The Great Britain pound versus the Canadian dollar currency pair may establish above the 1.7500 mark. Is this a bullish profile, or are the bears waiting for even better prices?

Long-term perspective

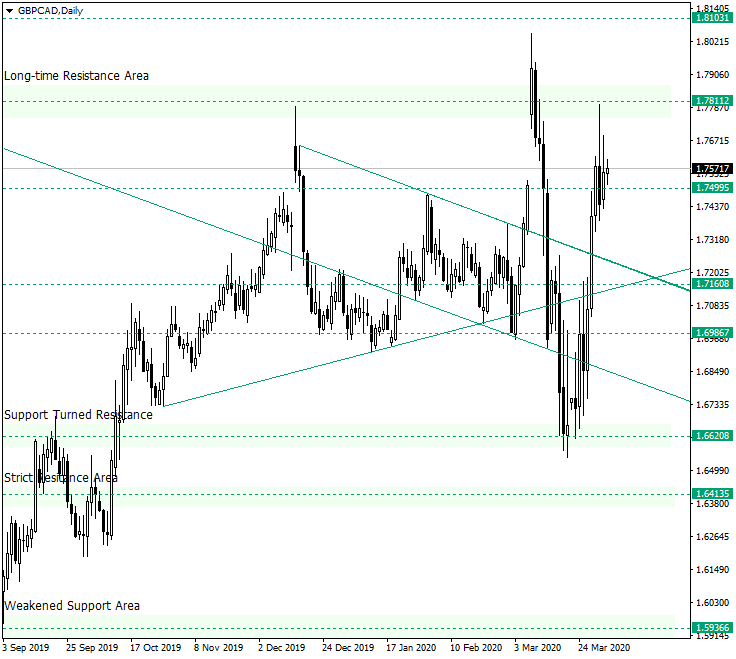

After the price was not able to maintain the gains above 1.7811, it strongly depreciated, reaching the important support area of 1.6620. However, this area, being packed with bulls, favored a strong appreciation, one that reached the 1.7811 resistance yet again.

But this time, the price confirmed is as a resistance — or at least it seems so — not via a false piercing, but with an actual retracement. So, this would seem to be a bearish message — the bulls were repelled by the bears protecting the 1.7811 level, thus the resulting decline that revisited 1.7499.

There is one detail that seems to turn the situation for the bulls: both recent retracements from 1.7811 — the one in the middle of December 2019, and the one in the middle of March, respectively — unfolded as sharp declines. However, with this occasion, it looks like the price is somehow “thinking” if whether or not it should do the same. The fact that the candle on April 1 managed to close above the level is a sign that the bulls just might try to push the price towards higher values.

So, if the bears cannot establish the price under 1.7499, then 1.7811 may be in reach and, not only that, but it could also open the door to the next level, 1.8103, respectively. Only if the bulls fail to establish the price above the level, then the bears would be able to print a new downwards leg pointing to the triple support area formed by the upper line of the descending channel, the trendline, and the 1.7160 level.

Short-term perspective

After the price confirmed the support level of 1.6684, it started an appreciation that, for now, seems to have formed a diamond. As this chart pattern is usually indicative of a turning point, and as it is preceded by an upward movement, the expectation would be to eye lower levels.

So, for the bearish scenario, the price must pierce and confirm as resistance the level of 1.7383. If this happens, then their main target would be 1.7130, followed by 1.6959.

On the other hand, if — after the price confirms as support the lower ascending trendline or one of the 1.7481 or 1.7383 levels — the price manages to pierce the descending trendline that starts from the high of 1.7797, then the bulls would be seeking to confirm 1.7227 as support and then aim for 1.8047.

Levels to keep an eye on:

D1: 1.7499 1.7811 1.8103 1.7160

H4: 1.7383 1.7130 1.6959 1.7481 1.7227 1.8047

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Be First to Comment