With the approach of the final deadline for EU-wide product intervention measures on July the 30th 2019, national regulators are on track to implement their own product restrictions. The CySEC has so far been refraining from announcing its views on the market until today, as the Cypriot regulator just issued an official stance on the matter.

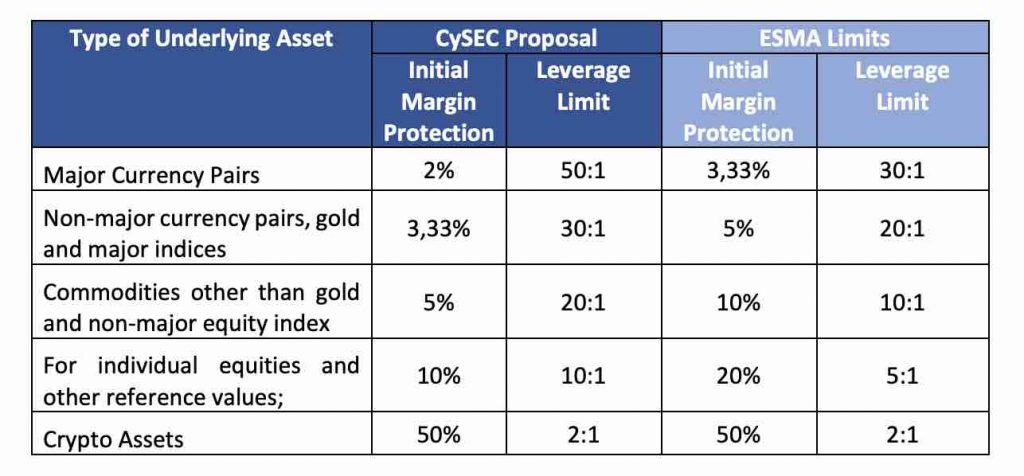

In contrast to most national regulators which have copied the ESMA’s product intervention measures and turned them into national rules, the CySEC is setting out into a new direction. The regulator is proposing a risk-based approach on leverage. Different clients with different experience will be tiered into different segments and will be able to use different leverage.

Meanwhile, binary options are confirmed by the CySEC to be completely banned from offer to retail clients under the proposed national measures.

Risk-Based Leverage Approach

The new approach on leverage under the CySEC’s proposal will be closely tied to the level of knowledge and risk-appetite of different retail clients. Each retail clients must be categorized by the brokers within a specific target market – either ‘positive’ or ‘negative.’

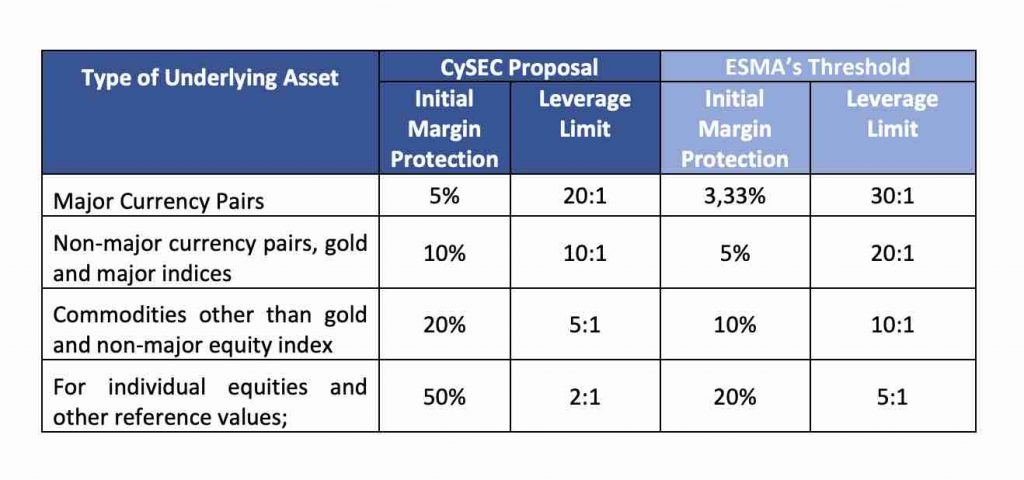

Retail clients who fall in the ‘grey’ area of the target market (fit neither within the positive target market nor within the negative target market) could be vulnerable to being offered leverage that exceeds their knowledge, financial position, and risk appetite. Hence, the CySEC is proposing to introduce stricter leverage limits for retail clients falling within the ‘grey area’ of the target market.

In order to classify for the upper ties, clients need to have either a gross annual income surpassing €40,000 or net liquid assets of at least €200,000.

Proposed leverage limits are based on the volatility of the underlying asset(s), and the knowledge, wealth, risk appetite, objectives, and needs of the respective retail client.

“Segmentation of the retail clients into three separate categories (plus retail clients falling within the negative target markets, who will not be allowed to be onboarded) will require careful CIF due diligence, onboarding, and client categorization processes,” the CySEC stated.

The regulator also proposes a prohibition of marketing, distribution, and sale of leveraged CFDs on crypto assets to retail clients. Only retail customers in the upper tier of the positive target market are proposed to be excluded from this measure designed to prevent exposure to the excessive risk caused by the extreme volatility of the cryptocurrencies.

What Remains The Same

Aside from leverage, all clients will be protected from negative balance and will have their positions closed out automatically when their funds reach 50 percent of the margin required to maintain their positions.

All brokers will continue to be prohibited from providing any incentives that encourage clients to trade. Standardized clear risk warnings also remain mandatory and firms will continue to display the percentages of clients making and losing money.

Client Protection

Highlighting the regulator’s efforts in tandem with the pan-European product intervention measures enforced since last year, the Chair of CySEC, Demetra Kalogerou, said that the standard and conduct of Cyprus Investment Firms when marketing, selling and distributing retail contracts for difference has increased significantly.

“Temporary product intervention measures set across Europe have supported CySEC’s own efforts to enhance investor protection. As this guidance is transposed into law alongside additional national measures and restrictions set by CySEC, our consultation with investors and the industry will provide an opportunity for feedback on what we see as the fundamental new rules of engagement.”

Further, Kalogerou highlighted that consumer demand for high risk, speculative trading products shows no sign of decreasing in Europe and Cyprus Investment Firms must continue reforming their business models to ensure investors are adequately protected.

Brokers and clients have two weeks to submit their comments on the proposed measures before the 14th of June.

Be First to Comment