Bitcoin fell in and out of the news this year for all of the wrong reasons. Indeed, the year of the coin’s tenth anniversary was–by many accounts–a real stinker. It was the year that wasn’t for Bitcoin; the year that wasn’t Bitcoin’s big adoption year, the year that wasn’t Bitcoin’s big moment in the sun.

But if all publicity is good publicity, the negative pieces of coverage that got over the course of the year all but dwarfed the dwindling amount of light shone on most altcoins. They slipped and slided just like Bitcoin did–but without the greek chorus of the media groaning and tutting at every turn.

Ethereum’s Precipitous Fall

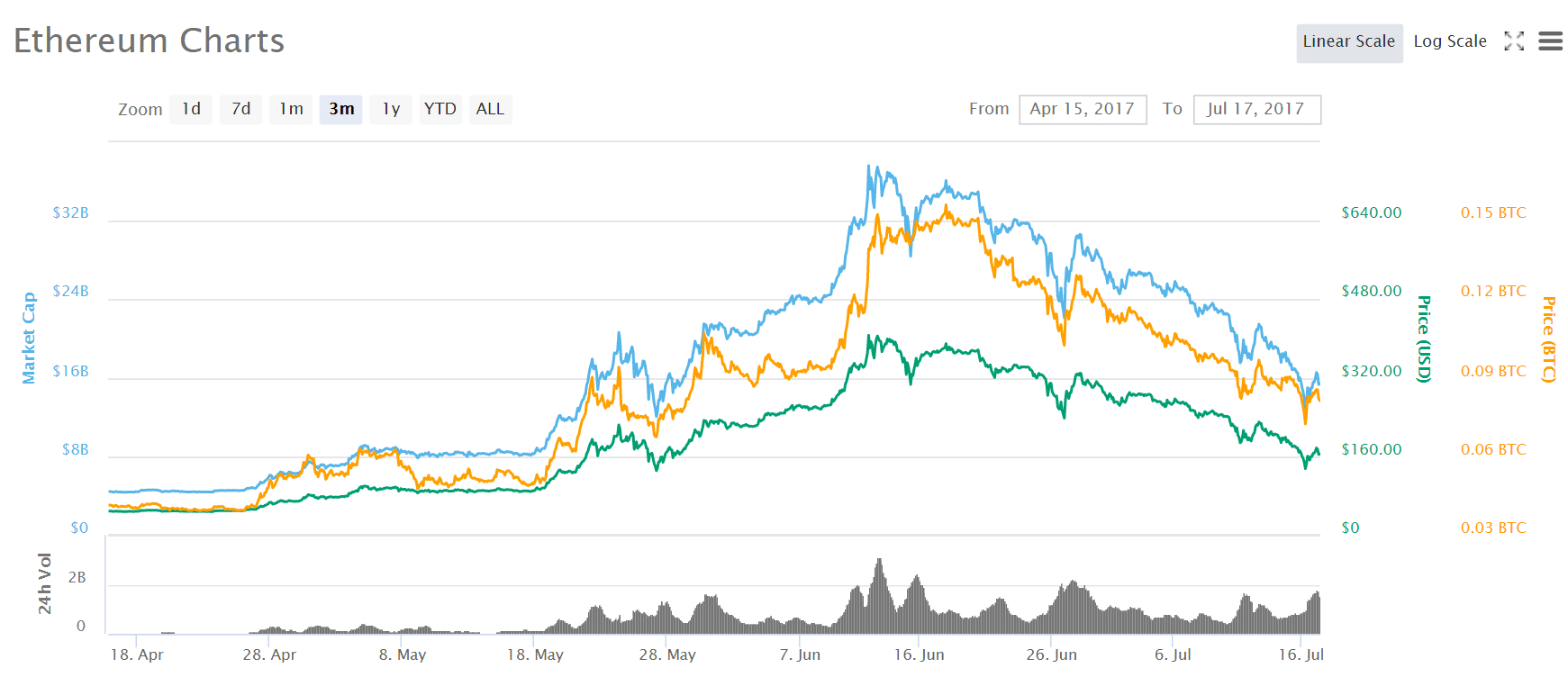

Remember 2017? 2017 was a huge year for Ethereum. Indeed, the cryptocurrency’s massive rise in Q2 of 2017 was one of the factors that put crypto on the map of the first place–within a matter of months, lept from $50 a pop to nearly $400. Some of those who got in several months earlier, when Ethereum sat around $15, managed to clear a massive profit.

