When the creation of Bitcoin futures contracts was first announced on Cboe and CME, American economists and investors were taken aback.

After all, futures contracts have long been regarded as than other types of investments due to the fact that they involve leverage trading. According to some, the volatility in the price of Bitcoin pushed the risk factor over the edge.

Thomas Peterffy, Chairman of trading platform Interactive Brokers, even went so far as to have a full-page letter to Commodity Futures and Trading Commission Chairman Christopher Giancarlo. In the letter, he warned that the trading of Bitcoin futures contracts could “destabilize” the entire economy.

“Cryptocurrencies do not have a mature, regulated and tested underlying market,” he wrote. “The products and their markets have existed for fewer than 10 years and bear little if any relationship to any economic circumstance or reality in the world.”

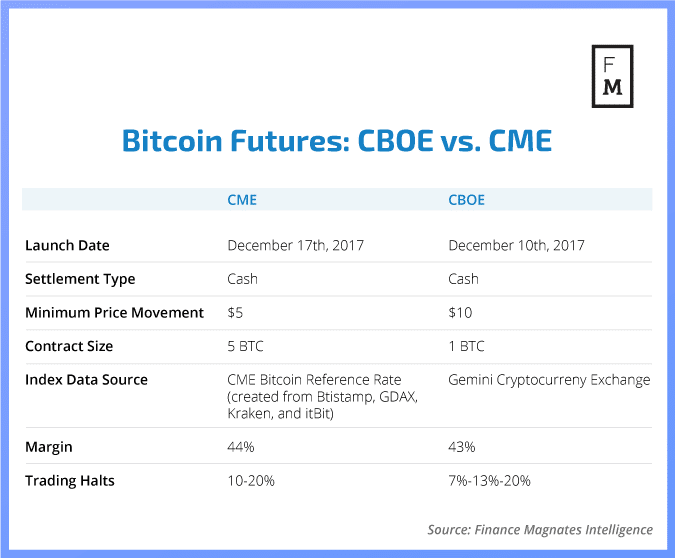

But Peterffy’s attempts to raise the alarm bells around the trading of Bitcoin futures contracts was in vain. Both Cboe and CME .

“Over the next 10 years we believe that the cryptocurrency market will explode in terms of the assets that they touch, the currencies that they involve,” he said.

Not so fast…

But for all of their gusto, neither Peterffy nor Concannon were quite correct in their predictions.

While the launch of these contracts may have contributed to the speculative bubble that drove Bitcoin and other cryptocurrencies to new heights at the end of 2017, the economy as a whole was more or less unaffected–and certainly was never “destabilized.”

Ironically, Bitcoin futures and other kinds of crypto-based futures contracts even became the product-of-choice for many institutional investors, who saw crypto futures contracts as less risky than trading directly in crypto assets.

And while interest in Bitcoin futures contracts did continue to grow, Cboe’s Bitcoin futures never seemed to catch on in the way the exchange was hoping they would.

So when Cboe after the closure of its last open contract, it wasn’t because they had proven to be too risky, as analysts like Peterffy may have believed would eventually be the case.

Instead, the decision seemed to be motivated by a lack of interest in the product, although the exchange said that it was open to the possibility of re-opening its BTC futures offerings one day in the future.

“CFE is not adding a Cboe Bitcoin (USD) (“XBT”) futures contract for trading in March 2019,” the exchange announced in March. “CFE is assessing its approach with respect to how it plans to continue to offer digital asset derivatives for trading. While it considers its next steps, CFE does not currently intend to list additional XBT futures contracts for trading.”

What does this all mean?

At the time the announcement was made, it seemed to make sense–it was just the latest piece of bad news on an ever-lengthening list of signs that the Bitcoin markets were falling past the point of no return. Bitcoin was sitting around $4000, where it had been hovering for months; many analysts predicted that the doldrums would continue, or that conditions would worsen.

Ari Rastegar, CEO of Rastegar Property, told Finance Magnates that at the time, Cboe’s decision to close its Bitcoin futures markets could have reflected a lack of institutional interest in cryptocurrency markets.

And this did seem to be the case. While Bitcoin futures markets on other platforms seemed to be faring fairly well, Cboe’s decision to close the offering seemed to signify a sort of turning point–the exchange, which had been the first US exchange to offer BTC futures contracts, decided that it had bigger fish to fry.

But shortly after Cboe’s decision was announced, it seemed as though the exchange may have jumped the gun.

