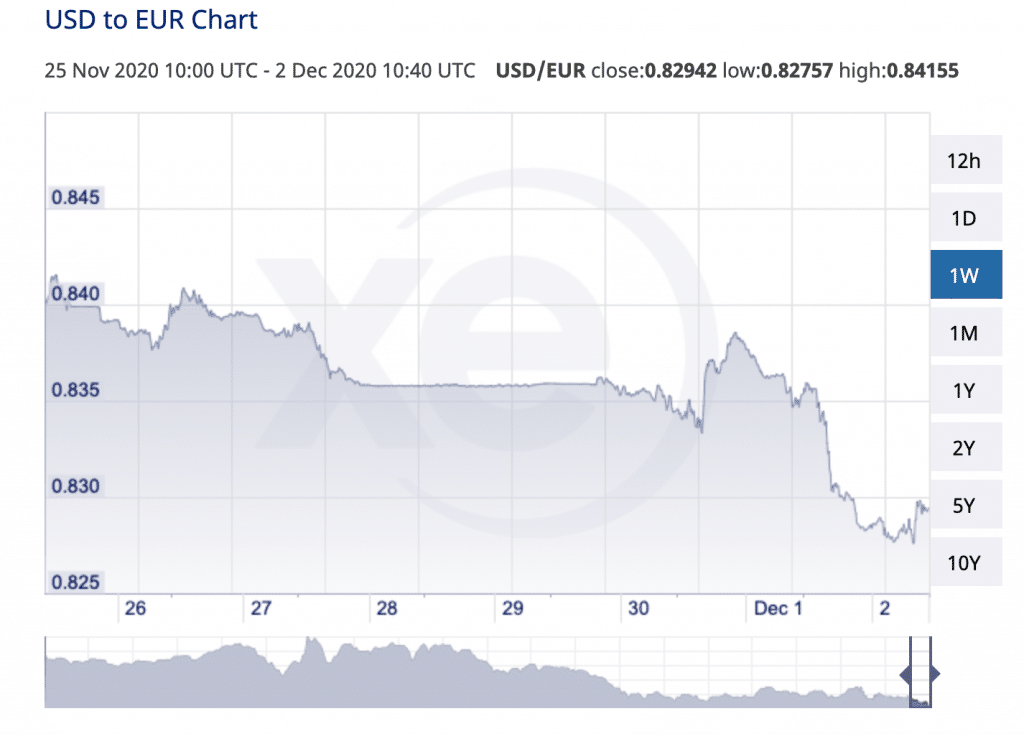

Reports have emerged throughout the week that the United States dollar has reached its lowest point in more than two and a half years. The social, political and macro-economic consequences of prolonged weakness in the dollar could be severe. However, in the short term, there is one group of people that seems to be looking on the bright side of a weakened USD: Bitcoin hodlers.

In one respect, the reasons for this seem to be quite clear: in a recent note to clients, “the improving outlook for global growth combined with strong signals from the Fed that it will maintain loose monetary policy well into the economic recovery has been encouraging a weaker U.S. dollar.”

Indeed, after COVID-19 began to wreck the United States economy earlier in the year, the Federal government responded with quantitative easing (QE). As more dollars are ‘printed’ and added into the economy, the more that many economists believe that the dollar was on the path to possible inflation and weakening over the long term.

While it is too early to say exactly where the dollar will go from here, some analysts believe this moment of weakness could be the first sign of what is to come.

”A Weak Dollar Is a Dream Scenario for Crypto.”

Indeed, “a weak Dollar is a dream scenario for crypto,” said Bill Noble, the Chief Technical Analyst at Token Metrics, to Finance Magnates. Bitcoin and other cryptocurrencies “are a legitimate component of the foreign exchange market, and it’s like any other currency. It rises as the Dollar falls.”

Chief Technical Analyst at Token Metrics.

Therefore, he believes that consumers in the United States will eventually be forced to turn to Bitcoin as a safe haven for their savings, just as many in Venezuela, Turkey, Iran, and other countries have done when their nations were stricken with hyperinflation or other economic crises.

“Consumers will be forced to own crypto in their PayPal account to protect their purchasing power,” Noble said. “Consumers will need crypto to rise as the Dollar falls. The rising crypto can be sold to be used to buy higher-priced goods like food and housing.”

“It Would Be a Mistake to Assume That Bitcoin’s Price Can Only Go up If the US Dollar Weakens.”

Dr. Garrick Hileman, Head of Research at Blockchain.com, also told Finance Magnates that a weaker dollar is basically a positive thing for Bitcoin. “some, including Michael Saylor, CEO of MicroStrategy, have explicitly stated they were attracted to purchasing Bitcoin due to perceived US dollar weakness,” he pointed out.

“However, Bitcoin has historically not shown a consistent correlation with the movement of the US dollar, or other asset classes for that matter,” Hileman explained. “Given the broad range of uses for Bitcoin, including some non-monetary uses like Microsoft’s digital identity system, it would be a mistake to assume that Bitcoin’s price can only go up if the US dollar weakens.”

“Nobody believes that will end anytime soon,” Token Metric’s Bill Noble told Finance Magnates. “The new Treasury Secretary, Janet Yellen, is a former Fed chairman. QE is in her blood.”

“So, that means the Fed will continue to flood the market with Dollars,” Noble continued. “The Treasury will likely add to the flood by creating additional lending programs and facilitating ongoing payments to all taxpayers. While helping Americans survive is an admirable goal, the mechanism to do that is Dollar negative.”

Could the Dollar Recover?

“Yes and no,” Bill Noble said. “The US dollar has a path to recovery against other major fiat currencies, particularly if events like a no-deal BREXIT or a major European debt sustainability crisis were to unfold.”

