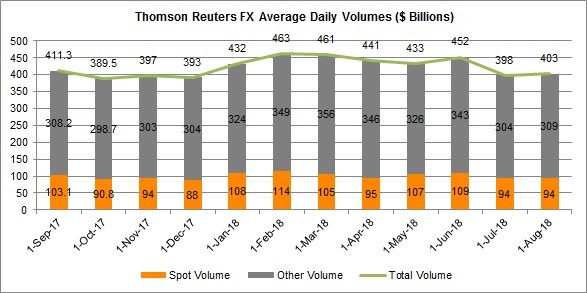

Thomson Reuters (NYSE:TRI) said that average daily volumes (ADV) of currency trading were in excess of $400 billion last month on the company’s main FX spot trading services.

Volatility is coming back slowly to FX markets after a subdued July. The modest bull run lately has made a profitable opportunity for industry players, from major venues, including the likes of , to an array of .

In particular, Thomson Reuters saw a total average daily volume (ADV) of its foreign exchange (FX) products coming in at $403 billion in August 2018. This total reflects trading volumes on Thomson Reuters Matching and FXall in all transaction types, including spot, forwards, swaps, options and non-deliverable forwards.

The figure represents an increase of 1.2 percent month-over-month from $398.0 billion in July 2018. It has also outpaced the trading turnover from the same month a year ago, marking a gain of 9.8 percent year-over-year from $367 billion in August 2017.

The August volumes, however, were well below the $461 billion and $463 billion reported back in March and February of this year respectively, the two best months on record for trading volumes.

Thomson Reuters recently launched a new version of its MarketPsych Indices (TRMI) to include market for the top 100 cryptocurrencies. The stated goal is to encourage efficiency and transparency for the virtual asset investors within the global marketplace. The step also follows the successful launch of bitcoin sentiment data in March 2018.

Earlier in July, Thomson Reuters launched a price data feed for virtual currencies, dubbed “,” building on the success of similar benchmarks that leverage price data from a suite of crypto exchanges

Be First to Comment