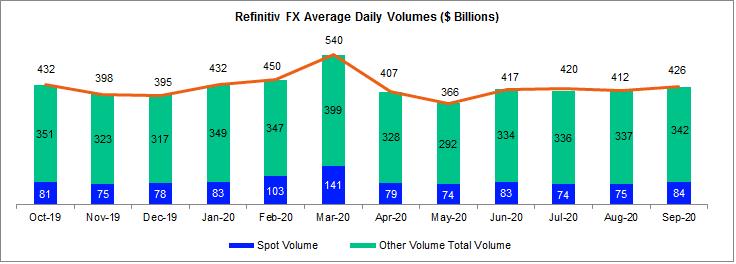

Refinitiv, the former , today reported that the average daily volumes (ADV) of currency trading were $426 billion last month on the company’s main FX trading services. September’s ADV figure is the highest in six months, namely since currency volumes peaked at $540 billion back in March 2020.

Foreign exchange trading volumes across Refinitiv Matching and FXall platforms were up 3.4 percent from $412 billion in August 2020, but the figure was down three percent than $439 billion in September 2019, and also reflects a 21 percent drop from March’s record metrics.

This was the third monthly rise of turnover in a row since the volumes bottomed out at $366 billion in May when corona-led volatility that sparked record trading in March lost steam.

Spot FX volumes at , still partly owned by Thomson Reuters, held up much better than other volumes, which include swaps and options. The institutional venue reported $84 billion was FX spot, representing a 12 percent rise over the monthly interval when compared to $75 billion in August 2020. Over a yearly basis, the spot turnover slightly outpaced its counterpart of September 2019, which came at $83 billion.

Refinitiv Provides Resources to Trading Central

Stronger activity in other transaction types – including forwards, swaps, options and non-deliverable forwards (NDFs) contributed to the monthly rise, having clocked in their best month since March. The figure averaged $342 billion daily, up two percent from $337 billion the previous month.

reflect the trend observed in the monthly figures from many of the major trading platforms which have seen record-breaking volumes in the first quarter before turning to suffer lackluster activity. But after several flat months, the latest metrics from major show the FX market has bounced back with hefty jumps in daily trading volumes.

has recently struck up a strategic agreement with , which will see both Refinitiv and Reuters provide resources to TC Market Buzz, a news curation application for Wealth Management firms.

Under the agreement, Refinitiv, will provide, its , and Reuters, its digital news, to bolster the news portal. TC Market Buzz aims to help modernise digital investor portals.

Be First to Comment