In the wake of the (ESMA) latest regulation, a lot of time has been spent examining how brokers are going to have to change their behaviour. Here at Finance Magnates, that we would see industry consolidation alongside brokers shutting up shop or moving offshore.

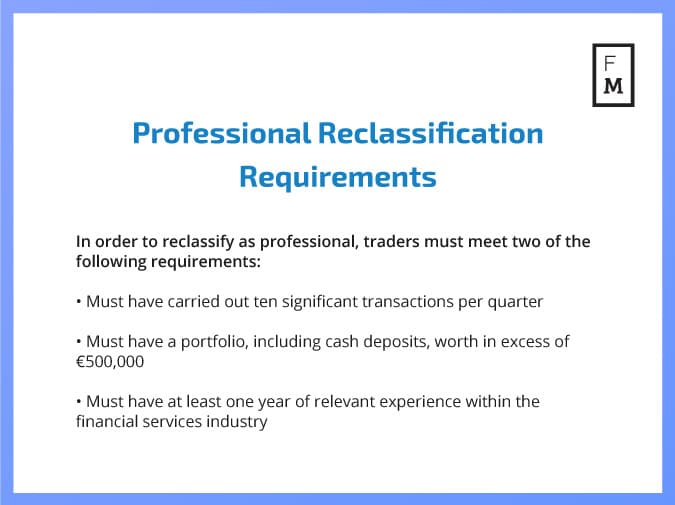

Less attention has been paid to the people who actually make the retail industry’s existence possible – clients. Last month, yours truly wrote an article, which – thanks for asking – , covering professional reclassification and how it could affect the makeup of the industry’s client base.

A statement issued exclusively to Finance Magnates this Wednesday by (ADSS), a retail broker, indicates that this was not a bad conclusion to have drawn. ESMA’s regulation, the firm told Finance Magnates, “has meant that brokerages in countries covered by ESMA are all looking to work with professional traders.”

ADDS’ statement was also of note as it reflected another change in the dynamics of the retail industry. Confirming the suspicions of other industry insiders, ADDS told Finance Magnates that its clients were starting to move to use its offshore, United Arab Emirates-based (UAE) brokerage services.

Chasing leverage

As noted, many predicted that brokers would move offshore after the implementation of ESMA’s regulation. Less certain was whether or not clients would follow them there.

The reason for this uncertainty was simple: brokers working offshore do not have the greatest of reputations. As we at Finance Magnates , regulatory warnings against offshore brokers are issued on a nearly daily basis.

Prior to ESMA’s regulation, however, traders had access to high leverage trading without the need of offshore brokers. This was vital given that access to high leverage has been one of the main marketing appeals for brokers since the industry’s beginning.

With high leverage gone in Europe, however, it seems some clients are indeed going to be moving offshore. In its statement on Wednesday, ADSS noted that its Middle East and North Africa-based (MENA) clients are starting to trade with local, rather than European, brokers.

“We have seen a lot of new traders on-boarding with us, and we expect this to continue.” , ADSS’ Global Head of Sales and Marketing at ADSS, told Finance Magnates “MENA traders who have been using European based providers are moving back to regional brokerages which have the capitalisation, levels of service and technology they want, but are not restricted by the ESMA rules. “

Fears assuaged

This state of affairs will certainly be a blow to European brokers – after all, no one wants to lose clients. For the industry as a whole, however, it may indicate that fears of a mass migration to dodgy, unregulated brokers were unfounded.

ADSS’ statement does not indicate that clients are flocking to an unregulated jurisdiction. Instead, former clients of European brokers are moving to a broker regulated by the .

How long this state of affairs will last looks set to be determined by the behavior of non-European regulators. We could be at the beginning of a cat-and-mouse game in which retail traders move from jurisdiction to jurisdiction as regulators clamp down on high leverage trading.

This hasn’t happened yet and, for now, it seems European brokers will continue to consolidate and focus their efforts on attracting professional clients. Concurrently, the average Joe trader, who can’t meet professional reclassification requirements, is going to look offshore.

Retail Traders Start to Move Offshore as ESMA Regulation Bites

More from AnalysysMore posts in Analysys »

Be First to Comment