FXCM Group today reported its for August 2019, which showed lower rates across its average spreads for cryptocurrency and certain FX instruments.

For the cryptocurrency pairs, the company averaged 36.8 pips on BTC/USD, lower from 42.5 pips .

Cryptocurrencies printed fresh highs in August, extending a rally that has seen major coins more than double in value since the start of the year. Rumors that global and exchange will soon start crypto trading for institutional customers was also having a positive impact on price.

For the Ethereum and Litecoin instruments, charged on average 1.9 and 0.6 pips, respectively, also a touch lower from the months prior.

The introduced the new asset type earlier last year when it began testing the service with its already installed Bitcoin offering.

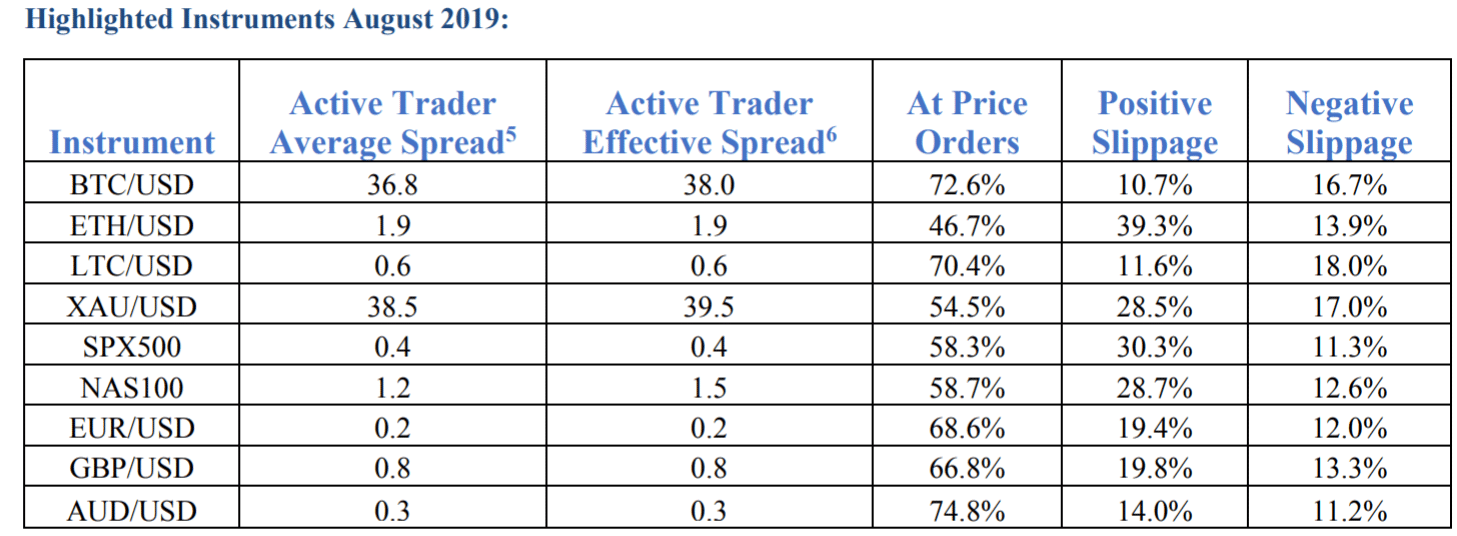

also published its price improvements/slippage statics for August 2019, which showed the following highlights.

The company also reported on its execution speed, which is measured from the time a customer’s order is received to the time of filling. The average order execution time was 31 milliseconds in August, compared to 24 in May. Although an important factor in determining where orders are routed, it is only one factor. Some brokers already provide a good speed of execution but fail to provide price improvement or liquidity.

According to figures stated in the report, the average spreads on the EUR/USD, GBP/USD and XAU/USD pairs were 0.2, 0.8, and 38.5 pips respectively.

The following table shows the exact figures in March:

Additionally, the online brokerage disclosed its Effective Spread statics, which displays its quoted spread for its top FX pairs, and compares the figures with actual spreads, at which trades were already filled, with the difference being displayed in a table key.

Be First to Comment