With all the furor surrounding the European Securities and Markets Authority’s (ESMA) (CFDs), its been easy to forget another serious problem in the retail trading industry – payments.

As far back as 2016, VISA began to via their systems. More recently, and more worryingly for brokers, MasterCard has started to take steps that suggest it will be blocking payments processors from working with unregulated FX and Contracts-For-Differences (CFDs) brokers.

In April of this year, the payments giant that these firms are to be considered “high risk” unless they can produce a regulator’s approval.

Poor processing

All of this has pushed many brokers into using extremely unreliable payments processing services. Most of the companies providing these services are and are – much like many of the brokers they are serving – out of the reach of regulators.

On top of a lack of security, these firms often charge extremely high fees for their services and reject a large number of payments. Brokers have also been complaining of cash flow issues and limitations on how many payments they can accept.

“It’s a really tough time for the industry,” one broker told Finance Magnates, “there’s trouble for us at every level. Payments processors are either refusing to work with us or putting a hurdle in at every step of the way.”

The good, the bad and the unregulated

Others in the industry tend to disagree. Its true that payments providers have been cracking down on the shadier side of the retail trading industry, they argue, but the regulated, big players are not facing the same challenges.

“This is just not an issue for legitimate firms,” a CEO of an EU regulated broker, who wished to remain anonymous, told Finance Magnates, “it’s only a problem for unregulated firms. That may not even be such a bad thing.”

It is hard to argue against this. Binary options firms are often singled out as the bogeyman of the retail trading industry, but there is a operating across the globe that is just as ruthless in their treatment of clients.

Filling the gap

Regardless of the perception, one has of unregulated brokers, the market is responding to the payments processing crisis they are facing. One new payments processor hopes to fill the gap, left by the traditional providers, that is now present in the retail market.

“People will lose their business if they don’t make changes to their payments processing systems,” Sami Mana, , told Finance Magnates, “it’s that black and white.”

Along with his partner Itai Novak, Mana has created a new solution that he claims will be able to solve the problems that brokers are currently facing. Originally a B2B cryptocurrency trading platform, Cryptency is now branching out into payments.

Fiat to crypto, crypto to fiat

Their new system, called Crypto Swift, was created for these struggling brokers. Having , a software provider for the brokerage industry, Mana is familiar with the problems they are facing.

“With the VISA decision in April, it’s getting harder and harder for brokers.” said Mana, “The biggest problem facing the online trading industry, whether its CFDs, FX or cryptocurrency, is receiving fiat payments in a ‘legit’ way.”

So how will Crypto Swift ensure firms are able to get their cash in a ‘legit’ way? Importantly, the firm is already compliant with ESMA’s Markets in Financial Instrument Directive II (MiFID II).

Just having this in place means the firm has an official seal of approval that should lend it a sense of legitimacy across the globe. More importantly, it means the firm can operate in the European Union legally.

Beyond a regulatory stamp of approval, the firm actually appears to have the requisite technology that will enable it to ease brokers’ payments worries. The system Crypto Swift uses means brokers’ clients can either pay in cryptocurrency or fiat.

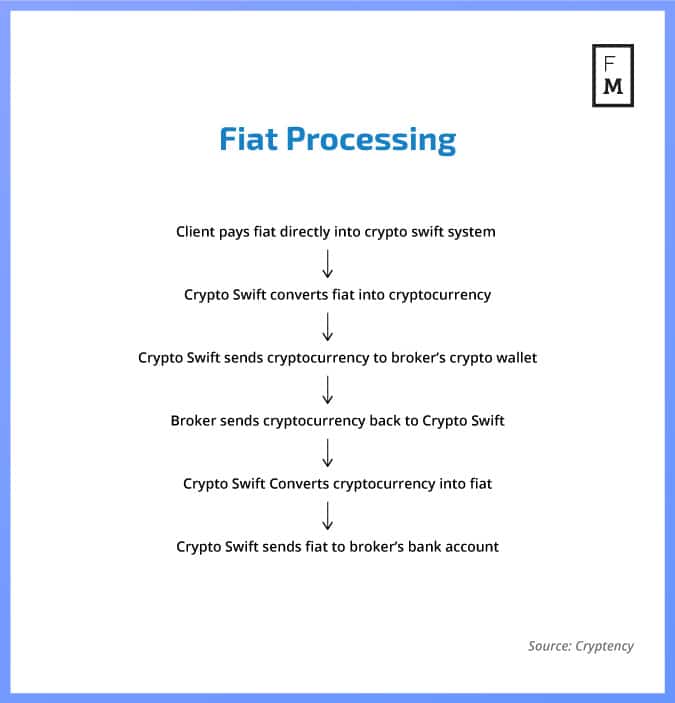

For brokers, at least for now, receiving payment in fiat is more common. When they use Mana’s solution, instead of paying the broker, a client’s fiat cash is paid directly into the Crypto Swift system. The system then converts the fiat cash into cryptocurrency which is then paid to the broker.

