2020 has started off with a bang when it comes to political tensions around the globe. briefly caused rumours of an upcoming war; the United States impeachment trial is in full throttle, Brexit is on the calendar for later this week–the list goes on.

As such, investors of the world seem to have their trigger-fingers on their purse strings, either eager to take their assets out of the fiat currency of their home countries or hoping for an opportunity to profit off of others who may be doing so.

For a growing number of individuals in the world, Bitcoin and other cryptocurrencies have become the safe-haven-of-choice. Despite its volatility, cryptocurrency is highly liquid, easy to access, and easy to store; others, however, prefer something a bit more traditional–namely, gold.

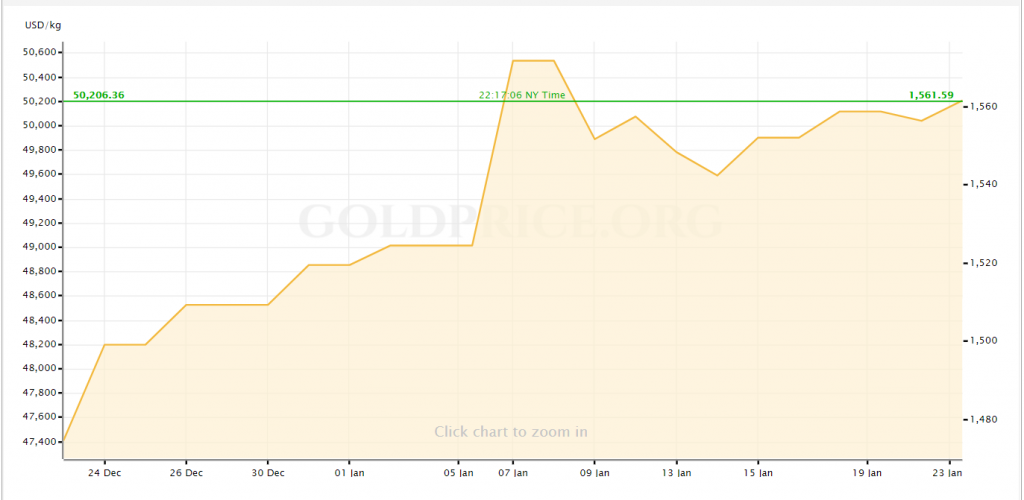

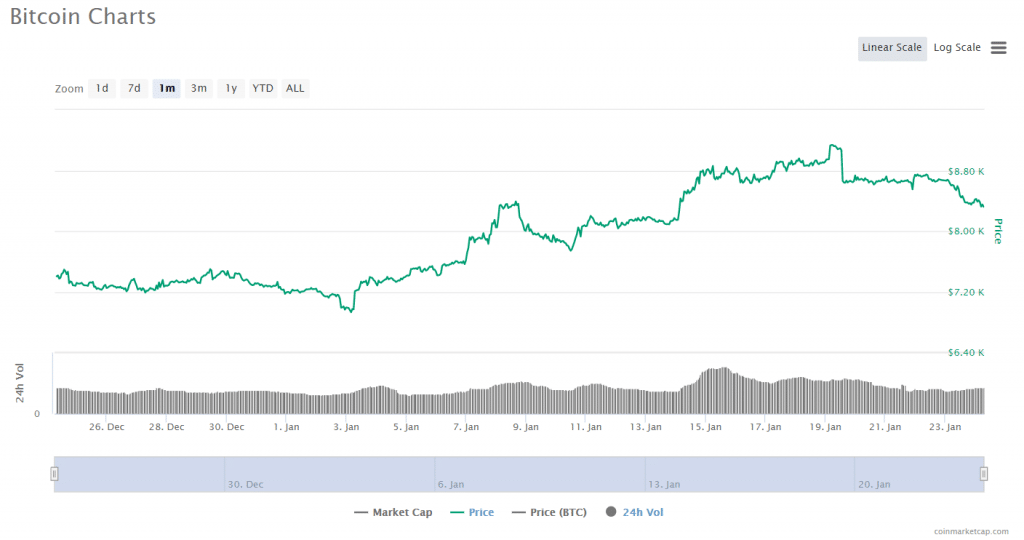

Indeed, during the tensions between Iran and the United States earlier this month, the prices of

Perhaps the interest in both of these types of assets separately is the driving factor behind what seems to be a growing trend in the investing world: cryptocurrencies that are backed by gold.

