The 30 percent correction in the value of retail brokerage Plus500 is attracting attention from more professionals. The increasing amount of institutional investors which have purchased shares in the company include some old and new names.

The previous largest institutional investor in Plus500, Playtech, offloaded its stake to private equity investor Bright-Tech Limited. The 9.99% stake which the has been holding since 2015 was offloaded earlier this month.

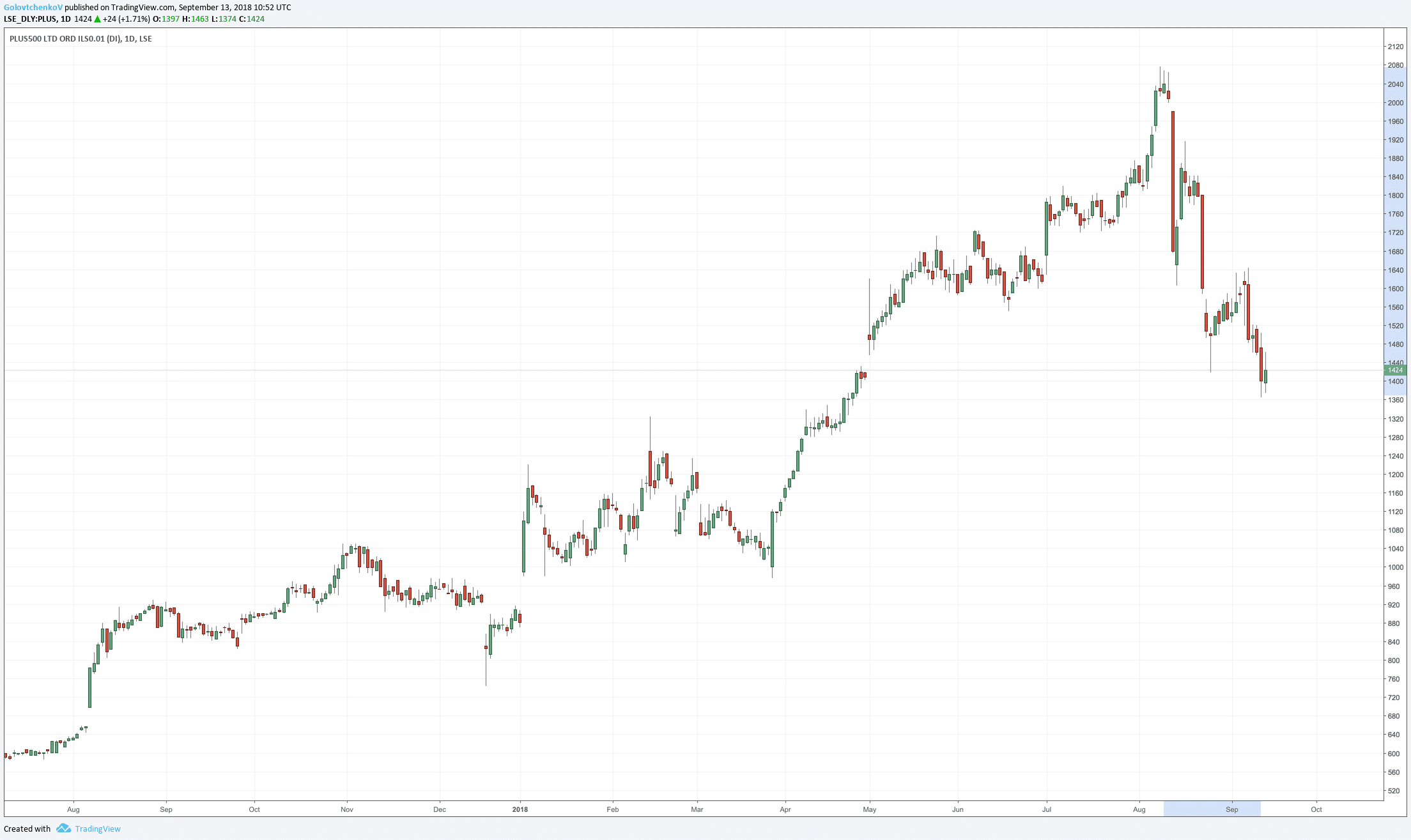

The news comes a little less than a week after the founders of the company sold about 8 percent of the company’s float. The event triggered another leg lower with the shares of the retail brokerage bottoming out yesterday around 1366 pence per share, a since the peak marked about a month ago.

Crispin Odey’s Fund is Back In

The investment venture of Crispin Odey, is back in, building up its stake. The company’s holdings have surpassed 10 percent once again after falling near the 5 percent mark earlier this year.

Crispin Odey’s investment fund was a vocal opponent of the deal between Playtech and Plus500 several years ago. At the time the retail brokerage was facing some difficulties when dealing with clients.

As to the second new player in this mix, its Luxembourg-based private equity fund Axxion. The news about the company acquiring a 5 percent stake in Plus500 was publicly announced via the London Stock Exchange news service yesterday.

The largest institutional investors of Plus500 now, Bright-Tech and Odey Asset Management now own close to a fifth of the company.

Plus500 Shares Volatility

After staging a massive rally in the aftermath of a blowout first half of the year, shares of Plus500 have peaked out. The company’s founders and Playtech cashed out after the firm’s record-breaking first half results.

The firm’s management highlighted after the announcement that to repeat these results in the near future. After the company onboarded a record number of new traders in the fourth quarter of 2018, the crypto bubble burst led to outsized losses for CFDs traders in this asset class.

Be First to Comment