Reports this Wednesday suggest that the is launching its first . The asset manager, one of the oldest banking institutions in Switzerland, is arguably the largest asset manager now offering a cryptocurrency product.

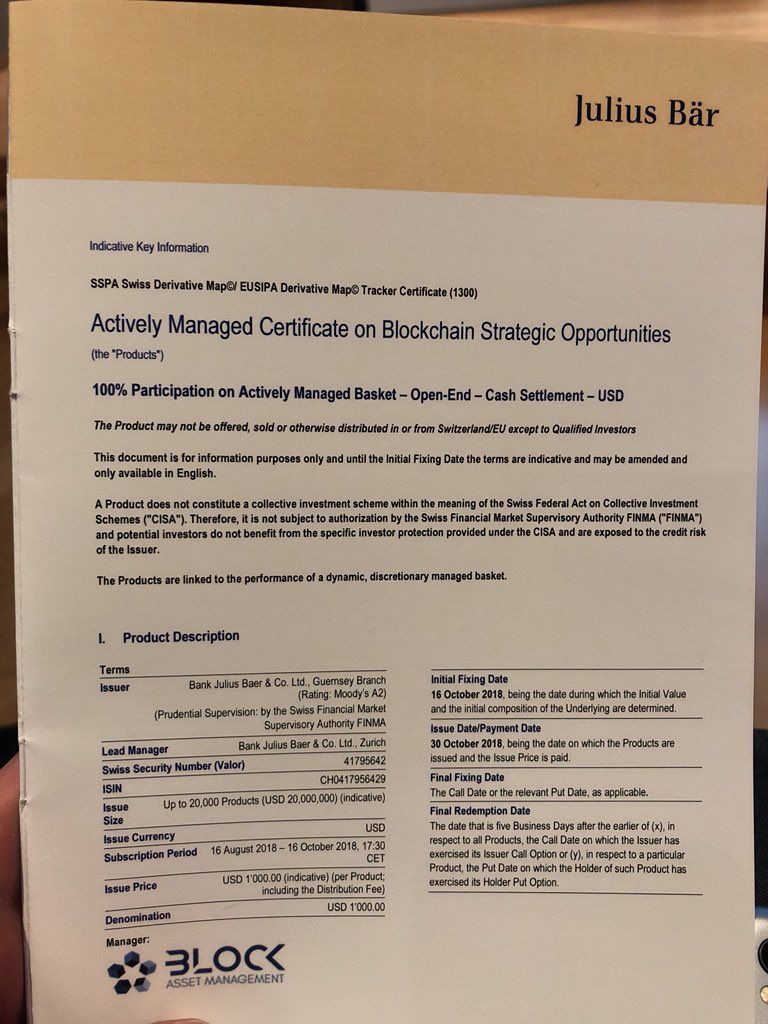

Company documents indicate that the asset manager is using Block Asset Management to aid it in its product launch. Block Asset Management is a cryptocurrency investment management firm.

Julius Baer – Learning to love crypto?

Julius Baer will be issuing up to 20,000 of the products. A company document seen by Finance Magnates show that the products will be issued at $1,000 a piece.

An initial fixing date has been set for the 16th of October. The asset manager defines this as the date during which the initial value and initial composition of the underlying asset are determined.

Why you should stay away from and other . Read our interview with Next Generation analyst Alberto Perucchini

— Julius Baer (@juliusbaer)

Accompanying this, an issue date has been set on the 30th October. This means that at the end of October the products will be issued and the issue price, $1,000, will have to be paid.

A length subscription period will also be held. This started on the 16th of August and will end on the 16th of October at 17:30 Central European Time.

The launch of a cryptocurrency product marks quite a change in tone for Julius Baer. As you can see above, in late 2017, the asset manager on its website entitled “Stay away from Bitcoin and crypto!”

A few months prior to this, the company’s Chief Investment Officer had been equally dismissive of cryptocurrency. Julius Bonz said that bitcoin was “from the Stone Age” and “unsuitable for an investment portfolio.”

Be First to Comment