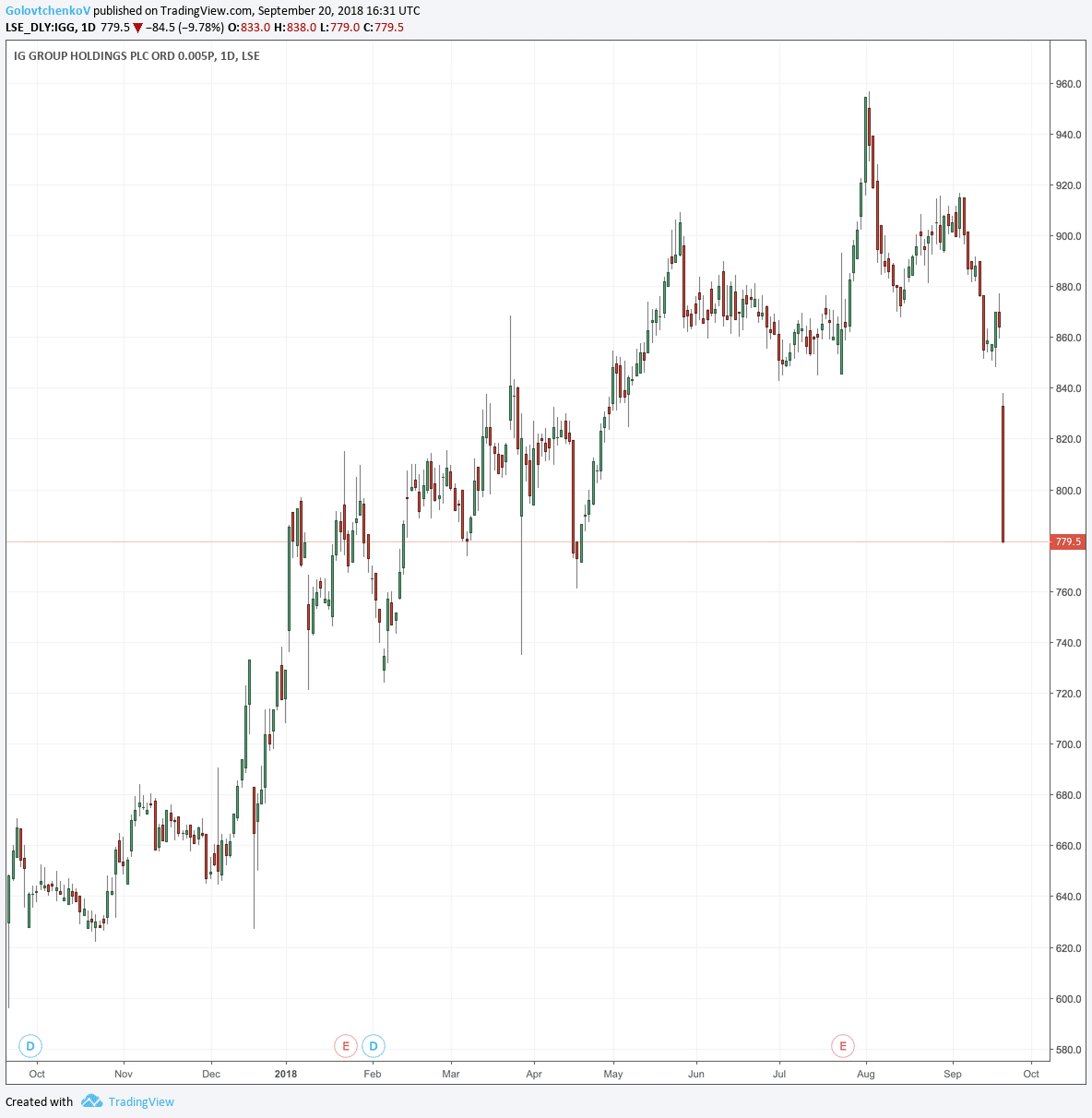

IG Group on Thursday reported on the outcome of the of the year. The value of the broker’s stock declined sharply in the aftermath of the announcement. The company booked a drop in client numbers in the EU and the UK. The two markets have been the strongest geographical regions for the company for years.

This has changed in the first quarter of fiscal 2019 which for IG Group ended on August 31. The company reported that revenues from the APAC region had surpassed the numbers from the UK.

Market Repricing ESMA Risks

The market has been looking at the new regulatory era dictated by ESMA with half an eye open. The firm stated in its trading update yesterday that the have been affecting it as previously expected.

It seems the stock market hasn’t fully priced in the extent to which the revenues and client numbers of IG would decline in the new regulatory environment.

The impact of for retail traders is taking shape. For some industry-insiders, the results are not a big surprise, but investors in shares of IG Group have clearly misinterpreted the message which the company has been sending for months regarding the implementation.

IG Group Revenues Spike Higher

IG Group’s revenues in the first quarter of its fiscal 2019 totaled £128.9 million ($168.56 million). Out of those, the firm’s UK and EMEA figures were reported at £53.9 million ($70.5 million) and £34.4 million ($45 million) respectively. This nets to annual declines of eight 8 and 12 percent, respectively.

The revenues per client figures have shifted somewhat. A client in the UK generated on average six percent more when compared to last year. The number of customers declined by over 5,000 to 34,000. The number of EMEA clients declined by about ten percent to 27,200.

Be First to Comment