The gave cryptocurrency futures trading platform Bakkt the go-ahead to offer the Bakkt Warehouse–Bakkt’s custody solution–to “all institutions.” Previously, the Bakkt Warehouse was only available to clients trading the Bakkt Bitcoin Futures contracts. The announcement came in on November 11th.

The announcement says that so far, Pantera Capital, l, and have chosen Bakkt Warehouse as their custodian.

“A critical link — perhaps the critical link — in the institutional adoption of bitcoin is custody,” the post explains. “When investors have ready access to regulated custodians whose security and processes they trust, the full potential of this emerging asset class and technology can flourish.”

Indeed, in the weeks running up to the United States Securities and Exchange Commission’s proposal from Bitwise Asset Management, about adequate custody options for cryptocurrency investors.

“[…] How do we know that we can have custody and have a hold of these crypto assets?,” he asked during an interview with CNBC. “That’s a key question.”

Bakkt’s launch was not as significant as many thought it would be

The expansion of Bakkt’s custody offerings are a good sign for the futures exchange, which–despite recent upticks in trading volume–has been a bit underwhelming since its September launch.

Indeed, when trading on Bakkt went live, the exchange saw just $5.8 million in trading volume within its first 24 hours. The figure was far lower than a number of industry analysts and participants had predicted it would be.

Indeed, more than half of respondents on a Twitter poll conducted by economist Alex Krüger said that they believed that Bakkt would see a “successful launch” rather than a flop.

Bakkt’s first week volume was approximately $5.8 million.

It managed to get traders interested in 5 bitcoin worth of its physically delivered daily futures. Quite the successful launch.

— Alex Krüger (@krugermacro)

After trading volume failed to meet expectations, however, Krüger that the low volume surrounding the launch could be the result of “either poor marketing, bad execution, few care (sic), or a combination of these factors. I can only speculate.”

A slow climb

However, it seems that interest in Bakkt trading has been picking up–albeit, not as quickly as many had hoped.

Indeed, on November 9th, the exchange announced that it had set a new daily trading volume record of 1,756 Bitcoin Futures contracts traded in a single day.

Today we set a new daily record of 1,756 Bakkt Bitcoin Futures contracts traded

— Bakkt (@Bakkt)

Charles Phan, CTO at cryptocurrency exchange Interdax, said to Finance Magnates that “this represents around $15.5 million in volume.”

