The (CFTC) has published its highly-anticipated monthly report for December of 2018, which covers data for Futures commission merchants (FCMs) that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker-dealers that hold retail forex obligations in the United States.

Retail forex obligations, in simpler terms, means client money held for FX trading. This figure is the combination of all money, securities and property deposited by a retail forex customer into their retail forex account(s). The figure is adjusted for the realised and unrealised net profit or loss.

Due to the current government shutdown in the United States, the CFTC data was not released for November of 2018. Therefore, it is not possible to make a month-on-month comparison for the latest set of results, instead, we’ll measure December’s figures against October of 2018.

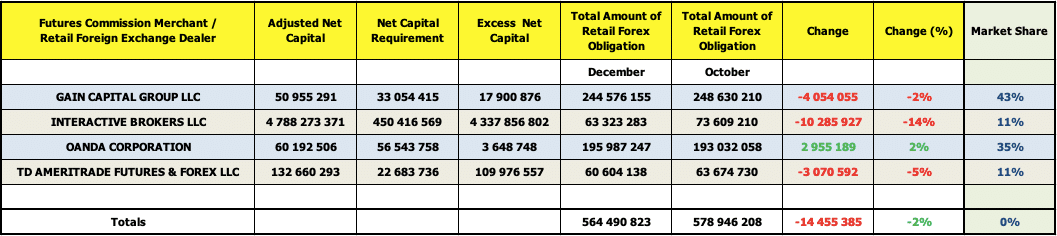

Overall, the CFTC monthly report shows that balances of US retail traders have dropped from October to December. According to the agency, the FX funds held at registered brokerages and those included as broker-dealers came in at $564.5 million in December 2018, which is a retreat of 2.6 per cent when compared with the $578.9 million reported in October.

The four forex firms listed are Gain Capital, Interactive Brokers, OANDA Corporation and TD Ameritrade Futures & Forex. Out of the four firms, OANDA was the only one to not report a drop in Retail Forex Obligations. However, the company only managed to report an increase of 1.51 per cent, or just under $3 million, from October 2018 ($193 million) to $195.99 million in December.

Interactive Brokers reports biggest drop, CFTC data shows

Posting the biggest loss on a percentage basis was Interactive Brokers. In December the broker held $63.3 million in client funds for forex trading. This is around 13.97 per cent less, which translates to a drop of more than $10 million, than what the company held two months prior, which was $73.61 million.

TD Ameritrade had the second largest loss, in terms of percentage, of 4.8 per cent or $3.1 million when measuring December’s figure of $60.6 million of clients funds against October when the broker held $63.67 million.

also posted a loss on a December to October comparison. On a percentage base, the broker had the smallest loss out of Interactive Brokers and TD Ameritrade, at 1.63 per cent. However, this translated to a loss of more than $4 million, which is larger than TD Ameritrade’s loss.

Specifically, Gain Capital held $244.58 million in client funds in December of 2018. In October, the broker held $248.63 million.

Be First to Comment