Any business owner, no matter how big or small, will probably tell you that payments are something of a minefield. Not only are the processes involved opaque to outsiders, there are so many providers to choose from that it can often be hard to know who to actually work with.

But things may be about to get a bit simpler – even if the number of providers goes up. In January of last year, went into effect.

Those regulations, , meant banks were forced to provide third-party companies with access to their clients’ banking information via an application programming interface.

In the UK, there are now close to 100 companies regulated as either Account Information Service Providers (AISPs) or Payment Initiation Service Providers (PISPs).

AISPs have read-only access to your banking information, meaning they are likely to provide budgeting or lending services. PISPs, on the other hand, can – as their name implies – initiate payments from your account.

Changing the process

This may not sound like a big deal but it could drastically reshape the online payments sector.

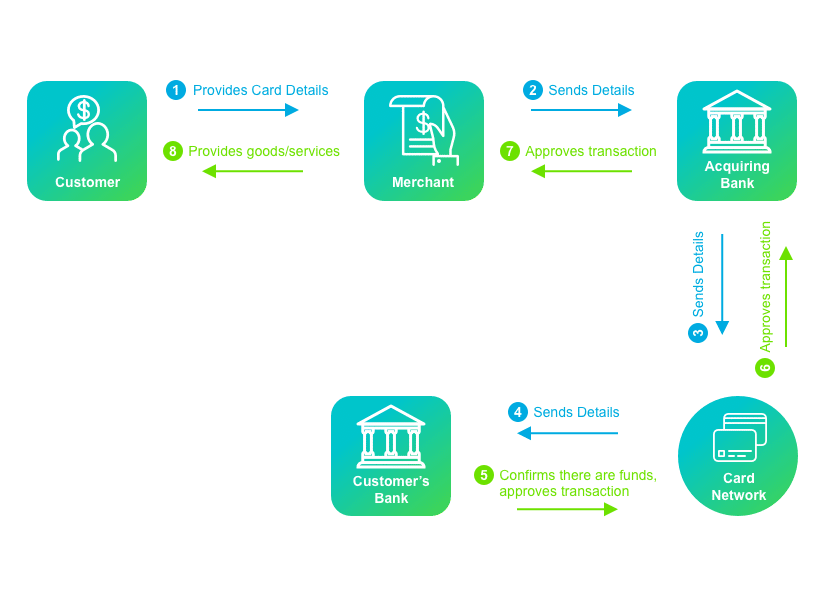

When you buy something on Amazon or iTunes, the payment will usually go through in a couple of seconds. But in that short period of time, a lot of stuff is happening.

In simple terms, your payment will be transmitted to the online store or ‘merchant.’ In turn, the merchant will send the details to their acquiring bank – the institution responsible for processing their payments.

Assuming your bank approves the transaction, it will send an authorisation code back, through the card network, to the acquiring bank. The acquiring bank will then send that information to the merchant, who will – at last – provide you with your product or service.

Simple, right?

Except this isn’t the end of the process. You may have your service or product but the merchant will have to wait for a lengthy batching, clearing and funding process to be completed, something which can take over a week, before your funds are actually deposited into their bank account.

Bank to bank

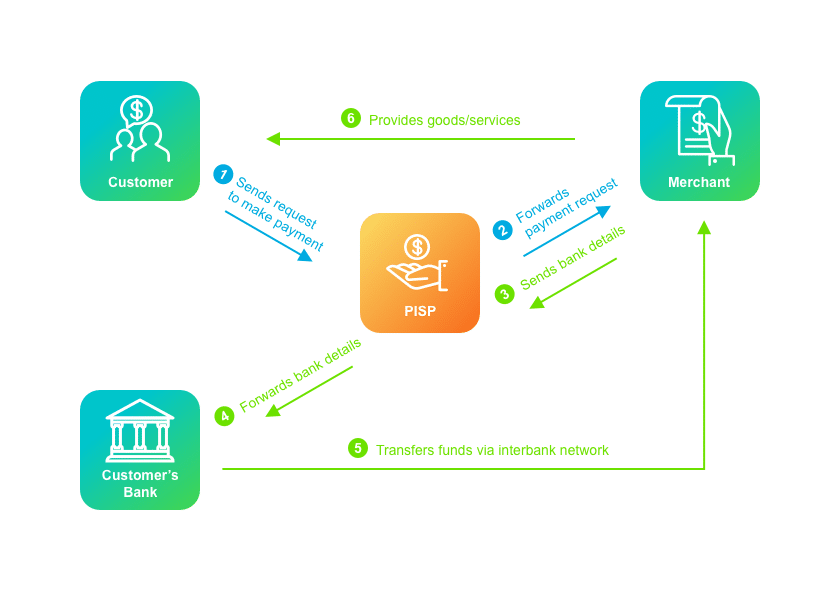

PISPs are able to change this process entirely.

