Two Nevada residents, an attorney, and a law firm business manager were charged by the United States Securities and Exchange Commission after they were found to have been illegally profiting off of internet stock sales for Hong Kong-based startup UBI Blockchain. In an official announcement, the SEC described UBI as “a company claiming to have a blockchain-related business,” but the charges allege that UBI Blockchain didn’t have much to do with at all.

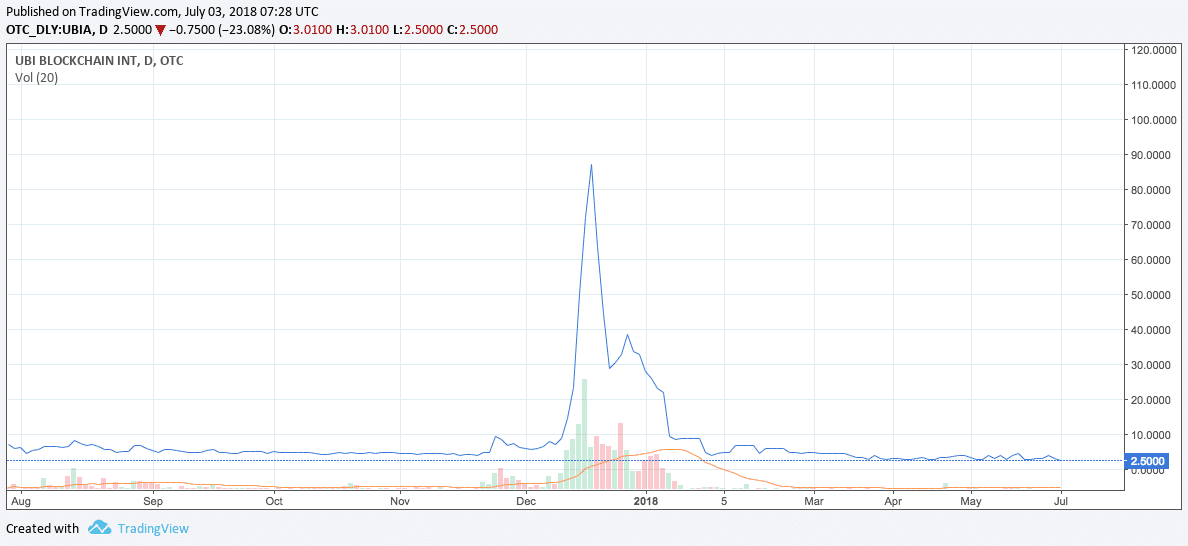

Combined, TJ Jesky and Mark F. DeStefano, are estimated to have profited to the tune of $1.4 million for sales they made over a 10-day period from December 26th, 2017, to January 4th, 2018, just after the height of the blockchain boom that sent the price of up to nearly $20,000. The SEC put the sale to a halt after questions arose around the “accuracy of assertions in its SEC filings and unusual and unexplained market activity.”

The two men allegedly received 72,000 shares of UBI Blockchain stock in October of 2017 and had legal permission to sell each of the stocks at a fixed price of $3.70 a piece. However, both Jesky and DeStefano have been accused of selling the shares for anything from $21.12 to $48.40.

Defendants Will Pay Back their Earnings, and Then Some; SEC Warns Against Companies Who Suddenly Add the word ‘Blockchain’ to Their Names

Despite the fact that neither of the defendants has confirmed or denied the SEC’s charges, both have agreed to return $1.4 million and to pay an additional $188,862 in fines; both are subject to permanent injunctions.

Bitcoin magazine reported that since then, UBI’s stocks have traded for as high as $115, a more than 20,000 percent increase since trading for roughly $0.55 just a year ago.

SEC charges attorney and law firm business manager with illegal sales of UBI Blockchain internet stock

— SEC_News (@SEC_News)

On December 27th, Bloomberg reported dubious findings in the company’s legal filings, which were made on December 21 to initiate the selling of shares–the company had accumulated $6.3 million in debt and had just $15,406 in available cash; the company also claimed expenses of “approximately $220,000 per month,” and contained a statement that “management is uncertain that the company can generate sufficient revenues in the next 12-months to sustain our operations.”

Robert A. Cohen, Chief of the SEC Enforcement Division’s Cyber Unit, said in an official statement that “this case is a prime example of why the SEC has warned retail investors to be cautious before buying stock in companies that .”

The charges come amidst a larger effort by the SEC and other North American financial law enforcement bodies to crack down on fraud in the cryptocurrency and ICO space. In this case, the SEC was assisted by the Financial Industry Regulatory Authority (FINRA), the Mexican Comisión Nacional Bancaria y de Valores, and the Panamanian Superintendencia del Mercado de Valores.

Be First to Comment