After only having just completed its last share buyback program, Plus500 (LON:PLUS) is back at it again, with the repurchasing more than 4 thousand of its ordinary shares.

Yesterday, at the same time as announcing its for the first six months of this year, the Israel-based broker revealed that it would be commencing yet another share buyback program. In its latest round, the company is planning on repurchasing $67.3 million worth of its own shares.

According to a regulatory filing through the news service of the (LSE), on the 11th of August 2020 Plus500 bought 4,119 of its ordinary shares of ILS 0.01 each through Credit Suisse Securities (Europe) Limited.

The volume weighted average price paid per share was £12.87. Therefore, the broker spent around £52,999.58 for its first batch of shares. The lowest price paid per share was around £12.81 and the highest price paid per share was £12.91.

Looking at the document, it appears the Plus500 is starting off its new buyback program slowly. As , during its previous buyback, the broker was regularly spending around £300,000 per batch.

In its , before the one announced on Tuesday of this week, the contracts for difference (CFD) trading provider repurchased $38.9 million worth of its own ordinary shares. The program concluding during the first half of 2020.

Plus500 shares rise after record H1 2020 results

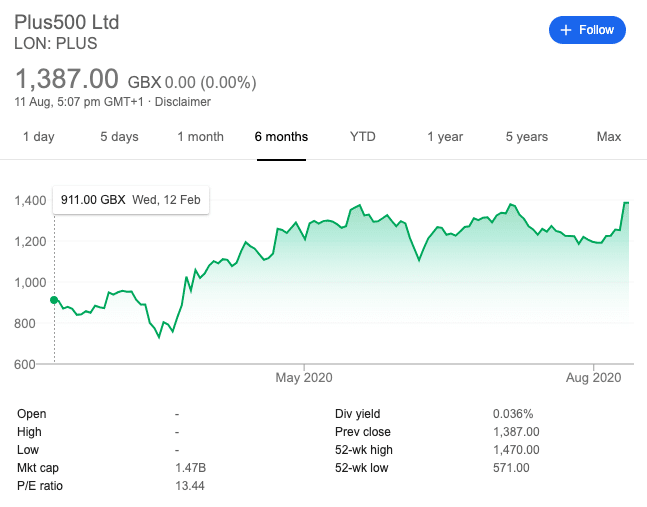

At the close of trading on Tuesday this week, Plus500’s share price was at its highest point since the onset of the coronavirus pandemic – even higher than during March when COVID-19 driven volatility was at its peak. At the time of publishing, the broker’s share price is around £14.00.

Be First to Comment