FXCM Group today reported its execution quality metrics for January 2020, which showed higher rates across its average spreads for cryptocurrency and certain FX instruments.

For the cryptocurrency pairs, the company averaged 27.5 pips on BTC/USD, up from 28.4 pips in December 2019. For FX traders, these spreads feel like a disservice, and they’re certainly high compared to the trends in mainstream retail trading.

However, January’s spread was significantly lower when weighed against the 44 pips the company charged when it first reported spreads metrics for its bitcoin instrument two years ago.

While have exerted pressure on legacy brokers to lower their commission on mainstream tradeable assets, the same cannot be said of its effect on the cryptocurrency. Perhaps it’s the inherent risks associated with crypto trading, but overall fees remain sky-high.

For the Ethereum and Litecoin instruments, charged on average 1.0 and 0.2 pips, respectively, also a touch higher from the months prior.

FXCM has recently expanded its crypto offering with the launch of a for its retail clients.

Named CryptoMajor, the product groups five cryptocurrencies all into one tradeable derivative therefore allowing traders to collate multiple instruments in one go, without the need to independently manage them. Instead of adding more exposure to a major cryptocurrency, FXCM’s CryptoMajor is made up of Bitcoin, Ripple, Litecoin, Bitcoin Cash and Ether, giving an equal weighting for each coin in the basket.

The introduced the new asset type earlier in 2018 when it began testing the service with its already installed Bitcoin offering.

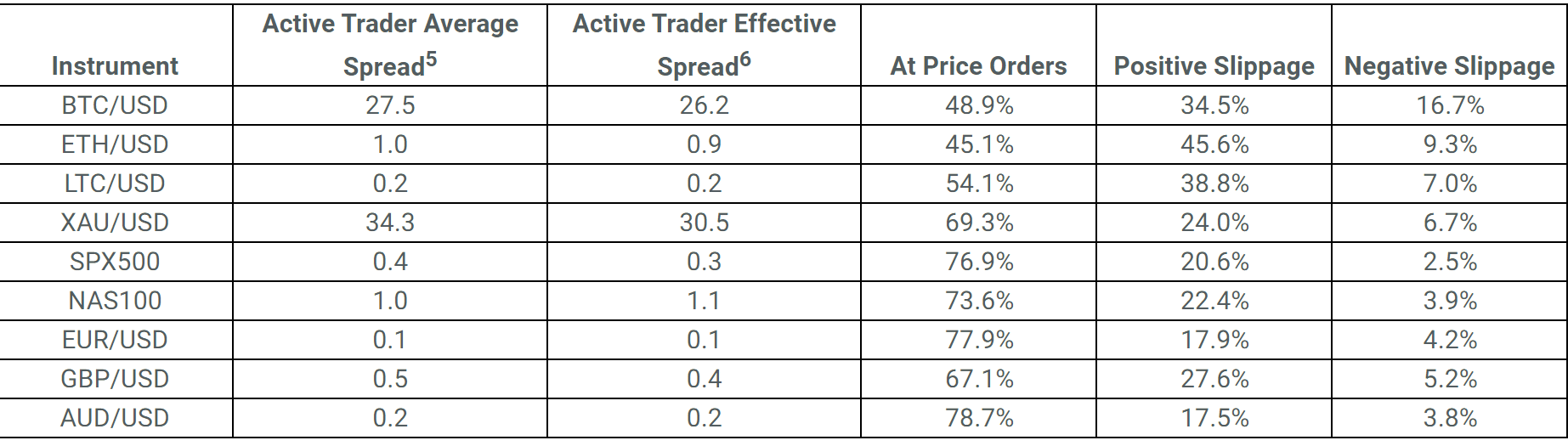

also published its price improvements/slippage statics for January 2020, which showed the following highlights.

The company also reported on its execution speed, which is measured from the time a customer’s order is received to the time of filling. The average order execution time was 16 milliseconds in January. Although an important factor in determining where orders are routed, it is only one factor. Some brokers already provide a good speed of execution but fail to provide price improvement or liquidity.

According to figures stated in the report, the average spreads on the EUR/USD, GBP/USD and XAU/USD pairs were 0.1, 0.5, and 34.3 pips respectively.

The following table shows the exact figures in January:

Additionally, the online brokerage disclosed its Effective Spread statics, which displays its quoted spread for its top FX pairs, and compares the figures with actual spreads, at which trades were already filled, with the difference being displayed in a table key.

Be First to Comment