Europe is home to one of the largest retail foreign exchange (forex) markets in the world. The FX market in the region is often thought of as a whole, however, it is comprised of smaller local markets, each with varying degrees of maturity and size.

In Europe, Italy is not often thought of as an FX trading hub. However, although the market is small, it could be on the verge of a turning point. So how does the FX industry in Italy stack up?

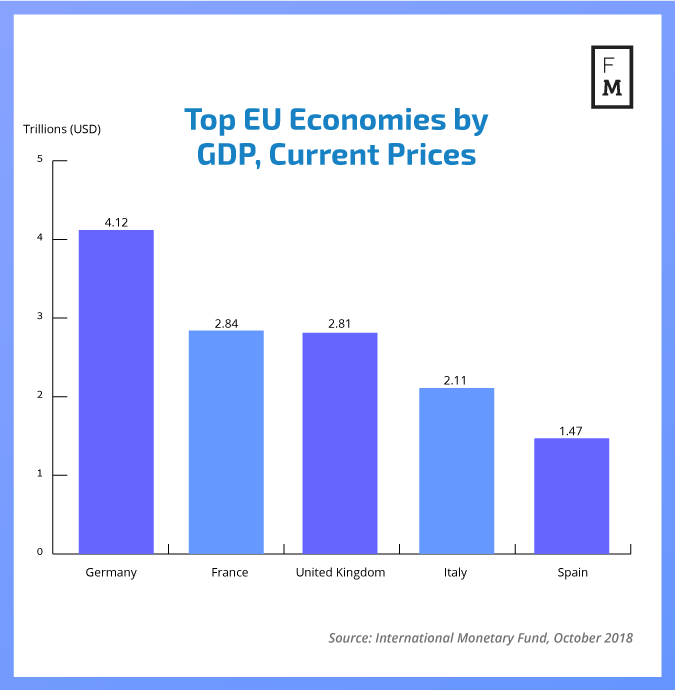

As far as economic importance, Italy is right up there in the European Union (EU). In fact, based on data from the International Monetary Fund in 2018 Italy’s economy was the fourth largest in the bloc, with a gross domestic product of $1.935 trillion by the end of 2017.

With the United Kingdom soon to leave the region, that would bump Italy into third place. Not only that but the importance of Italy as a country resonates throughout history right back to the Romans.

Italian Financial Market Structure

In order to understand the foreign exchange market in Italy, it is first important to understand the financial market in general. Typically, a country’s financial market is usually composed of three segments – the banking system, capital market and insurance market. Out of these three, either the banking system or capital market dominate, depending on the country.

