It seems that the good ol’ USA is the new center of the crypto-trading universe. According to from Estonian crypto research firm DataLight, most of the world’s cryptocurrency traders are located in the United States.

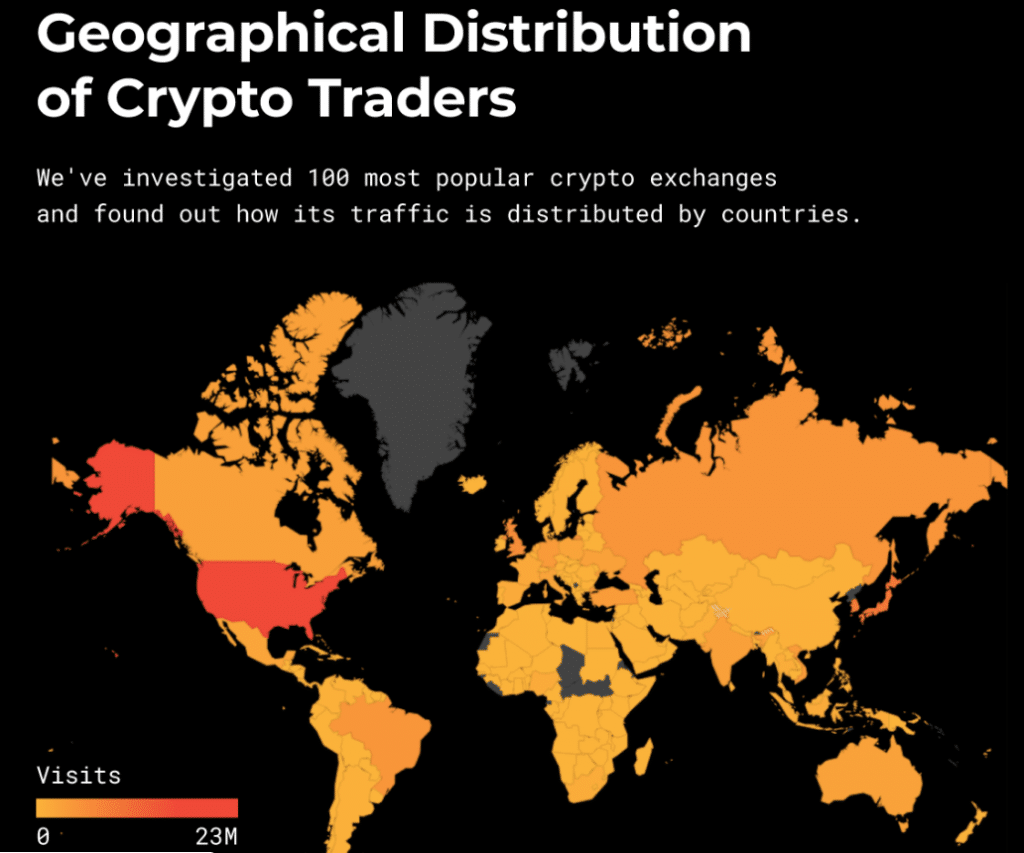

DataLight collected and analyzed data from the top 100 “most popular” cryptocurrency exchanges to find that 22 million monthly visits to these cryptocurrency exchanges were from US-based users, followed by Japan (6.14 million monthly visits) and South Korea (5.73 million monthly visits.)

The data also showed high numbers of users from countries whose fiat currencies are unstable, including Mexico, Ukraine, and Turkey. “Interestingly, on one day in August 2018, a 10% drop in the value of the Lira was accompanied by a marked spike in volumes on bitcoin exchange LocalBitcoins,” the report explains.

The Report Also Revealed Untapped Markets

DataLight’s report also revealed another interesting demographic: where cryptocurrency trading traffic is completely nonexistent. While most countries in the world saw at least some trading volume, Greenland, parts of Central Africa, and a couple of countries sprinkled throughout Asia saw no monthly visits to cryptocurrency exchanges at all.

Despite the apparent popularity of cryptocurrency trading within the United States, the country’s regulations around cryptocurrency are still unclear. However, the lack of clarity doesn’t seem to correlate with a lack of enforcement activity–last month, the to a peer-to-peer Bitcoin trader for failing to register as a money services business.

8/ Here, it looks like FinCEN wanted to settle two debates once and for all. It believes:

1) Mere two-party exchange is “money transmission”

2) Individuals can be money transmitters

(2) should be obvious. (1) is deeply problematic.

— Marco Santori (@msantoriESQ)

In August, a LocalBitcoins trader was sentenced to 41 months in prison for money laundering after conducting in-person Bitcoin trades amounting to over $160,000.

Be First to Comment