FXCM Group today reported its execution quality metrics for May 2020, which showed the spread on its Gold instrument remains high as traders pay over the top to get their hands on the safe-haven asset. The report, however, shows stable rates across its average spreads for cryptocurrency and certain FX instruments.

FXCM charged traders on average 64.3 pips on the XAU/USD pairing (the ratio of gold to the US dollar), up from 15.7 pips in March 2020.

Like most asset classes, gold was affected by the unprecedented economic and financial market conditions in play around the globe. The bullion liquidity was thinner recently due to logistics issue as the coronavirus has decimated supply chains across the world.

This has led to much wider spreads than usual while margin requirements increased on trading platforms run by banks and brokers, with the difference between prices in New York and London rising to as much as $70 an ounce.

Meanwhile, investors have been piling into gold this year in order to hedge against the rapid spread of coronavirus.

For the cryptocurrency pairs, the company averaged 27.5 pips on BTC/USD, down from 28.1 in March.

May’s spread was significantly lower when weighed against the 44 pips the company charged when it first reported spreads metrics for its bitcoin instrument two years ago, which in itself was in line with the industry norm at the time.

For the Ethereum and Litecoin instruments, charged on average 0.9 and 0.3 pips, respectively, also a touch lower from the months prior.

FXCM has recently expanded its crypto offering with the launch of a for its retail clients.

Named CryptoMajor, the product groups five cryptocurrencies all into one tradeable derivative, therefore, allowing traders to collate multiple instruments in one go, without the need to independently manage them. Instead of adding more exposure to a major cryptocurrency, FXCM’s CryptoMajor is made up of Bitcoin, Ripple, Litecoin, Bitcoin Cash, and Ether, giving an equal weighting for each coin in the basket.

According to figures stated in the report, the average spreads on the EUR/USD, GBP/USD, and AUD/USD pairs were 0.1, 0.5, and 0.2 pips, respectively.

also published its price improvements/slippage statics for May 2020, which showed the following highlights.

The company also reported on its execution speed, which is measured from the time a customer’s order is received to the time of filling. The average order execution time was 28 milliseconds in May. Although an important factor in determining where orders are routed, it is only one factor. Some brokers already provide a good speed of execution but fail to provide price improvement or liquidity.

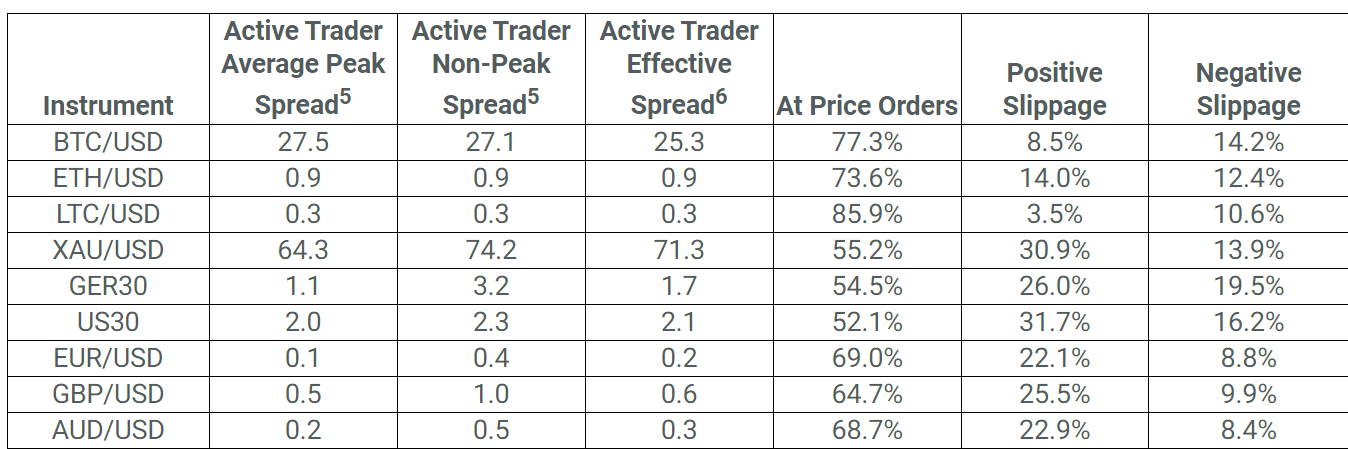

The following table shows the exact figures in May:

Be First to Comment