Indeed, gold-backed cryptocurrencies seem to be more popular than ever. In fact, a recent by Bitcoin.com found that there are at least 77 of these gold-backed projects currently on the books in spite of the fact that at least 30 similar projects have failed over the course of the last ten years.

And more are appearing on the books–just last week, stablecoin issuer , its own gold-backed stablecoin, “in response to the growing demand for a digital asset that provides exposure to the world’s most enduring asset and a geopolitical need for an alternative financial system.”

But with at least 30 failed projects already in the bin, will there be enough interest in gold-backed cryptocurrencies to sustain the projects that are trying to make their ways in the world? Why do some projects survive while others fail? And why could gold be such a good candidate for tokenization in the first place?

Theoretically, “gold-backed stablecoins provide investors with the benefits of both gold and digital assets, without the drawbacks of physically holding the precious metal.”

In many ways, the combination of the stable and universally-recognized value of gold with the security and accessibility of blockchain does seem to be a sort of perfect marriage: “old, with its historically proven price stability, is seen by many as the ideal counterpart to volatile cryptocurrencies like Bitcoin,” said Andreas Ruf, chief executive officer of InfiniGold, the developers of The Perth Mint’s GoldPass, and issuer of the Perth Mint Gold Token (PMGT).

However, the two assets share some important characteristics, he said, including scarcity, lack of counterparty risk, and a non-inflationary nature. “Add to this that [gold] is fully fungible and globally recognized as a store of value,” which makes the precious metal “an ideal candidate for tokenization,” in Ruf’s opinion.

At the same time, “in the digital asset market, there is a big demand for secure storage of value. Blockchain-based infrastructure is becoming more and more crucial to a new generation of financial services that require stable assets as collateral and transfer of value. Besides fiat-backed stablecoins and multi-asset projects like Dai, gold seems a clear candidate.”

“Lastly, the gold market itself, “he continued. “an estimated USD 20 trillion-dollar market, largely dominated by over-the-counter and interbank trading, is an ideal market to target with a digital asset technology that promises better credit quality, transparency, and cost-efficiency.”

In other words, what’s not to like? Steve Ehrlich, chief executive officer of crypto-asset broker Voyager Digital explained to Finance Magnates that “gold-backed stablecoins provide investors with the benefits of both gold and digital assets, without the drawbacks of physically holding the precious metal.”

Interest could come from both “sides” of the investing world

As such, it’s possible that that the interest in gold-backed stablecoins could be coming from both sides of the investment world: crypto investors interested in adding “traditional” assets to their portfolios, and “traditional” investors who may be looking for a cheaper or more secure route to invest in gold.

Indeed, Rob Odell, vice president of product at SALT Lending, a crypto-backed lending firm that recently on a gold-backed stable coin project, told Finance Magnates that “gold-backed stablecoins offer an on-ramp to the crypto space for traditional investors and offer an opportunity for crypto holders to diversify their portfolios with an asset that is traditionally more stable than most crypto assets.”

A saturated space?

However, the growing popularity of the gold-backed stablecoins market may eventually have consequences for companies hoping to enter into the market.

Nick Hill, vice president of business development at investment platform Invictus Capital, told Finance Magnates that this stablecoin “gold-rush” may be hindered by the fact that “gold-backed stablecoins is an extremely competitive market, resulting in razor-thin margins for issuers.”

By comparison, Hill said, fiat-backed stablecoins “have an inherent advantage since fiat deposits earn interest for stablecoin issuers which results in a viable business model.”

At the same time, traditional gold “has an inverse economic model where fees must be paid to custodians and purchasers of gold tokens need to be charged fees, usually based on AUM, in order to make the product sustainable for issuers.”

”Very few will survive.”

