, one of the world’s longest-operating cryptocurrency platforms, has introduced FX trading to its customer base with the launch of nine new currency pairs. The San Francisco-based platform said their cryptocurrency traders are now able to expand their horizons and begin trading into a $6 trillion market, further diversifying their portfolios and trading options.

Not to be confused with its fiat-crypto offering, the new service allows Kraken users to directly trade between CAD, CHF, EUR, GBP, JPY and USD. The venue already allows users to trade between cryptocurrencies such as Bitcoin, Ethereum, Ripple, and Litecoin against various fiat currencies, namely the US dollar, the Canadian dollar, Euro, British pound and Japanese yen. Most recently, the Swiss franc joined the roster of fiat currencies that .

Kraken has recently joined the Silvergate Exchange Network (SEN), developed by crypto-friendly lender , to enable its customers to deposit and withdraw US dollars from their bank accounts with no fees.

According to the official press release, the exchange will go live with its FX products tomorrow at approximately 14:30 UTC. The Kraken team further revealed that those residing in the US, however, are barred from trading currencies directly on the platform.

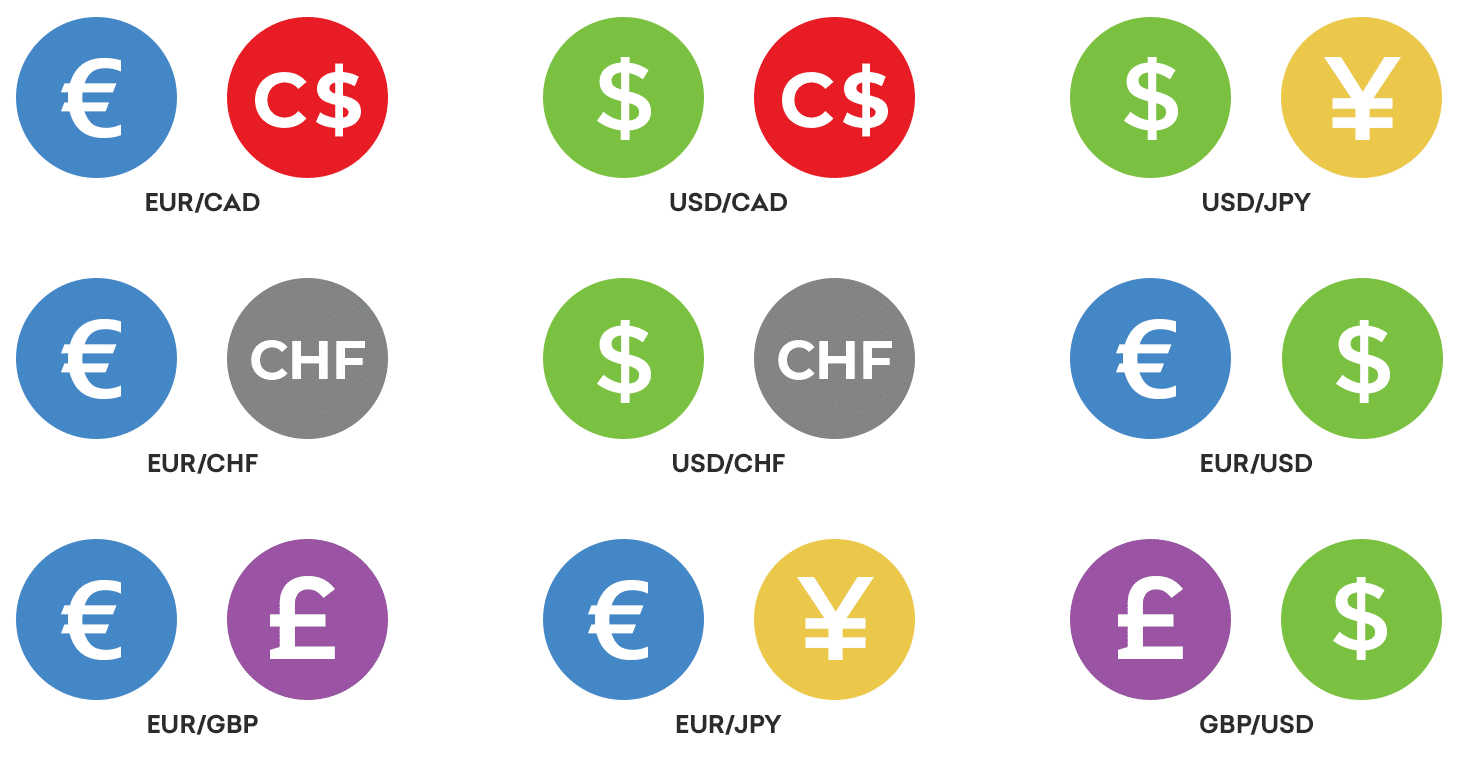

Kraken will support the newly-introduced product with the following pairs: EURCAD, USDCAD, EURCHF, EURGBP, USDCHF, EURJPY, USDJPY, EURUSD and GBPUSD.

Further trading pairs will be added to the exchange in the future and Kraken’s stablecoin fee schedule will apply for current instruments, the company said.

While the number of trading platforms is growing, Kraken has recently made infrastructure upgrades to create an ecosystem that integrates both fiat and crypto trading in one platform. Now to stand out from the crowd, Kraken allows traders to set up advanced orders such as stop loss and take profit options through its web-based trading portal.

Many crypto exchanges already have the aspiration to bridge the gap between cryptocurrencies and traditional asset classes, boasting features including leverage, advanced order types, and charting tools.

were also enticed to join crypto firms by the appeal of working in a fast-growing nascent industry where a background in traditional finance can be a big advantage. Last year, the US arm of Japanese cryptocurrency platform Liquid.com appointed CEO of US-based introducing broker Justin Hertzberg as its first chief executive officer.

Over the past two years, has transformed itself into a global crypto powerhouse, establishing its strong presence in both the US and European Bitcoin markets. Once the largest Bitcoin exchange in Europe, Kraken has also been a strong contender in the US market, with around three percent market share. Furthermore, acquired Circle Trade, the largest in crypto markets that handled last year alone over $24 billion in volume.

Be First to Comment