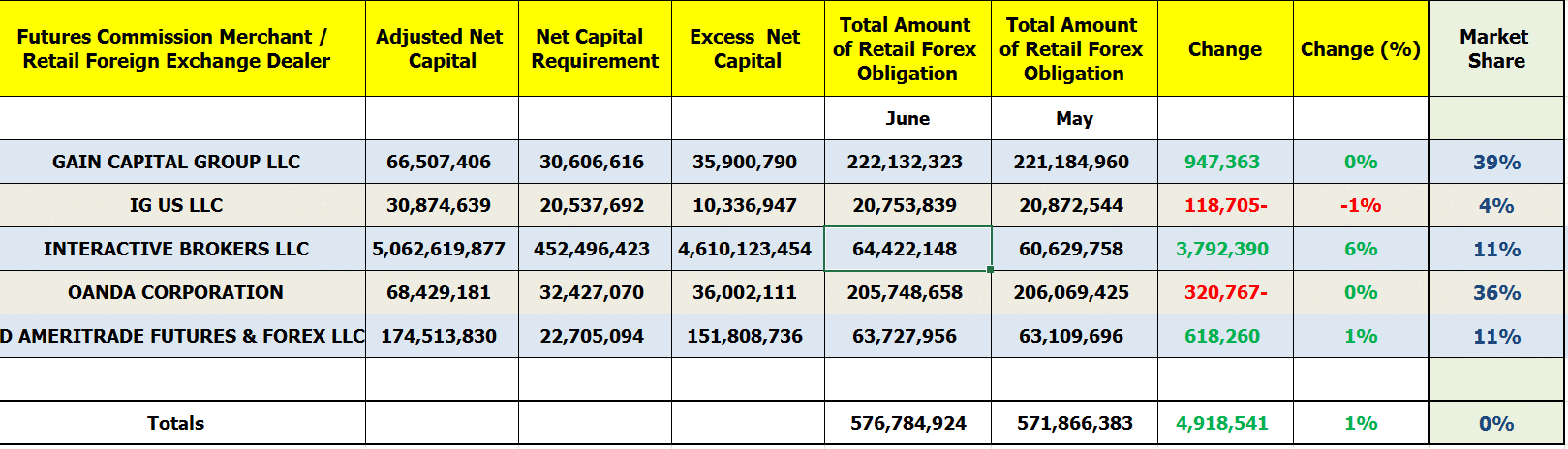

Data from the US securities regulator for June shows that all registered retail FX platforms added less than $5 million in clients’ deposits. The less than one percent increase came though trading activity surged in other segments amid a boom in retail investing during an unprecedented time for financial markets.

After consecutive increases in its market share, IG US has suffered a slight drop in retail deposits in June 2020. Specifically, the broker’s net balances decreased by $118,000, or one percent, to $20.7 million. The US arm of Europe’s largest spread better has been the best performer over the last year after recording an overall rise of nearly 600 percent in traders’ deposits relative to the figures it booked when the company re-launched its operations a year ago.

Other highlights from the CFTC’s monthly report shows that Interactive Brokers LLC (NASDAQ:IBKR) has racked up $3.8 million in additional deposits, which stood at $64.4 million in June 2020. In the same month, the electronic brokerage segment at , which deals with clearance and settlement of trades for individual and institutional clients globally, experienced a rush of activity with volumes rising by 131 percent year-over-year and nearly 13 percent on a monthly basis.

Meanwhile, saw an increase of nearly $1 million, while retail funds at OANDA Corporation slumped by more than $320,000 in July. also showed minor changes in clients deposits, having risen by $618,00 or one percent month-over-month.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending on June 30, 2020 – for purposes of comparison, the figures have been included against their May 2020 counterparts to illustrate disparities.

Be First to Comment