Plus500 shares plunged over 12 percent today after a Times report on Thursday warned of material weakness in its financial reporting for 2017 results. The publication identified accounting errors stemming from a $103 million loss the company had suffered from client trading activity that year.

The FCA-regulated broker acknowledged the error in a filing with the London Stock Exchange on Friday, adding that it took a similar hit in 2016 revenues of nearly $20 million.

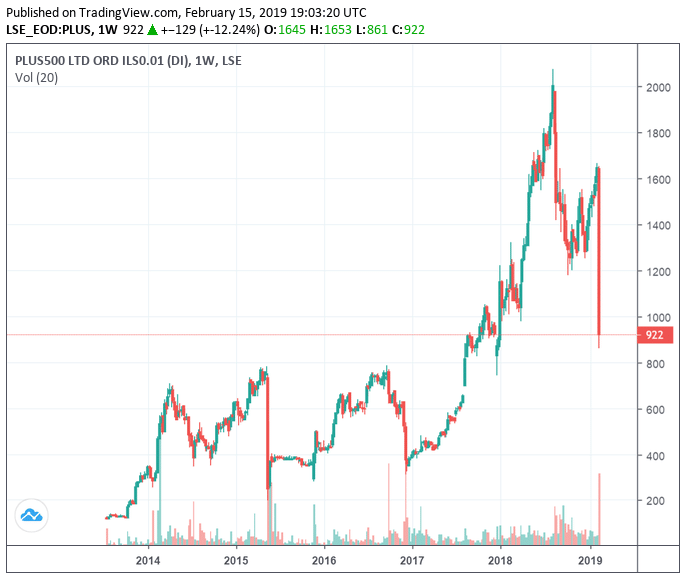

Shares in Plus500 closed down 12.24 percent at 921.50 pence per share in London, the lowest in 14 months. Earlier in August, the stock surged to 2,040.00 pence, the highest level since the Haifa-based firm first sold shares to the public in 2013, as amid an explosive interest in its products tied to cryptocurrencies.

The statement further explains that Plus500 in 2017, as in 2016 and 2015, stated that Plus500 “did not generate net revenues or losses from market P&L”. The words “or losses” in this statement were included erroneously, the company claims.

However, the UK spread better has disclosed in its lastest , which released earlier this week, the negative revenue impact it incurred in 2017 which came “due to strong client trading performance, particularly in the final quarter of that year.”

“Further, the Company confirms that it incurred a negative revenue impact of $19.5 million for the financial year ended 31 December 2016 (2015: $0.0 million),” it concluded.

Situation further complicated by weak outlook

Plus500 disclosed the accounting problems a few days after releasing its yearly earning reports that underlined the pressures on the London-regulated but Israel-headquartered broker.

this week, the largest slump since it froze operations in 2015 as part of a regulatory review into AML controls, after the company warned on Tuesday that its revenue and profit would fall short of analysts’ expectations this year.

Plus500 said in a statement that it expects material operational and financial impact from the new rules it can offer to retail clients, which means that revenue and profit would be “materially lower than current market expectations” in 2019.

Plus500’s warning on this year’s earnings took the shine off its where it doubled core profit to $506 million and full-year revenue to $720.4 million.

Be First to Comment