Additionally, “USD-backed stablecoins and a well designed official US digital dollar launched in the not-too-distant future could also help boost demand and use.”

Still, Noble pointed out that the dollar’s days may be numbered: “many feel any recovery by the US dollar against a crypto asset like Bitcoin will be relatively short-lived,” he said. Though, this view is likely relatively insular within the Bitcoin community.

In any case, “a growing number of people would prefer to store value in something scarce like Bitcoin, with an algorithmically hard-capped total supply, than something with a supply growing in perpetuity like the US dollar,” Noble said.

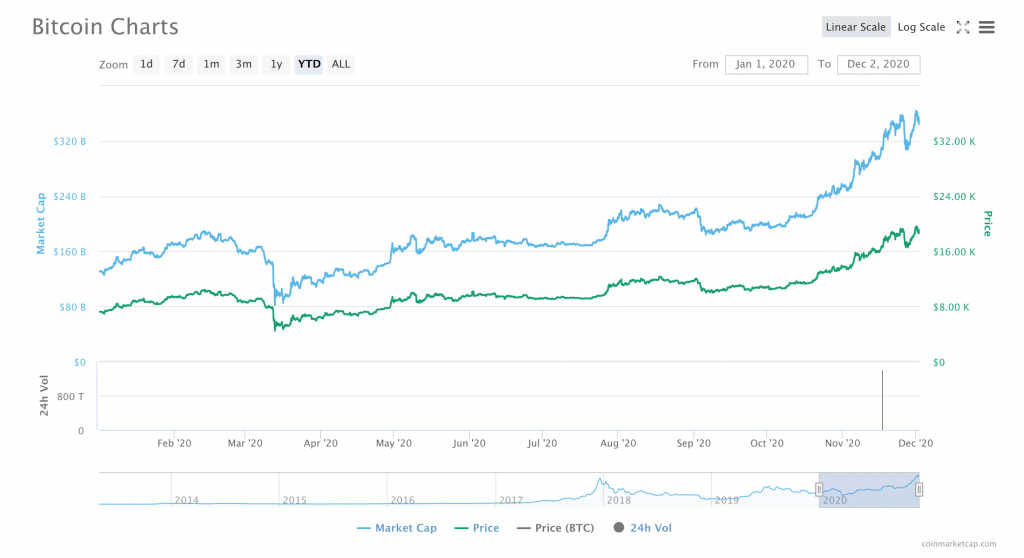

And indeed, Bitcoin is increasingly being added to the portfolios of multi-billion dollar corporations.

At the end of the day, Bitcoin and the dollar (or any other fiat currency, for that matter) share an inextricable bond: the value of Bitcoin is still denominated in dollars or euros or yen; we have not reached a point in which Bitcoins are valuable in and of themselves. In almost all settings, Bitcoin must be converted into fiat currency before it can be used to purchase just about anything.

Of course, there is a possibility that this could change. Many will point to the letter from the US Office of the Comptroller of the Currency that permitted US banks to offer custody services for cryptocurrencies earlier in the year. Still, the world seems to be a long way from measuring Bitcoin alone, without bringing fiat currencies into the mix of measuring BTC’s value.

Other Factors Have Also Been Driving Bitcoin up

And, even if the point at which Bitcoin will no longer be measured in fiat currency is in the distant future, Zac Prince, Chief Executive of BlockFi, believes that “the narrative of Bitcoin as a hedge against devaluation, as a portfolio diversifier and as an asset with the potential for outperformance has finally stuck.”

“Seeing is believing, and 150%+ growth year-to-date has clearly been enough for the curious to take the plunge,” he said.

“Institutional inflows may have been much of the driving force behind this rally, but it’s been retail investors that have helped Bitcoin pick up steam in recent weeks,” he said. However, data from his own company shows that “balances on BlockFi’s retail accounts have grown over 25% in the last 30 days, compared to just under 10% for institutional.”

“That said, we’ve seen a 145% growth in institutional activity over the last three months, which is exponentially higher than what we saw in retail,” he explained. “This aligns with how institutional sentiment has grown over the last three months, as notable hedge fund managers and CEOs disclosed their investment and their support for Bitcoin.”

As for Bitcoin’s next move, Prince believes that “a fresh wave of retail activity may be what finally pushes Bitcoin past $20,000. Some of these traders may be willing to take some profit and walk away after that point, but there’s a much larger contingent of retail investors that are going to take every chance possible to add to their holdings,” he said. “The runway to $25,000 is looking clearer by the day.”

What’s Next?

Still, while an increase in the price of Bitcoin is a positive side-effect of a weakening US dollar, Alex Mashinsky pointed out to Finance Magnates in October that “as plans for big government spending continue, combined with the Fed continuing to do whatever it takes to keep the safety net under the US economy, you can see how a mountain of debt, greater than all the debt anyone had in history, will come bearing down on the US dollar.”

In other words, it is possible that we could be staring down the barrel of the end of the dollar’s status as the world’s dominant currency.

Indeed, Steve Ehrlich, Chief Executive and Founder of Voyager Digital told Finance Magnates that the end of the dollar as the world’s reserve currency is “most certainly possible.”

‘History tells us that World dominant currencies are always temporary cycles which only last 100 to 200 years,” he said.

But, the US still has a chance to turn things around: “for the sake of the American economy though, we hope this isn’t the case, that we find a new era ushered in by American innovation in combination with digital currencies,” Ehrlich said.

Is a Weakened USD a ‘Dream Scenario for Crypto’?

More from AnalysysMore posts in Analysys »

Be First to Comment