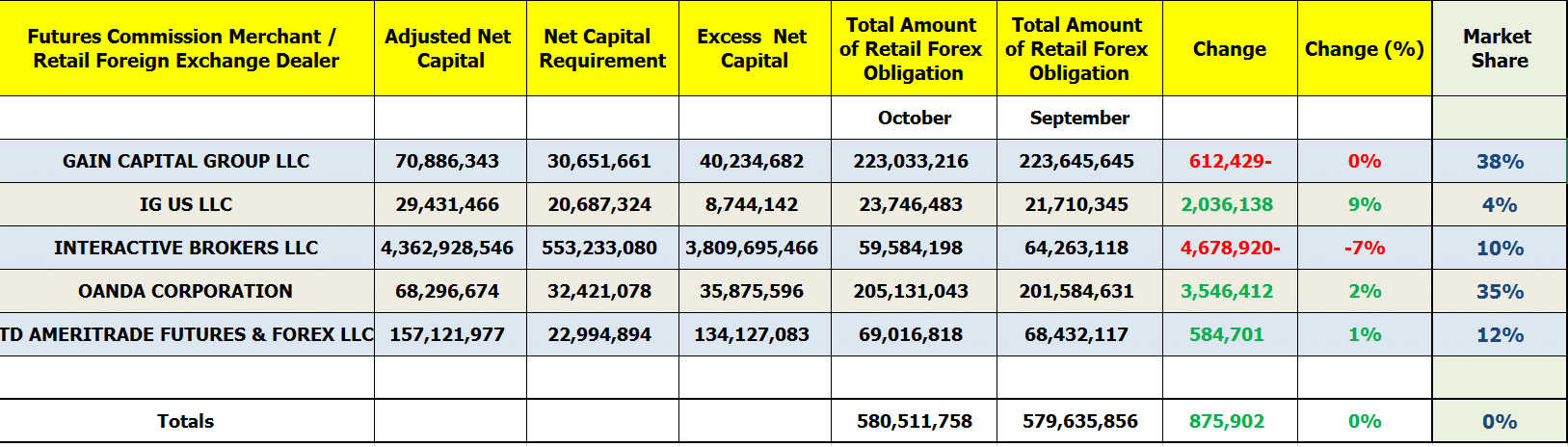

Data from the US securities regulator for October shows that all registered retail FX platforms added less than $1 million in clients’ deposits. The less than 1 percent increase came as trading activity surged in other segments. This was amid a boom in retail investments during an unprecedented time for financial markets.

IG US was the best performer among retail FX brokers in the United States, after racking up $23.7 million in customer deposits in October, up nine percent from the month earlier.

Other highlights from the CFTC’s monthly report shows that OANDA Corporation has won $3.5 million in additional deposits. The Canadian broker’s totals for this segment stood at $205 million in October 2020.

In contrast, Interactive Brokers LLC (NASDAQ:IBKR) lost nearly $4.6 million in retail forex deposits, or seven percent compared to the figure of September, which stood at $59 million.

In the same month, the electronic brokerage segment at , which deals with clearance and settlement of trades for individual and institutional clients globally, also saw a ten percent drop in daily average revenue trades, or DARTs. However, the discount broker experienced a rush of activity in November with volumes raising to a record 2.29 million trades.

The mixed turnover comes as has won more clients as volatile markets and renewed stay-at-home restrictions had seemingly amplified interest from retail investors. November’s active accounts increased to 1.03 million, or 3 percent higher from the previous month when this metric crossed the one million milestone for the first time in the company’s 42-year history.

Meanwhile in July, saw a decrease of nearly $612,000 million. Additionally, showed some minor changes in clients deposits, having risen by $584,00 or 1 percent month-over-month.

Overall, the CFTC’s latest monthly report shows that balances of US retail traders have skewed slightly higher during the reported period.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending October 30, 2020. For purposes of comparison, the figures have been included against their September 2020 counterparts to illustrate disparities.

Interactive Brokers’ Retail FX Funds Drop 7pct in October

More from AnalysysMore posts in Analysys »

Be First to Comment