The (FOS) has published its first quarter statistics for 2018/2019. From April to the end of June this year, the British Ombudsman received a notable uptick in new enquiries and complaints.

Each quarter, the FOS publishes an update on the financial products and services consumers have contacted them about. In the report, the number of new enquiries and complaints the receives plus the number of complaints that were settled in the consumer’s favour are included.

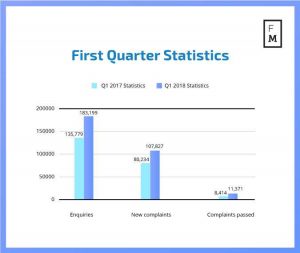

In the first quarter, the FOS received 183,199 enquiries. This is up by around 26% from the same period last year, which saw 135,779 enquiries. New complaints were also up this year, increasing by 25% or 27,593 new complaints to reach 107,827.

The number of complaints passed also increased in the first quarter. In Q1 of 2018, the number of complaints passed was 11, 371. When compared to the first quarter of last year, this is an increase of 26%.

Overall, the percentage of cases upheld during the first quarter of the 2018/2019 year, was 35%. This is the same portion of cases upheld in the same period last year.

Payment protection insurance complaints to the FOS dominate in Q1

Out of all the financial products, payment protection insurance (PPI) was the most complained-about financial product. In the first quarter, the FOS received 55,223 new complaints about PPI. This was 54% of the total complaints received by the ombudsman.

Payday loans saw the second largest volume of complaints, coming in at 14,799. From the total volume of complaints, this made up 21%. Current accounts had the third-highest number of complaints, taking up 13% of the total volume.

The changing tactics of scammers

Not only did the financial ombudsman experience an uptick in complaints from investors in the United Kingdom, it also noticed a change in .

Source: Financial Ombudsman Service Limited

“Today, it’s often loopholes in new technologies, rather than in old ones, that fraudsters are using to their advantage. Your first step toward being scammed may be putting your details into an identical, but fake banking website – or responding to a text message that, on the face of it, looks like it’s from your bank.”

Be First to Comment