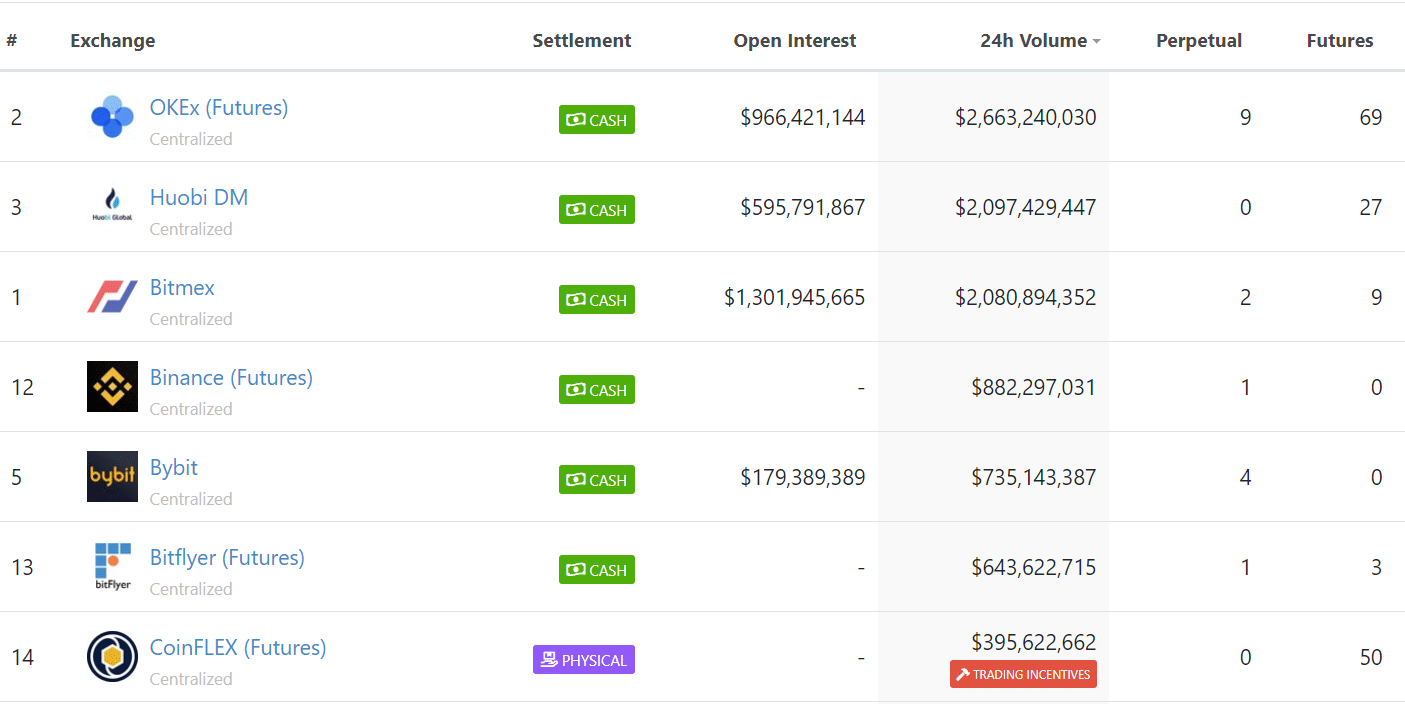

However, while $15.5 million in trading volume may be a new record for Bakkt, it is quite paltry when compared to other trading platforms: “$15.5 million is anywhere between 10 times to 100 times smaller than the volume of the dominant cryptocurrency exchanges,” Phan said.

Indeed, at press time, cryptocurrency derivatives exchange volume on OKEx (Futures), Huobi DM, and BitMEX was above $2 billion. Trading volume on CoinFLEX (Futures), another physically-settled cryptocurrency derivatives exchange, was over $395 million.

At press time, Bakkt’s 24-hour trading volume was just over $12.6 million, or about 1440 BTC.

∙ Today’s volume so far: 1438 BTC ($12,618,450)

∙ Last traded price: $8,775

∙ Trading day progress: 83%

∙ Current daily Bakktarget™: 1527 BTC ($13,402,948)

— Bakkt Volume Bot (@BakktBot)

Phan explained to Finance Magnates that the increase in volume could be the result of market makers.

“Market makers arbitrage across exchanges so it’s not surprising to see that Bakkt might be picking up volume from other places,” he said.

“As volume continues to increase in the bitcoin market from the October lows, one consequence is that arbitrageurs might be trading more using Bakkt’s contracts. Any institutional investors in the market will also contribute to Bakkt’s volumes.”

“It’s not demand yet, it’s intense curiosity”

However, the low volume upon the launch of Bakkt (as well as the slow climb in trading volume that has followed) could be signals of a general lack of serious institutional demand in cryptocurrency.

Indeed, the lack of excitement around the launch of Bakkt was preceded by another “flop”–in the weeks running up to the SEC’s decision on its Bitcoin ETF application, , a sort of pseudo-Bitcoin ETF that was available to Qualified Insitutional Buyers (QIBs).

However, three days after its launch, Alex Krüger pointed out that just $41,400 had been invested in the BTF–hardly the “wave” that the industry had been waiting for.

Three days after launch, the VanEck bitcoin trust for institutional investors has reportedly managed to issue a whopping 1 (one) basket. It has 4 bitcoins or $41,400 in assets under management. Massive.

— Alex Krüger (@krugermacro)

This caused a number of individuals within the industry to begin to question the narrative of the “wave of institutional capital” that was just around the corner for Bitcoin.

And indeed, when Bakkt was launched, Jeff Sprecher, founder and CEO of the Intercontinental Exchange (Bakkt’s parent institution) that he wouldn’t go so far as to say that institutional investors are ready to buy into Bakkt’s offerings just yet: “it’s not demand yet, it’s intense curiosity,” he said.

“It’s the sense that money managers want to be at the front of this train and not left out. The day-to-day news covers Bitcoin when the prices go way up or way down, but underneath we see sophisticated people investing in infrastructure and compliance that’s unrelated to the price,” Sprecher continued. “But they won’t use that infrastructure; there won’t be true global acceptance until we can build out the rails in a regulated manner.”

However, Alex Krüger had a different take: “institutional money already trades lots of bitcoin …. just not the type of institutions who are long term holders,” he wrote on Twitter.

Institutional money already trades lots of bitcoin …. just not the type of institutions who are long term holders.

— Alex Krüger (@krugermacro)

What’s in the cards for Bakkt?

Still, the expansion of custody services on the platform could bring more investors onto Bakkt–which could eventually pump up trading volume.

Additionally, “Bakkt has applied for its liquidity incentive program but hasn’t yet received approval from the CFTC,” Charles Phan explained. “A liquidity incentive program could involve the reduction of fees to encourage market makers to trade at the venue. Large traders might shift over from other venues to Bakkt and take advantage of the lower fees and provide more liquidity, if approved.”

Be First to Comment