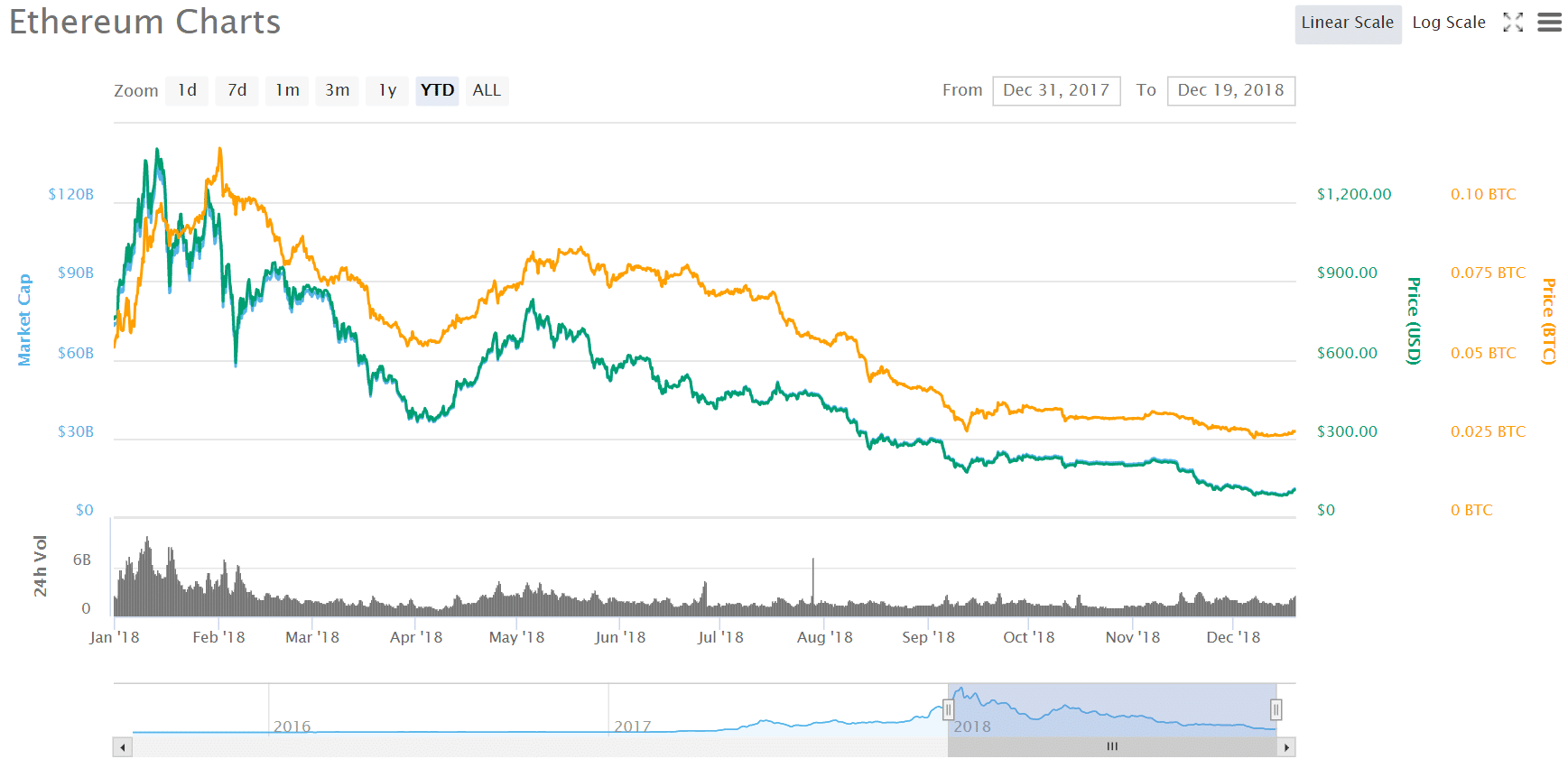

Ethereum rose again near the end of 2017 along with hundreds of other cryptocurrencies in the big crypto boom at the end of the year, this time clearing heights of over $1000. Much like Bitcoin, analysts sung Ethereum’s praises and predicted that it was heading to the moon in 2018.