Since Cboe’s Bitcoin futures markets closed, CME’s Bitcoin futures markets have skyrocketed

Roughly two and a half weeks after the markets were closed, the price of Bitcoin jumped from around $4100 to $4800. At first, it seemed as though the price increase was a “dead cat bounce”–a brief spike before a fall to a new low.

However, the price just kept climbing. By May 1st, Bitcoin had hit roughly $5300; by June 1st, the price had risen to nearly $8500.

And sure enough, the bullish energy in Bitcoin spot markets was reflected in Bitcoin futures markets. On April 4th, CME reported a new record trading volume in its Bitcoin futures markets with 22,500 contracts (representing 112,700 BTC) settled in 24 hours; another new record was posted the next day on April 5th. Previously, the 24-hour record had been 18,300 contracts on February 19th.

Then, in May, the exchange reported a new daily record of 33,677 contracts on May 13th, and monthly record of 300,000 contracts settled.

Over April and May, notional trading volume at the was larger than the volume for the previous 6 months combined.

— TradeBlock (@TradeBlock)

On June 26th, CME’s Bitcoin futures market saw another new 24-hour record volume of $1.6 billion in notional trading volume.

CME Bitcoin futures reached a record $1.7B in notional value traded on June 26, surpassing the previous record by more than 30%. The surge in volume also set a new open interest record of 6,069 contracts as institutional interest continues to build.

— CMEGroup (@CMEGroup)

Does the increase in futures contracts mean that institutional investors are bullish on crypto?

Of course, some of the trading volume on CME can almost certainly be attributed to the migration of traders who may have traded exclusively on Cboe before the Bitcoin futures market shut down.

However, another portion of the trading volume can almost certainly be attributed to the upward price motion in Bitcoin spot markets.

But does the ever-climbing Bitcoin futures trading volume on CME mean that traders are bullish on the future price of Bitcoin itself?

Not necessarily–in fact, a report from the Commodity Futures Trading Commission said that traders took 14% more bearish ‘short’ positions in CME bitcoin futures last week than they did bullish ‘long’ positions.

However, the Wall Street Journal said that this doesn’t necessarily imply that traders are bearish on Bitcoin. “Such data don’t necessarily mean hedge funds are placing outright bets that bitcoin will drop,” reads a recent article from the publication. “The short bets could also be part of hedging strategies: for instance, a fund with a portfolio of bitcoins might go short at CME as insurance against the value of bitcoin dropping.”

Overall institutional interest in crypto is strong, according to Fidelity

But the WSJ did point out an interesting dichotomy between retail and institutional traders–according to the same article, traders with fewer than 25 BTC held long contracts held more long contracts than larger investors by a factor of four to one, which could be an indication that small investors are more bullish than large investors.

Whether or not this is true, there seems to be no shortage of institutional interest in the crypto markets. Fidelity Investments at the beginning of May showing that not only was institutional engagement in crypto “here”, but also that “institutional investors are overwhelmingly favorable about the appealing characteristics of digital assets.”

Indeed, nearly 70 percent of respondents said that they found certain characteristics of digital assets

“Appealing.”47 percent “appreciate[d] that digital assets are an innovative technology play”, and 46 percent found their low correlation to other assets appealing.

Additionally, 27 percent of the respondents like the high upside potential that digital assets have to offer, and 25 percent were a fan of the decentralized nature of most cryptocurrencies.

Additionally, Bitcoin futures trading in other markets has also continued to grow; BitMEX’ Bitcoin futures trading market that its trading volume has exceeded $1 trillion in the past 365 days.

Cboe still has “nothing new to announce”

Indeed, it seems that offering Bitcoin futures products has been an extremely profitable endeavor ever since Cboe made the decision to shut its Bitcoin futures market down.

So, has the platform announced any plans to reopen the market? No–but Cboe spokeswoman Suzanne Cosgrove confirmed that the exchange is considering it. “CBOE is assessing its approach with respect to how it plans to continue to offer digital asset derivatives for trading, but we have nothing new to announce at this time,” she told Coinspeaker in June.

It seems that although there has been a lot of good news in the cryptocurrency markets over the last several months, Cboe will need to see a bit more of it before it makes any drastic decisions. But if the exchange does reopen its BTC futures markets, well–that’s an institutional player whose re-entry would surely signify a lot of bullish sentiment for Bitcoin.

Be First to Comment