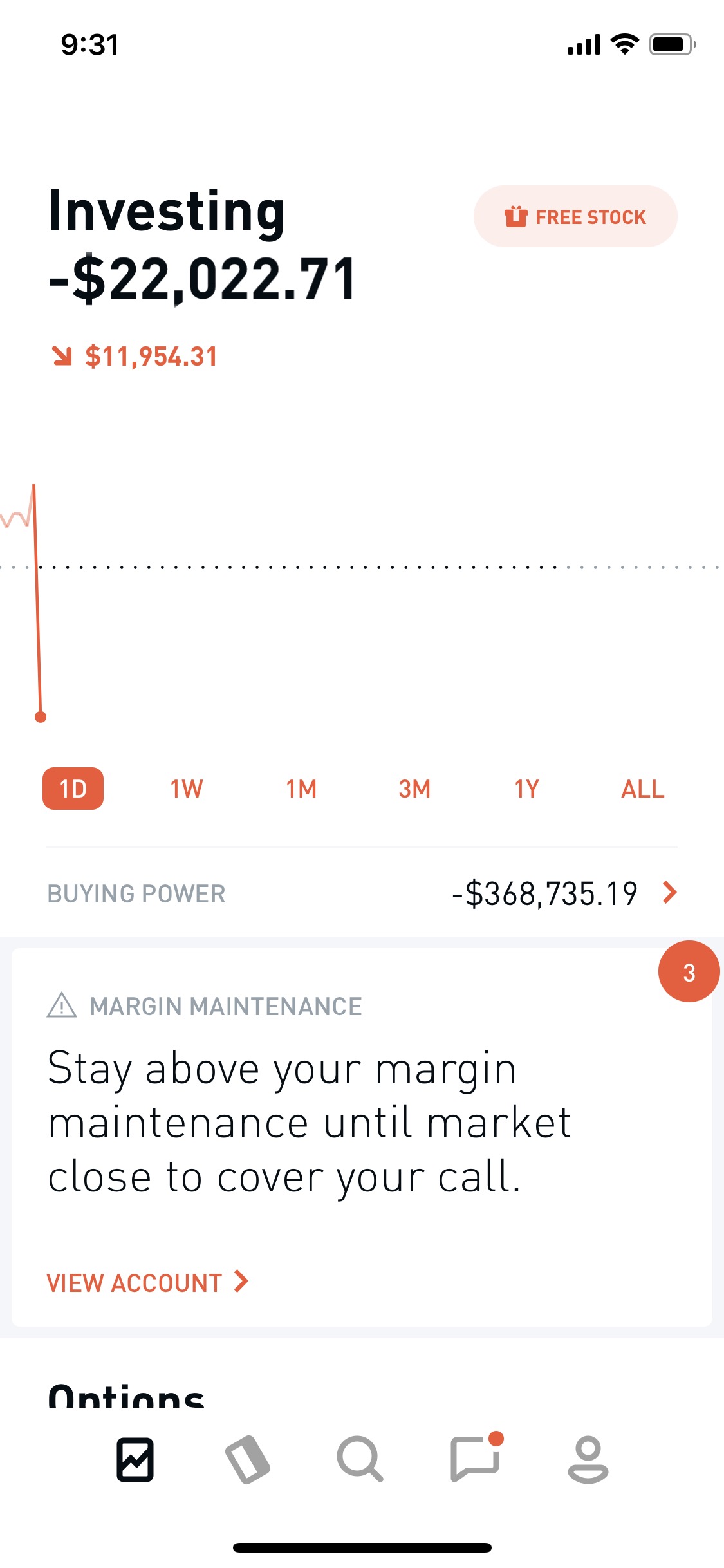

Commission-free was hit by a trading glitch that apparently allowed certain customers to acquire an ‘infinite leverage’ while trading stocks on its millennial-targeting platform.

Many users flagged this issue on Reddit and other social networking websites. While there is no official confirmation on Robinhood suffering losses resulting from this malfunction, some users on internet forums made claim losses that would be passed onto the no-fee trading startup.

