The Great Britain pound versus the United States dollar currency pair seems to be willing to go along with the bulls. Are they able to keep up and resume the climb?

Long-term perspective

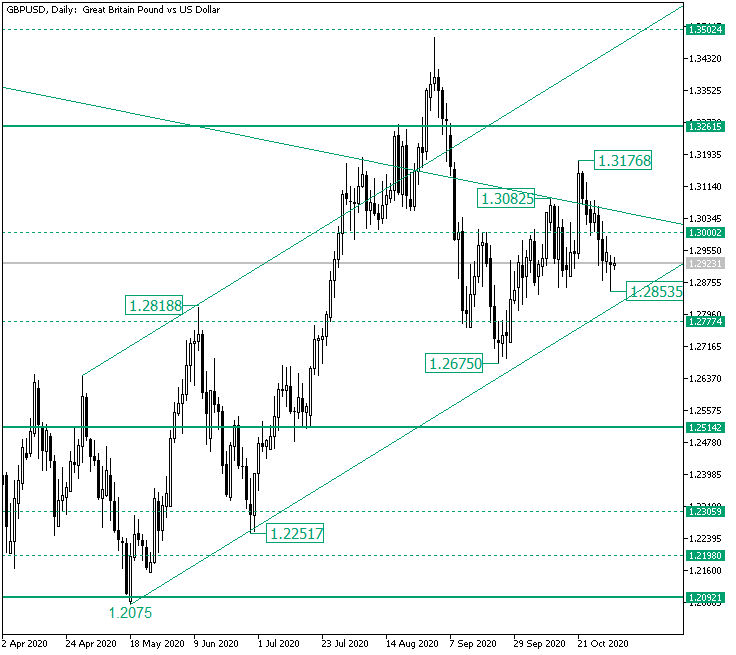

After the price validated the 1.2092 support area, the price extended until the 1.2777 intermediary level, crafting the 1.2818 high.

The correction swing that followed defined the higher low of 1.2251, and, with it, the new ascending trend was graciously marked on the chart.

From the 1.2251 low, the price then extended a hair away from 1.3502. The retracement that was supposed to validate the firm level of 1.3261 as support ended up as a false piercing.

As a consequence, the bears took over, sending the price a little under the 1.2777 intermediary level. From there, the bulls kept persisting, but the double resistance — made up by the descending trendline and the 1.3000 psychological — level limited their progress, as the 1.3082 and 1.3176 highs display.

Nevertheless, on the 2nd of November, the price printed a low at 1.2853, just above the lower line of the ascending channel.

This may give the bulls another shot, making 1.3000 the first target. If 1.3000 is validated as resistance, then a head and shoulders chart pattern could be underway, with the area highlighted by the 1.2843 low as the neckline. If 1.3000 is passed and confirmed as support, then 1.3261 is the second target.

Of course, the drop from 1.3176 could simply continue, rendering 1.2777 as the first bearish objective.

Short-term perspective

The fall that started after the firm level of 1.3175 was proved as resistance extended under the 1.2983 level and then around the 1.2876 intermediary level.

If 1.2876 gives way, then 1.2783 is the next bearish stop. On the other hand, if 1.2876 remains support, 1.2983 may be paid a visit.

Levels to keep an eye on:

D1: 1.3000 1.3261 1.2777

H4: 1.2876 1.2783 1.2983

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Be First to Comment