Steven Clausing is stepping down from his post as a member of board and chief operating officer of Dutch online broker, which was acquired by Saxo Bank over this summer.

BinckBank said it respect Clausing’s decision to leave the company, and confirms it was in connection with . Since then, he has been working with BinckBank management to ensure a smooth and seamless transition until his departure next month.

“The tasks and responsibilities of Mr S.J. Clausing will for the time being be assigned to the other board members of BinckBank N.V. Mr.V. Germyns (CEO) and Mr. E.J.M. Kooistra (CFRO). BinckBank thanks Mr Clausing for the valuable dedication and commitment shown and wishes him all the best for the next step in his career,” the company said in a statement.

Mr. Steven has served as COO and member of the executive board of BinckBank since 2015. He has originally joined the Dutch lender back in 2013 as head of risk management. During his term, he was tasked with IT and product management and also had a prominent role in various sub-committees of the executive and supervisory boards.

Saxo Bank completes takeover deal

Prior to BinckBank, he held several senior management positions in

the areas of commerce, internal organization and audit and risk management at leading banks. Clausing started his career in the Royal Dutch Navy, and then joined ABN AMRO Bank 1998 where he served in both commercial and internally focused posts. After a 10-year tenure with ABN, he moved to Royal Bank of Scotland in 2008 .

Clausing is a graduate of Eindhoven University of Technology also has masters in finance and internal auditing from Erasmus University, Rotterdam.

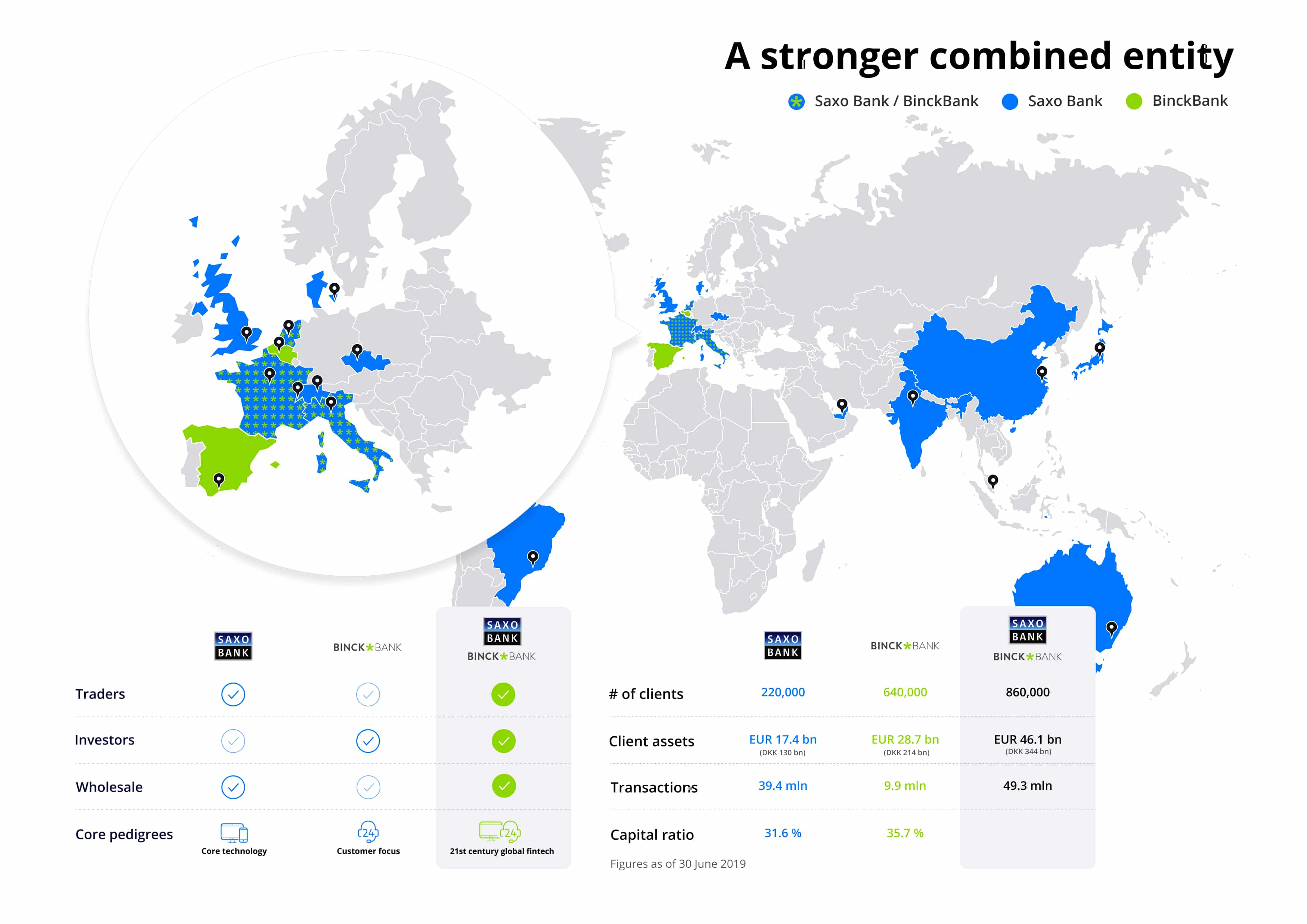

Saxo Bank announced earlier this month it has completed the and now owns nearly 98 percent in the online broker. BinckBank will be delisted from the Euronext Amsterdam as of September 26.

The two companies revealed they already started working on the integration of their technology infrastructure and plan to launch additional products and services to better compete in light of growing competing in the online trading and investment sector.

Saxo said that their similar geographic footprint, products and customer bases meant the merger made sense and would also drive efficiencies.

Be First to Comment