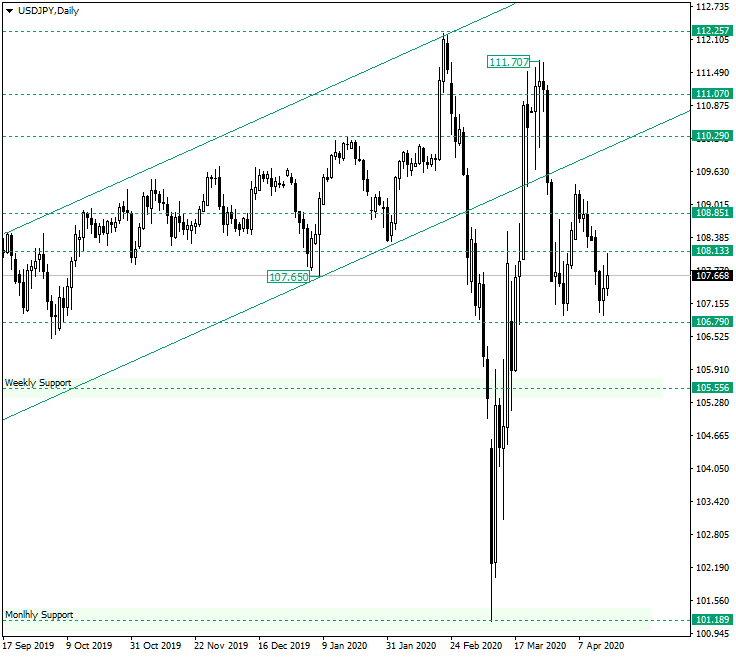

The US dollar versus the Japanese yen currency pair seems to be willing to go towards the north. However, something keeps the bulls from making their next move.

Long-term perspective

The depreciation that started from the peak of 111.70 and after the 111.07 level was confirmed as resistance extended to just a little above to the 106.79 support level.

From there, the bulls tried to regain 108.85, but their endeavor ended with another decline that sent the price around the previous low.

One thing that is favoring the bullish advantage is that the lows are at the same level, while the peaks are declining. This translates into the fact that the bulls are guarding their area quite well. But, on the other hand, as time passes and as they fail to produce a sustained appreciation, this could backfire on them, with the bears taking over and sending the price under 106.79.

So, as long as the bulls guard 106.79, they have the chance to pierce and confirm as support the 108.13 level. If this happens, then their next stop would be at 108.85.

On the other hand, if 106.79 gives way, then the next support, the important weekly level of 105.55, is the prime bearish target.

Short-term perspective

After confirming the support of 107.26, the price started an uptrend that extended beyond the 107.92 level but failed to remain above it.

As long as the price sits above the trendline or only falsely pierces it, the bulls still have a shot to get hold of 107.26. From there, further advancement could reach the next resistance, 108.43, respectively.

But if the ascending trendline gets invalidated, then the price could fall under the descending one and, thus, extend the movement in this direction, 107.06 being the main target.

Levels to keep an eye on:

D1: 106.79 108.13 108.85 105.55

H4: 107.26 108.43 107.06

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Be First to Comment