The first quarter of 2020 should be very positive for the retail forex industry as January and February analysis indicates. examines the latest data from , highlighting key improvements.

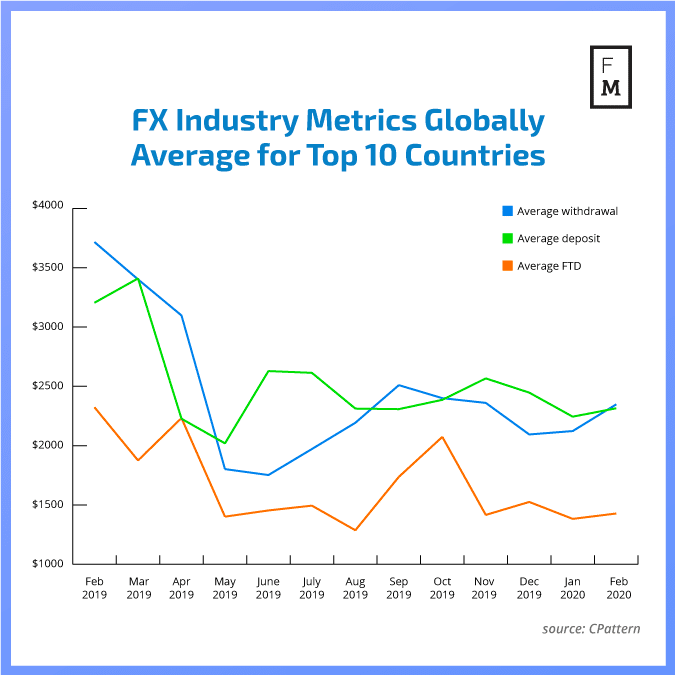

The main picture though remains little changed. It can be observed on the first chart that key metrics for the industry stay on a very similar level since May 2019. In February 2020 average size of one time deposits were equal to $2,315.28, just $32.78 below the size of the average withdrawal. Average first-time deposit(FTD) for new clients increased to $1427.89.

Retail forex industry very active

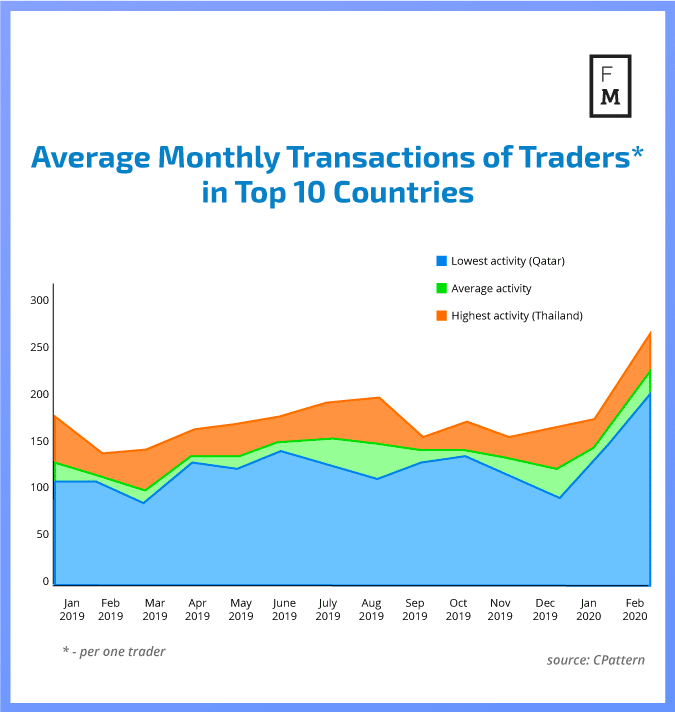

The biggest changes in February was observed in filed of traders activity, measured by the average number of transactions per month. This metric literally skyrocketed, with average activity growing to 207.8 from 147.3 seen in January. Again Asian traders dominated this rank. However this time it was Thailand, not China, to take first place in this category.

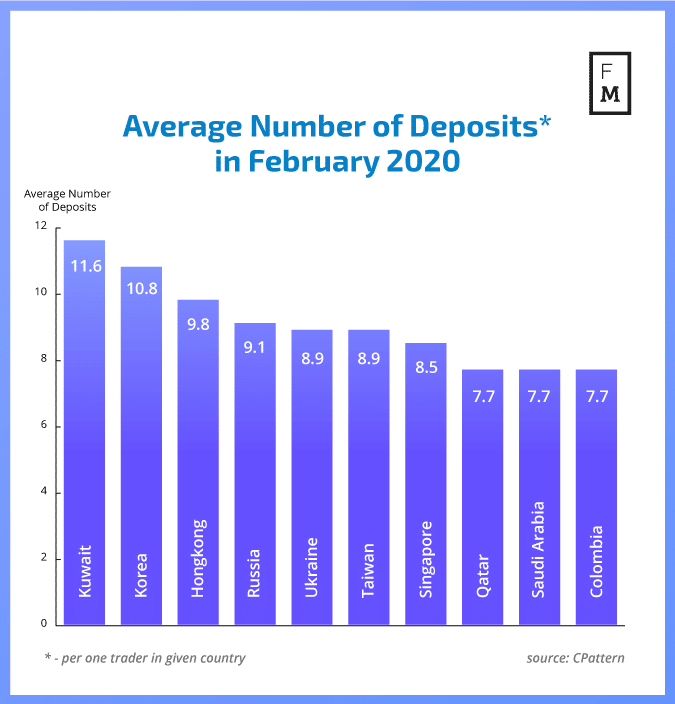

The growing activity of traders could be observed also in case of their deposits to trading accounts. Average for top 10 countries was 9 deposits per account in February. One month earlier average stood at 5.4 deposits per month. Surprisingly, the first position was taken in this rank by Kuwait with 11.6 deposits, followed by South Korea with 10.8.

Recently South Korea has been pretty hot topic in media, not only due to Coronavirus. Binance, a leading crypto exchange, has entered the . Also, the Bank of Korea announced in April the launch of a pilot program for a central bank digital currency (CBDC).

This is the latest publication from the FM Indices – a new cross-industry benchmark. In today’s business world, big-data analysis and access to objective information sources are crucial for success. Unfortunately, until now, it has been challenging and costly, if possible at all, to find any reliable benchmarks for operations in social media, cryptocurrencies, Forex, and CFDs trading.

For this reason, the has launched a new project, creating a set of indices encompassing various aspects of the online trading industry. These indices will provide you with unique data points gathered by our analysts, that will serve as a valuable knowledge base for your decision making.

Be First to Comment