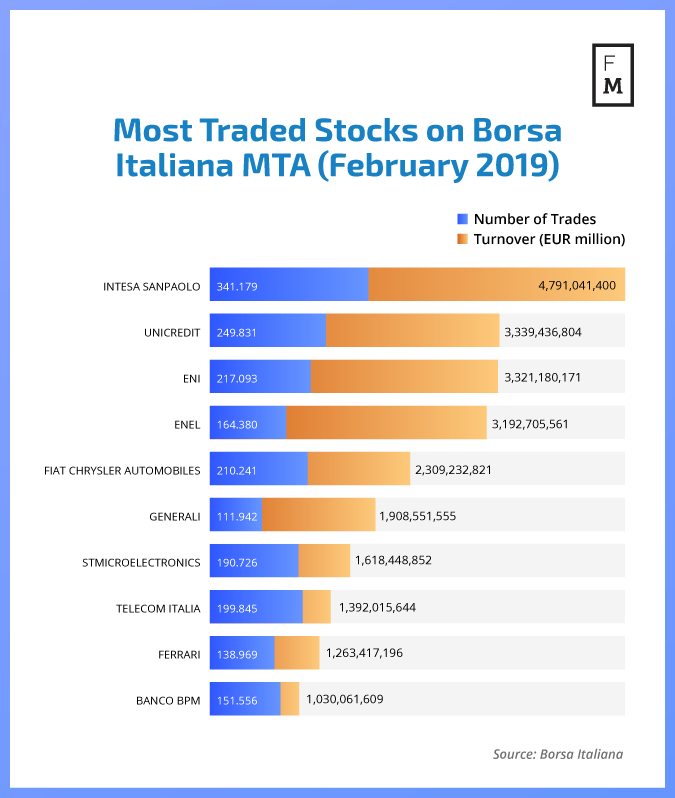

In Italy, despite its size to some of the more developed countries in the EU, the capital market has long traditions that underline its importance on the map of Europe. One of the most prominent participants in this market is the Borsa Italiana, the countries only stock exchange which was founded in 1808 by Eugenio Napoleone.

Since 2007, Borsa Italiana is a subsidiary of the London Stock Exchange Group. In terms of Italian stocks, the exchange’s trading share in Europe is 75 per cent. Another interesting figure for the Borsa Italiana is turnover velocity (TV), which is the ratio between volume traded compared with the overall number of listed shares. For the exchange, TV is more than 100 per cent. This is the highest value across all European trading venues.

Finance Magnates caught up with Massimo Giorgini, Head of Equity and Derivatives Markets Business Development, who highlighted that Italy has the highest participation of private investors on the listed market. Not only that, but investors are increasingly participating in this space through online trading venues.

“… And the same is actually the derivatives market is mimicking the performance of the cash, because for example on the FTSE MID futures, at least 20-25 per cent of the volume is done by online traders, but we estimate that if you factor in all the private investor this number may be in the range of 35-40 per cent. “

Furthermore, Italy’s listed markets are also extremely liquid and allow for high levels of diversification, allowing increasing numbers of Italian retail investors access to trade derivatives, ETFs and bonds.

What’s the Size of the FX Market in Italy?

But how does their FX market hold up? Well, it may come as no surprise to many of you to say that the forex sector in Italy is much smaller than the United Kingdom. In fact, the country has very few home-grown brokers.

This is in part due to the fact that the Italian financial regulator (CONSOB) has maintained a hard stance against investments which are considered high risk.

Because of this, Italian forex traders have very few choices when it comes to finding an Italian home-grown forex broker. In fact, most of the forex brokers that are currently serving Italian FX traders are based in other EU member states such as Cyprus or the UK. This includes eToro, , ActivTrades and Plus500, which are all big in the Italian market.

Home-Grown Italian Brokers – Are There Any Left?

In terms of local FX brokerages, Fineco bank appears to be the only local financial institution to provide forex trading in the country. When Finance Magnates previously conducted analysis, we identified two providers in the country, FinecoBank and IWBank. However, it appears the latter has stopped offering forex trading.

To learn more about the industry we spoke to , who is one of the main FX trading providers in Italy. For the firm, Italy takes up 6 per cent of its registered users, which equals around 60,000 users out of the brokers 10 million customers worldwide.

“In terms of the net worth per capita, Italy is still one of the wealthiest country in the world. Therefore, at eToro, we believe the country has a strong potential. Education has been and remains the main driver for the industry growth, in Italy as well as worldwide.”

Trading Activity in Italy

With little competition in the local Italian forex market and large international brokers dominating, is it worthwhile for new brokers to start up their operations in the country? It all depends on demand, and, as highlighted by Femiano, demand for FX trading in the country is correlated with industry patterns.

“I believe we have to look at the trend from a general perspective. FX is the typical beginner’s trading instrument, due to low margins and the possibility to apply scaling and position sizing techniques to small portfolios. Therefore, FX trading demand is highly correlated with the general trend of the industry,” Femiano added.

How do Italian Consumers Trade?

Historically, Italy is thought to be a more conservative trading market. The most commonly traded currency pairs are G10 currencies – EUR, USD, JPY, CAD and GBP, according to the trading activity on eToro. However, which currency pairs traders flock to depends on volatility.

Furthermore, Italians are more interested in trading stocks, such as the German DAX, and showing an increased interest in copy trading. Copy trading, as the name suggests, allows traders in the financial markets to automatically copy positions opened and managed by a chosen investor.

Be First to Comment