The Australian versus the New Zealand dollar currency pair seems to be unwilling to go any lower. It’s the bulls behind all this, or a new depreciation is just around the corner?

Long-term perspective

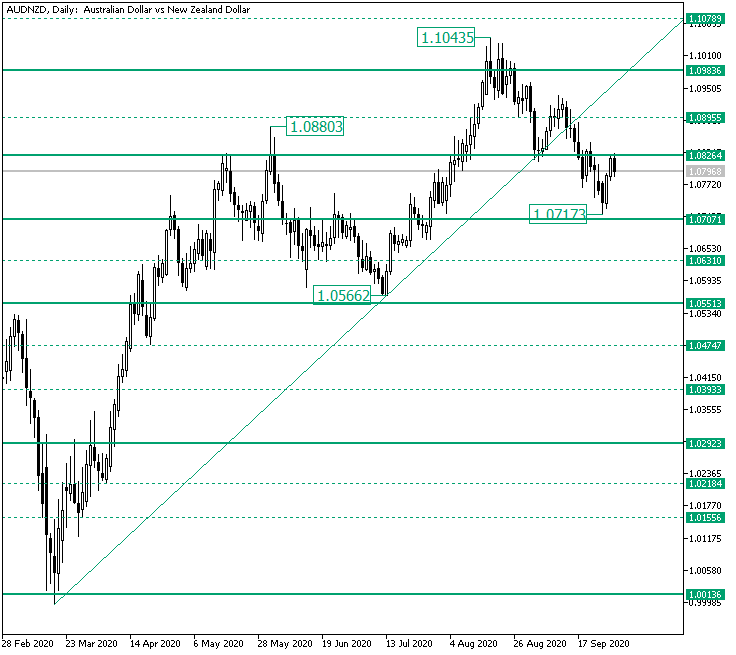

After the rally that started from the 1.0013 support area and the correction that extends from the 1.0880 high to the 1.0566 low, the price continued until the 1.1043 peak.

But as the peak formed above the major 1.0983 level and the following oscillations were not able to validate it as support, the bears kicked in, drawing a depreciation that not only pierced the double support etched by the ascending trendline and the 1.0826 level but also drove the price close to the next support area, 1.0707, printing the low at 1.0717.

However, the bulls show signs of determination, as from the 1.0717 low, they successfully sent the price to the 1.0826 ex-support area.

Of course, if they attempt and secure to confirm 1.0826 as support, then they could send the price to the next resistance, the 1.0895 intermediary level.

If the bears don’t put pressure from there, then the bulls could target 1.0983. On the other hand, if the bears keep the bulls in check and 1.0895 remains resistance, then a new drop may be in place, one that would target 1.0826 and also try to revisit 1.0707.

Short-term perspective

The resumption of the fall at the 1.0936 high extended to as low as 1.0717, piercing and validating as resistances both 1.0866 and 1.0820 firm levels.

But as the bulls retook control, they sent the price just beneath the 1.0820 level.

So, if 1.0820 is validated as support, then the bulls can have 1.0866 as their next objective, followed by 1.0921. On the flip side, if 1.0820 remains resistance, then 1.0778, and even 1.0741, may be paid a visit.

Levels to keep an eye on:

D1: 1.0826 1.0895 1.0983 1.0707

H4: 1.0820 1.0866 1.0921 1.0778 1.0741

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Be First to Comment