2019 was a bad year for Australian residents, with the Australian Competition and Consumer Commission (ACCC) publishing a report this Monday that Aussies lost more than AU$634 million (US$435.2 million) to scams during the year.

According to the authority, the amount lost to scams in 2019 was an increase of 34 per cent to the AU$489 million loss reported in 2019. This amount is based on financial losses to scams as reported to Scamwatch, other government agencies and the big four banks (ANZ, Commonwealth Bank, NAB and Westpac).

However, what is interesting, is that although the losses increased in 2019, the number of reports made to scamwatch actually declined by 5 per cent year-on-year in 2019.

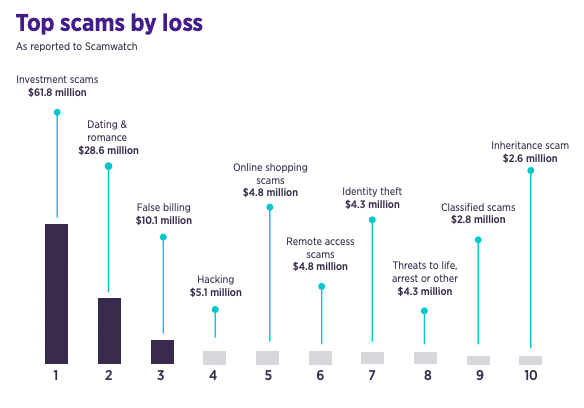

Out of the AU$634 million lost in 2019, AU$126 million of that was lost to investment scams, the ACCC said in its report. This translates to an increase of 59 per cent when measured against the previous year.

As , the ACCC previously announced that Australians lost AU$61.61 million during 2019 to investment scams. However, this figure is based purely on reports to scamwatch, whereas the above figure of AU$126 million is based on reports submitted to Scamwatch, other government agencies and the big four banks.

ACCC: crypto scams on the rise in 2019

In particular, the agency that: “High-profile investment scams using ‘celebrity’ endorsements contributed to significant individual financial losses.”

Furthermore, cryptocurrency became increasingly problematic in 2019 for Australian residents. In fact, AU$21 million was lost by Australians in 2019, an increase from the previous year. Most of these scams were Ponzi schemes, with no real crypto involved, and cloud mining farms became a common adaptation of this type of scam.

“Scammers continue to adapt their strategies and technology use. In the past scams have relied on persuading a victim to hand over money or personal information. While this is still the norm, many scams, including phone porting scams, now operate with limited contact or none at all, making it difficult for targets to recognise and avoid them,” the ACCC said in its report.

“Scammers have moved to unexpected platforms to target victims. For example, in 2019 we saw dating and romance scammers targeting unsuspecting victims through gaming apps such as Words With Friends, and investment scammers targeting Facebook and Instagram users with ‘get rich quick’ cryptocurrency investment scams.”

Be First to Comment