Ultimately, this means that the gold-backed stablecoin landscape may look quite different from the rest of the crypto world, which is well-populated with projects that may have smaller market caps, at least initially: “it will be difficult for gold-backed tokens to maintain a profitable business model without maintaining a significant market capitalization,” Hill explained.

Indeed, Charles Phan, chief technical officer of cryptocurrency exchange Interdax, told Finance Magnates that like “the market for cryptocurrency in general”, the gold-backed stablecoin space “seems saturated.”

“It seems that many have been launched as means to collect funding in the overheated ICO market,” he added. “Others have underestimated the complexity of the regulatory side” or “are lacking the background in precious metals trading.”

Therefore, “we are predicting that of the current gold-backed stablecoins, only very few will survive,” Ruf said, although “we are still seeing room for quality products to emerge, especially targeting the institutional sector.”

When platforms compete, consumers win

Therefore, competition is heating up–but, as it goes in crypto (and just about every other industry), the ultimate winner of competitions between platforms and products is the consumer.

And what are consumers looking for, exactly? “Adoption will come down to what else the organizations providing gold-backed stablecoins are able to offer,” said Rob Odell. This could mean expansion into other kinds of assets: “those that offer real estate, art, and other asset-based stablecoins will likely steal the majority of market share,” he said.

However, the most important factor in the competition between issuers of asset-backed coins, according to Odell, is reputation–the company that can produce the most trustworthy product will win out in the end.

“Mainly, it will come down to credibility,” Odell said to Finance Magnates. “In the reputation economy of issuing gold-backed tokens, you’re only as good as what you can prove you have in order to support the continued issuance of these tokens.”

Indeed, Andreas Ruf added that “the gold-backing of these stablecoins will always revert back to a custodian of the actual physical gold. Whether it is a single custodian or a network in an attempt to decentralize the assets: trust in the custodian and the issuer are key.”

Therefore, “buyers should seek answers to the following questions: where is the physical gold stored? What stability and track record do the custodian and issuer bring with them?”

“The main use case of a gold-backed token is to move from volatile, high-risk investments into stable, risk-off assets. If there are serious doubts or questions about the custodian or the issuer, then the asset does not appear risk-off.”

There have already been some instances in which issuers of gold-backed stablecoins have been identified as possible fraudsters: for example, CoinDesk in October of last year that “Florida regulators began investigating Karatbars, a German company that’s been promoting a token tied to a Miami ‘crypto bank’ without any banking license in the state.

Before the investigation, Karatbars allegedly issued a cryptocurrency purportedly backed by gold, but CoinDesk was unable to verify the existence of the mine the company says produced the gold.

”Transparency is absolutely key to creating trust in gold-backed tokens.”

Like any most other sectors in the cryptocurrency industry, the international nature of gold-backed stablecoins has the potential to leave investors who may be affected by fraud in the gold-backed stablecoin space without a clear path to legal aid. Therefore, investors in gold-backed stablecoins must be vigilant in vetting the products they purchase.

Gregor Gregersen, chief executive officer of CACHE, a provider of gold-backed tokens, told Finance Magnates that “to be a trusted investment these asset-backed tokens must be redeemable, transparent, compliant, public tokens backed by investment-grade physical gold, identified by serial number and stored in secure vaults that report their gold inventories directly to the public, thereby ensuring decentralized checks and balances.”

Indeed, “transparency is absolutely key to creating trust in gold-backed tokens. Investors need visibility to be completely confident that there is gold stored in secure vaults, and that it is exclusively reserved for backing the tokens, and not otherwise encumbered.”

Liquidity is also an important factor. “Trust in the investment is also boosted when the tokens’ redeemability is practical, efficient and fast,” Gregersen said. “Buyers should look into whether the company issuing the token is actually capable of fulfilling these requirements.”

Finally, it’s important to be aware of the level of decentralization a project has: “token holders should have control,” he continued.

“No centralized third party should be able to freeze customer accounts or take tokens. Deploying, for example, an open, public blockchain token using the Ethereum ERC-20 standard means the control is with the token holders — unless the smart contract underlying the token has been designed with backdoors,” he said, adding that his own company’s platform “does not.”

What are your thoughts on the gold-backed stablecoins space? Let us know in the comments below.

Be First to Comment