The top brokers in the foreign exchange (forex) industry are constantly changing, although, there are certain brokers that consistently dominate the markets. However, the to the sector in the European Union (EU) threatened to throw out that balance – so which brokers managed to stay on top?

Well, it is fair to say that EU based brokers or firms with an EU focus were clearly hit by the regulation. However, there was one broker that did manage to maintain its dominance throughout the whole year, despite it being a UK-based firm.

IG Group maintains dominance

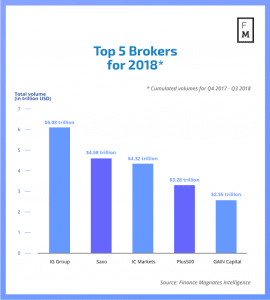

This is, of course, none other than . According to average monthly volumes, IG Group consistently topped every quarter from Q4 of 2017 up until the third quarter of this year, and most quarters had a comfortable distance between second place.

On August 1, 2018, the (ESMA) introduced restrictions for contracts for difference (CFD) trading. This included marketing and leverage restrictions.

As can be expected, this caused most brokers to take a hit in trading volumes and IG was no different, with the third quarter being the lowest quarter for the broker. However, it still managed to average a monthly trading volume of $460 billion. Its most successful period was the first quarter of this year, with an average monthly trading volume of $574 billion.

The rise of the Aussie brokers

Whilst the regulations within the EU have drastically changed the forex industry, the changes were limited to the region. As a result, during the second and third quarter of 2018, we saw the rise of Australian-based brokers.

One such broker is , an Australian-based online ECN forex broker firm. During the fourth quarter of 2017 and the first quarter of this year, IC Markets was in third place in terms of FX trading volume, behind IG Group and Saxo Bank, averaging $285 billion and $329 billion per month in the fourth and first quarter respectively.

However, IC Markets moved up the ladder to second place during Q2 and Q3, stealing the spot from Saxo Bank, with an average of $399 billion and $428 billion, respectively.

New record: IC Markets posts new monthly trading volumes record in May @ICMarkets__com

— Finance Magnates (@financemagnates)

Whilst this coincided with the ban on selling binary options to retail investors in the EU taking effect in the second quarter and the later restrictions on CFDs in the third quarter, whether IC Markets directly benefitted from the regulation is debatable.

Retail investors look outside of the EU

However, as has previously reported, many retail investors who previously chose firms within the EU for their investments did look to where they could choose their own risk, such as Australia.

It is interesting to note that , another forex broker in Australia experienced an almost identical pattern. In Q4 of 2017 and Q1 of 2018, Pepperstone was in eighth place, averaging $167 billion per month and $216 per month in fourth and first quarter respectively.

However, in Q2, Pepperstone jumped up to sixth place with an average monthly volume of $219 billion, and in the third quarter made it into the top five with $212 billion. With Pepperstone, it is easier to draw conclusions as to whether the broker benefitted from ESMA, as the firm mostly made its way up the ladder only as a result of EU-based firms reporting falls in their FX trading volume, as its average monthly volumes didn’t increase drastically during the two quarters.

EU brokers feel the pain of ESMA regulation

One EU-based broker, in particular, that embodies the pain inflicted on brokers by ESMA, is FXCM, a retail forex broker based in the UK. In terms of trading volumes, was in fifth place in the final quarter of 2017, with an average monthly trading volume of $194 billion.

In the first quarter of 2018, although FXCM fell down one place on the ladder, its average monthly volume increased to $233 billion. However, it was all downhill from then, slipping to $199 billion in the second quarter and falling down to $174 billion in the third quarter, pushing it down to seventh place.

Be First to Comment