Boy, were they wrong.

It turns out that similar to Bitcoin, much of the driving force behind Ethereum’s $1000+ valuation at the beginning of 2018 was driven by speculation. When the speculators left the market, it’s possible that the only thing remaining was the core group of entities that actually do use the Ethereum network.

Not everyone was convinced that Ethereum’s valuation was going to continue its astronomical rise throughout 2018. In fact, Ethereum creator himself expressed on more than one occasion that he believed that all cryptocurrencies were due for a serious market correction.

Reminder: cryptocurrencies are still a new and hyper-volatile asset class, and could drop to near-zero at any time. Don’t put in more money than you can afford to lose. If you’re trying to figure out where to store your life savings, traditional assets are still your safest bet.

— Vitalik Non-giver of Ether (@VitalikButerin)

Valuation aside, the Ethereum network is now closer than it ever has been to the release of the which is the next step in the network’s transition from a Proof-of-Work network into a Proof-of-Stake network. Proof-of-Stake networks utilize a method of confirming transactions and producing new coins that is much more energy-efficient than the method used in Proof-of-Work methods. Both phases of the implementation of the Casper protocol are scheduled for 2019.

In 2020, the Ethereum network will add the ability to “shard”–the ability to process multiple transactions at once by dividing them across several parts of the network.

Here’s a GIF of a sim of a multi-shard system with cross-shard routing of calls between shards 3 and 6. The shard hierarchy and message routes change during this execution of the protocol. Still experimental and not fully specified or implemented yet. See !

— Vlad Zamfir (@VladZamfir)

Who’s Surviving?

XRP and Litecoin, two of the world’s other most popular cryptocurrencies, fared similarly poorly this year in terms of price valuation. XRP began the year at just over $3.00 per token, and currently sits around $0.35. Litecoin did about the same, starting the year at just under $300 and sitting around $30. , EOS, Cardano–let’s not even talk about the. Everyone is suffering.

If the world’s most popular altcoins are faring so poorly, which coins–if any–are doing well?

