UK-listed brokerage today said that it has been notified by its founders that they intend to sell up to 9.4 million company shares, equivalent to an 8 percent chunk of the spread better. They agreed to a 90-day lock-in period in respect of the remaining balance of their ordinary shares in the company.

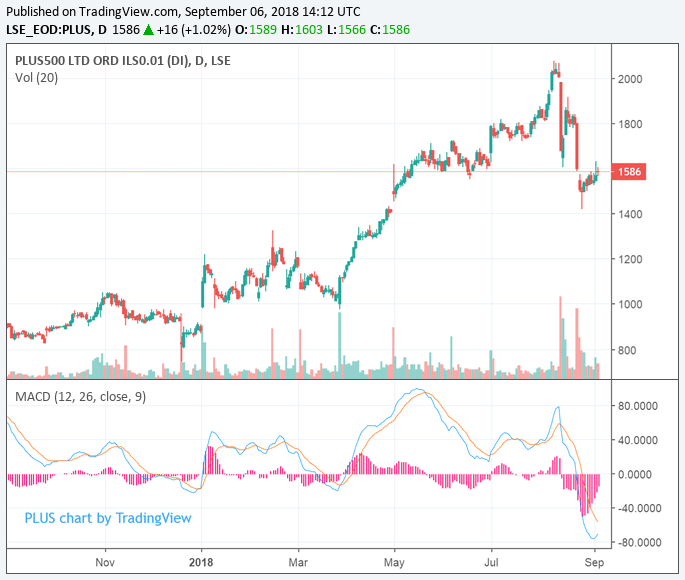

Shares in Plus500 are trading up 2.1 percent at 1,619.00 pence per share in London on Thursday. Earlier in August, the stock surged to 2,040.00 pence, the highest level since the Haifa, Israel-based firm first sold shares to the public in 2013, as revenue more than tripled amid an explosive interest in its products tied to cryptocurrencies.

Five of Plus500’s Israeli founders – Alon Gonen, Gal Haber, Elad Ben-Izhak, Omer Elazari and Shlomi Weizmann – plan to offload their holdings at a price of £15.50 per each, raising aggregate gross proceeds of £145 million for the sellers.

Plus500 itself will not be compensated in any way from this offering, according to the LSE filing.

Assuming all 9.4 million shares are sold, the founders will continue to hold a 8 percent stake in Plus500 when the placing completes.

Liberum Capital Limited, the company’s broker, is acting as global co-ordinator for the placing. The Israeli-based broker said the founders have agreed with Liberum, as part of the deal, not to sell any further shares for a period of 90 days after the completion of the current offering.

The decision to sell came “in response to significant demand from a small number of institutional investors,” adds the regulatory filing.

Plus500 was formed in 2008 and is currently one of the biggest CFD, FX and spread betting providers in the United Kingdom, trailing behind IG. According to the firm’s financial statement for the first half of 2018, its , coming in at $465.5 million. This is an increase of 147 percent from the first half of last year, which saw revenues of $188.4 million.

Earlier today, we reported that Plus500 stock is set to be officially listed on the FTSE 250 Index on Monday, September 24. The announcement was made by in its quarterly review that was published on Wednesday.

Be First to Comment