Let’s say I buy a book on Amazon using a PISP application on my phone.

After I click ‘buy,’ Amazon will send a request for funds back through the PISP. The PISP then initiates a payment from my bank account and sends the money – via the interbank payment network – directly to Amazon’s business account.

This makes things faster and cheaper for businesses. Faster because they get paid instantly and don’t have to wait for their acquiring bank to go through an end-of-day clearing process. Cheaper because it reduces the number of intermediaries that have to be paid.

Conversely, a PISP-based payment means it would be the merchant, not the buyer, that has to reveal their bank details.

“Traditional systems work on a ‘pull’ authentication where you authorise the payment processor to reach into your account and pull

“Our system works on ‘push’ authentication – the merchant says please pay me for ‘X’ and you push the payment from your account by authorising the sending of funds. Critically, you aren’t sharing your financial details – the merchant is. [The Banked] system essentially works in reverse [to traditional payments], with the customer in control.”

The scramble for PISPs

Goodall’s firm, which was launched last year and is based in London, is one of many start-ups attempting to capture some of the market share in this nascent payments industry.

A large number of these financial technology companies, most of which were founded in the past couple of years, were set up by ex-bankers or tech workers. Goodall, for instance, helped co-found cloud software provider 10x Banking with Antony Jenkins, the former CEO of Barclays, before he launched Banked.

Frank Zhou, the founder of payments and investing application Zeux, has a slightly different background. An ex-derivatives trader, Zhou had stints at Lloyds, Merrill Lynch and Societe Generale before launching Zeux last year.

“My previous jobs have always required a lot of risk taking and the ability to handle the pressure that comes with it,” Zhou told Finance Magnates. “So since I’d already signed myself up for a career taking risks – which I thoroughly enjoy – I thought I may as well take an even bigger risk in something that I truly believe in.

Big players coming for open banking

Of course, it’s not only start-ups that are trying to jump onto the open banking bandwagon. Several big players in the payments space have already received PISP licenses from the FCA or other European regulators.

American Express, for example, has set up a new service called Pay with Bank. As the name implies, this service allows you to pay

Given that this is the case, one could be forgiven for thinking that, in this new industry, there is already a surplus of providers. But for Jakub Zmuda, chief product officer at payments technology company Modulr, there’s a lot of business to go around.

“PISP regulation has been put in place to enable competition and to improve choice for consumers and businesses,” said Zmuda. “Some new firms will focus only on payment initiation, but others will integrate it into their product set, enabling innovative ways to make payments.

“Modulr will be building in payment initiation services into our core offering, enhancing our existing products through which we help business and partners already move billions of pounds. This means that our offering will be enhanced by [PISP licensing], but we do not see ourselves in direct competition with pure-play PISPs.”

“Seamless treasury function”

As Zmuda’s comments suggest, it’s not just retail customers and e-commerce stores that PISPs can help grow – any businesses can likely benefit from the new offerings being made available to them.

A company could, for example, use a PISP to visualise ten different bank accounts in one application, as opposed to having to log on to ten different proprietary banking application accounts and then trying to make sure all the numbers match up.

Aside from making life easier for accountants, this could allow businesses to move cash between their different bank accounts much more easily.

“Payment initiation could ultimately be utilised by businesses to move funds between accounts, optimising cash flow and easily using new providers to lower cost of payment fulfilment,” added Zmuda.

“Today this would need to be done manually, moving between disparate accounts using differing logins and platforms. Tomorrow, businesses could use an [AISP] for aggregation and a PISP to create a seamless treasury function.”

No more overdraft

It might not just be businesses that can optimise their payment flows. There are also plenty of applications looking to provide similar services to retail customers via mobile applications.

A PISP could allow a user to move money between different bank accounts so that they don’t go into overdraft. Some app developers have even hinted that they are developing features that would allow users to automate this process.

Others are looking at providing investment options to their clients. Zeux, for example, provides users with access to a range of investment products, ranging from P2P lending to fixed-rate interest on cryptocurrency deposits.

The start up has also introduced a range of features that enable its users to make online payments direct to a merchant’s bank account or in store via a number of different methods.

“As we have a PISP license, our users can make payments directly from their bank accounts,” said Zhou. “But we are trying to make our service as convenient and flexible as possible. So our users can make mobile payments with Apple Pay or Samsung Pay, perform quick bank transfers or do instant customer to customer payments.”

The card payments process may be the most immediately affected by developments in the open banking space. But ultimately the regulatory changes implemented in January of last year will allow for a plethora of technological developments that will change the way we save, pay and bank in the long run.

Whether it’s the average Joe being better able to manage his money and make faster payments to friends or a massive business that can optimise cash flows and receive money from its customers instantly, open banking regulations are going to change the way we make payments significantly.

Be First to Comment