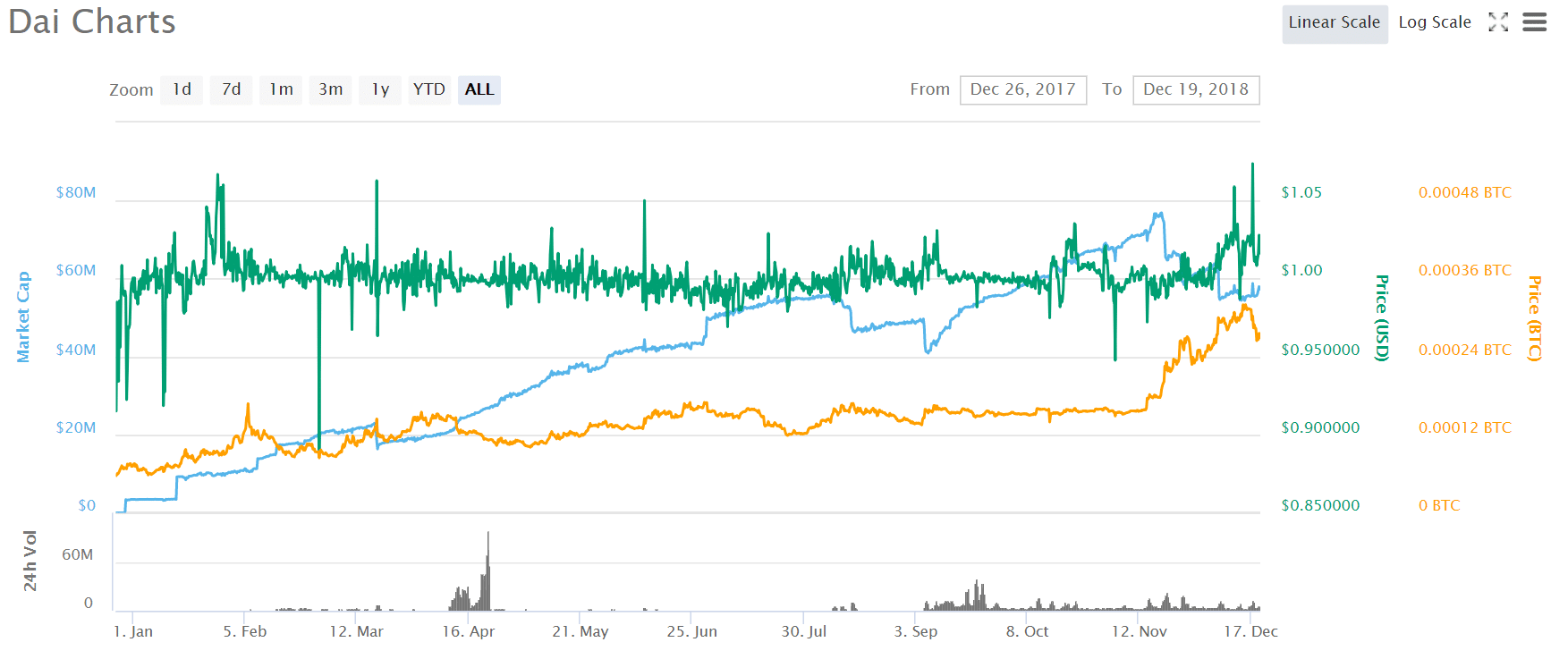

Many analysts have picked up on a notable uptick in the usage of stablecoins, as well as an explosion of new altcoins on the market. At the end of 2017, there were only a handful of in existence; now, there are more than 60.

Of course, purchasing stablecoins won’t bring a profit the way that investing in other cryptocurrencies might–they maintain a relatively stable valuation by their nature. However, it may be possible–and profitable–to invest in the companies that are responsible for creating and maintaining stablecoins.

