Earlier on Thursday, IG Group announced that the company’s CEO after 24 years with the firm. The news impacted the shares of the company materially.

After the close of the London Stock Exchange, IG Group’s stock is 13 percent lower. A move which opens a second consecutive week of . After trading as high as around 955 pence per share, the value of a single share of the retail brokerage today is 640 pence.

Question of Timing

Hetherington’s exit comes at the worst possible time for the firm. The ESMA’s new regulatory framework in Europe has been implemented in August, capping leverage for retail clients at 30:1 for FX.

The limits are even lower for CFDs on indices, commodities, and stocks. The retail brokerage business is suddenly not as attractive for the shareholders of IG.

The resignation of Hetherington comes almost two months after the introduction of the new regulatory framework. He has been with the company for over 24 years, spending the last three as CEO after the resignation of Tim Howkins.

Speaking of the former CEO of IG Group, a video clip from CNBC’s Squawk Box from 2013 is worth watching:

Stock Performance of Listed Brokers

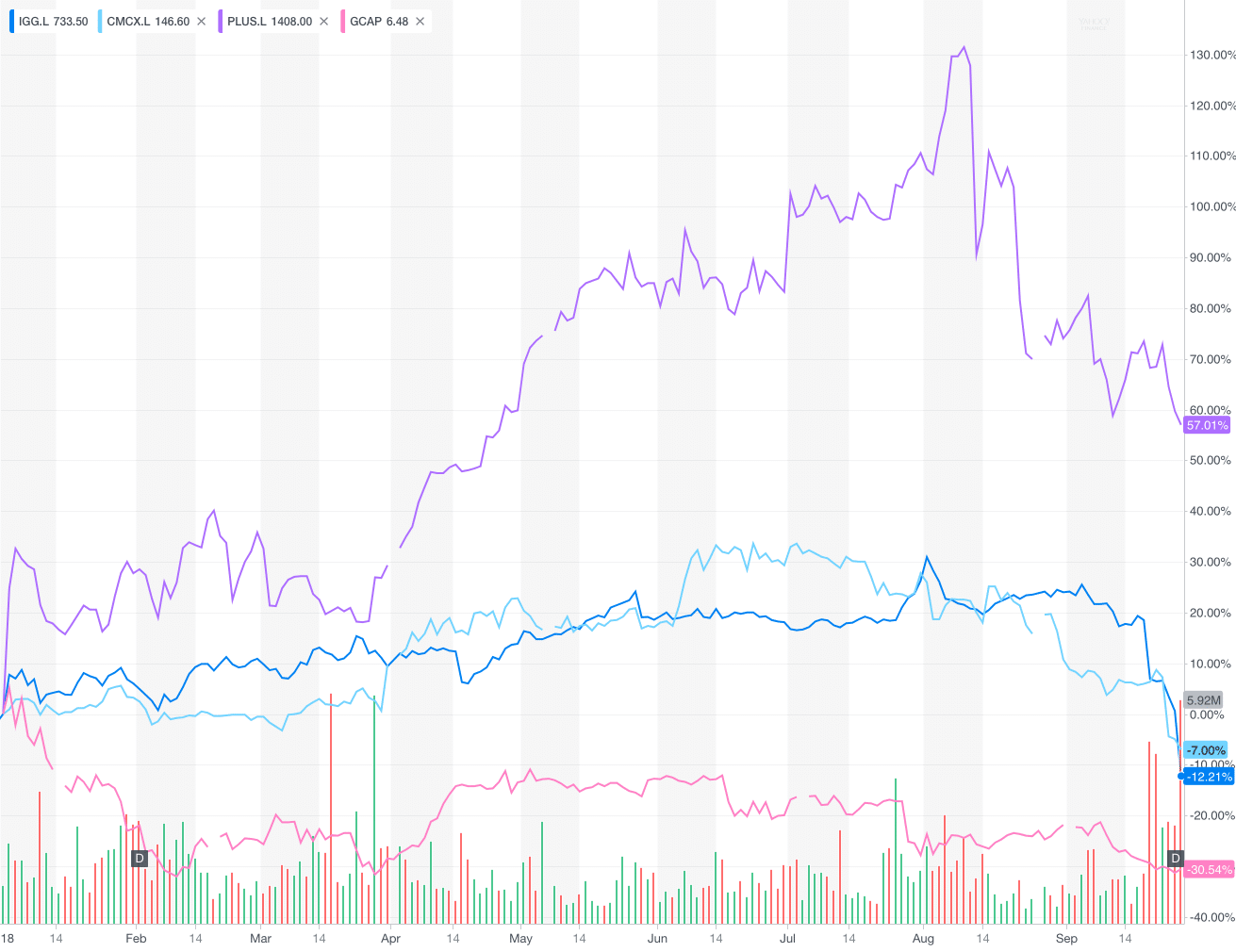

The shares of the big four brokers that are traded publicly have been punished during the last couple of months. Plus500 appears to be the outlier, however, the trend in the company’s stock has clearly been lower since August.

As we can see on the chart below Plus500 is the only company still in the green since the start of 2018. Shares of CMC Markets are lower by 7 percent, IG Group is lower by 12 and GAIN Capital is down 30 percent since January 1st.

Another significant change may happen if the brokers manage to somehow convert retail traders to institutional ones. Proactive solicitation, however, is explicitly forbidden by the European regulators.

In any case, it appears as if the market has been misplacing trust in the ability of retail brokers to conserve revenues after the regulatory changes.

Be First to Comment