A Reddit user reflected on this situation, saying, “Remember folks, if you lose 5 grand, it’s your problem. If you lose 5 million, it’s Robinhood’s problem.”

from

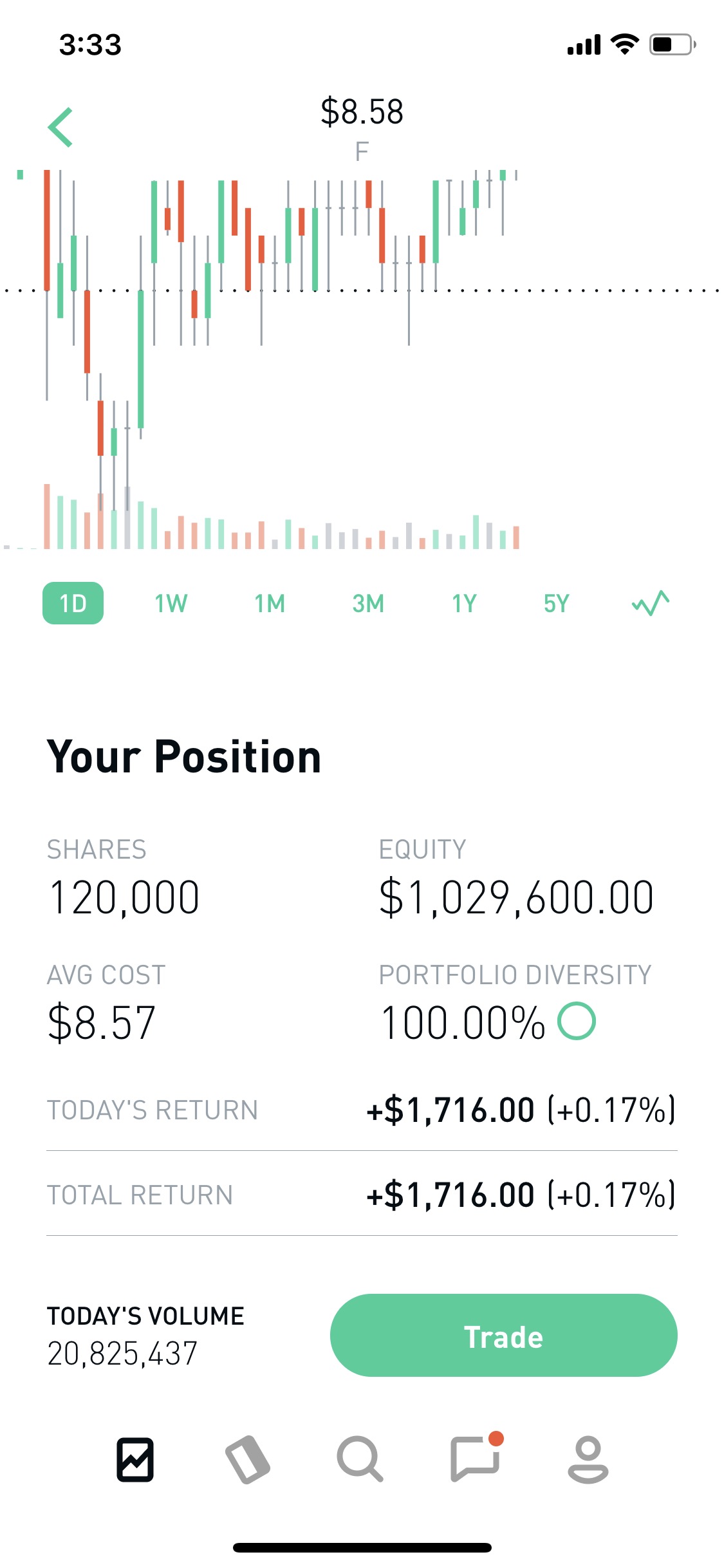

As a result of the bug, one trader turned his $2,000 balance into the purchasing power of $50,000, but the excessive leverage wiped out his account. Another user supercharged his $4,000 deposit to open a $1 million position.

Robinhood admitted to the technical glitch, saying that the matter is being examined by the internal technical team to analyze and identify the cause, which led to the issue and to suggest solutions to prevent a recurrence.

The yet-to-be patched flaw, dubbed ‘“infinite money cheat code,’ is being exploited in the wild to take over unlimited buying power using borrowed money from Robinhood, regardless of whether the investor uses the full amount.

The users exploited the company’s subscription product, Robinhood Gold, which offers margin trading and extended-hours trading. More specifically, when traders are selling leveraged covered calls, Robinhood mistakenly tops up the values of these trades to their accounts’ equity, which in turn qualifies them to get more leverage.

Although yet to be explained, we expect the bug relates to Robinhood’s cross margining function, which allows traders to offset their positions whereby excess margin from profitable trades is used to satisfy margin maintenance requirements.

Robinhood revealed earlier this year that 75 percent of its transaction volume went through its Gold product.

Be First to Comment