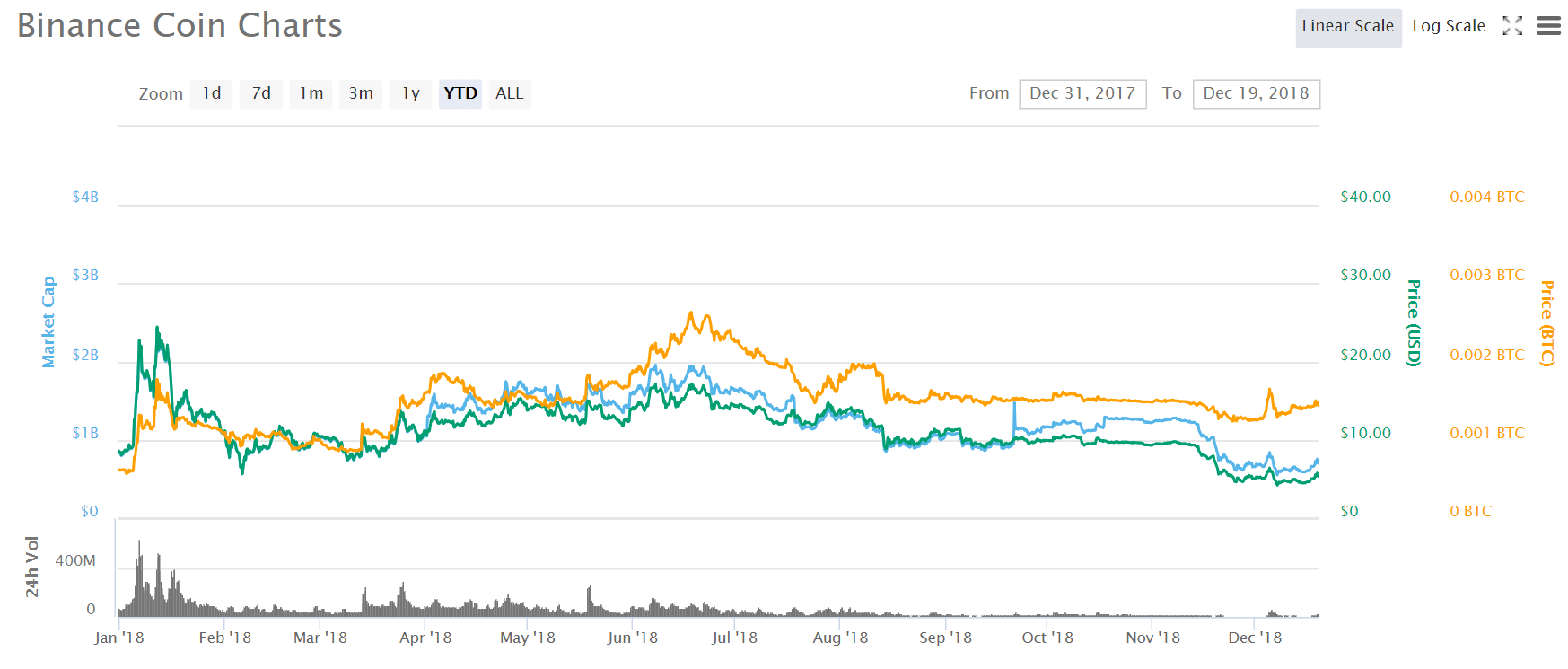

Coins that have a concrete purpose and use have also managed to fair better than those that are still being built or those who’s sole purpose is to act as a transactional network. For example, BNB (the native token of the Binance exchange) has managed to retain much more of its value than most other altcoins have.

When the Chips are Down….

The falling markets have caused more problems than just empty wallets–indeed, the sliding valuations seemed to have brought out the worst in people.“The provide a pungent reminder that many in the blockchain and cryptocurrency industry are in it for themselves, the fast money, or the constant ego-stroking,” said Eric Spire, Executive Vice President of World Crypto Con, in an email to Finance Magnates. “It has been difficult to watch all of the fighting, taking sides, and purposeful undermining of other projects as the market has taken a decidedly bearish turn for the year.”

What’s worse is the effect that all of this has had on the public perceptions of the cryptocurrency industry: “it paints a dire picture for Decentralized Public Blockchain Projects and might have opened the door for the entire ecosystem to be subsumed by Permissioned Private Blockchains seeking real-world applications of the technology without the suspicious and oft-manipulated token and coin side of cryptocurrencies.”

What Does The Future Hold for Altcoins?

Kevin April, CEO at SportsCastr and FanChain, told Finance Magnates that “in terms of ICOs, the future is clear: they will only be feasible for large brands, multi-nationals or established companies with deep pockets.”

Why Most ICO’s Will Fail: A Cold Hard Truth –

— Miko Matsumura ㋡ (@mikojava)

Indeed, “the days when a group of smart engineers or a small team can launch a successful altcoin are numbered,” he continued. “The resources required to succeed will continue to raise the barrier-to-entry significantly. This is similar to what we saw in the early days of microcomputers, video games and internet startups.”

“This is both good and bad for the world of altcoins. On the positive side, the caliber of projects introduced will increase. On the negative side, it will be more difficult for truly innovative ideas to break through.”

We surveyed major ICOs and found – large raises never mean high returns🙃🙃War chest may buy superficial “traction”, like how 40% of VC money for traditional startups all goes to Google/Facebook on ads. Being able to run lean is key to succeeding as a founder, in any sectors

— Dovey Wan 🦖 (@DoveyWan)

Additionally, April argues that “emerging markets will play an important role in ushering in mainstream adoption of altcoins, with remote/rural populations in countries like Nigeria, Argentina and leading the charge.”

It is perhaps within these markets that altcoins will finally have the chance to flourish. “In these markets, the ability for blockchain and crypto to remove gatekeepers by empowering the underserved/unbanked — combined with geopolitical instability and high inflation — has created the perfect storm of opportunity for blockchain-based solutions to overpower traditional banking and fiat.”

Still, things will get worse before they get better. “2019 will be the year when we start to see a few coins delivering network value and gaining network effects. This should be a very small percentage of tokens. 99% of them will and probably should die, but 1% or less may show real signs of life,” said Miko Matsumura, VC and General Partner at Gumi Cryptos and a founder at Evercoin Exchange, to Finance Magnates. “Once this happens we will see a bit more life in the markets.”

Be First to Comment