After this, the broker then converts the cryptocurrency back into fiat using the platform. Crypto Swift then transfers the resulting fiat currency into the broker’s bank account.

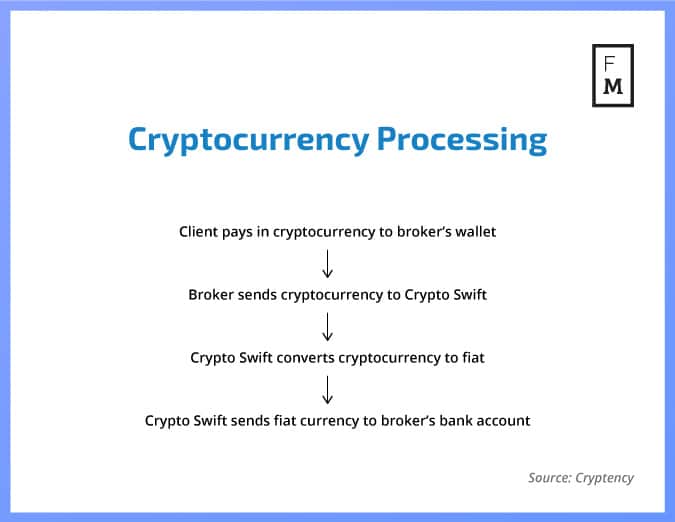

If they choose the former method, paying in cryptocurrency, the process is slightly more straightforward. The client pays the cryptocurrency into their broker’s wallet. The broker can then immediately pass the cryptocurrency on to the Crypto Swift platform. In turn, the Crypto Swift platform converts the cryptocurrency into fiat and then transfers the money into the broker’s bank account.

Taking a risk

The problem with this, as far as this author could tell, is the high level of risk involved. Exchanging fiat currencies entails some risk, but the volatility involved .

“We offer clients two options to ease the risk they are undertaking.” said Mana “They can keep their cryptocurrency and we will hedge it for them or they can do back-to-back transfers.”

Hedging services don’t come free and clients, according to Mana, will have to pay a fee of between 1 and 2 percent for the service. The back to back service will mean that cryptocurrency is exchanged for fiat almost instantaneously.

Using Crypto Swift should also enable brokers to get a hold of more cash. Mana claimed that his service would enable brokers “to take any payment size via any payment method from anywhere in the world except the US.”

More importantly, according to Mana, brokers will not be exposed to charge backs and will have a near 100 percent confirmation rate. Best of all, the money comes back in fiat and doesn’t have to pass through any dodgy, unregulated payment processor in China.

First adopters

Brokers, either as a result of Mana’s charismatic sales pitch or pure desperation, have already started using the service, despite it not having even been officially launched. Mana told Finance Magnates that he already has 25 brokers using the service with many more interested.

“It works well for us,” one broker using Crypto Swift told Finance Magnates, “the service takes some getting used to, after all it’s a new technology, but it’s the best option we have.”

Such a solution may be useful to desperate brokers, but those brokers are, to a large degree, desperate as a result of regulatory crackdowns. With many regulators openly disdainful of brokers, regulated or not, there doesn’t seem to be anything that would prevent them from making things difficult for Crypto Swift.

Mana was having none of this.

“Payment systems like ours is where the world is heading,” Mana said triumphantly, “the demand for our services means we won’t be going anywhere.”

Payments of the future?

Such a statement is open to debate, but there is, perhaps, one element of truth to it. A payment solution such as Crypto Swift doesn’t have to confine itself to the retail trading industry. As such, the solution really could offer a new means by which almost anyone accepts a payment.

“We’ve experienced a much more solid cash flow since adopting the technology.” said the broker using Crypto Swift, “It also doesn’t designate 100 percent of the risk to us – something that we found regular payments providers keen to do in the past.”

Crypto Swift seems unlikely to branch out as a fully-fledged payments processor in the near future. The company was set up by retail trading insiders and, at the moment, its focus is solely on brokers and companies launching (ICOs).

Having said this, if the service proves superior to that of regular payments providers, why not start using it? It may not be Mana and Crypto Swift that do it first, but the underpinning technology and the process itself could be adopted by others and applied to an individual buying a pair of shoes on eBay or paying for a take-out meal.

“This is the future,” the broker using the service told Finance Magnates.

We’ll have to wait and see if he is right.

Be First to Comment