What a year it’s been so far for the finance sector. With everything from ad bans to data breach scandals dominating the news headlines, you may be more than terrified to go anywhere near social media. And that’s totally understandable.

If you’re struggling to stay on top of everything, relax, we’re going to look at the main updates and what you need to do about them.

#1 Understand the recent ad bans

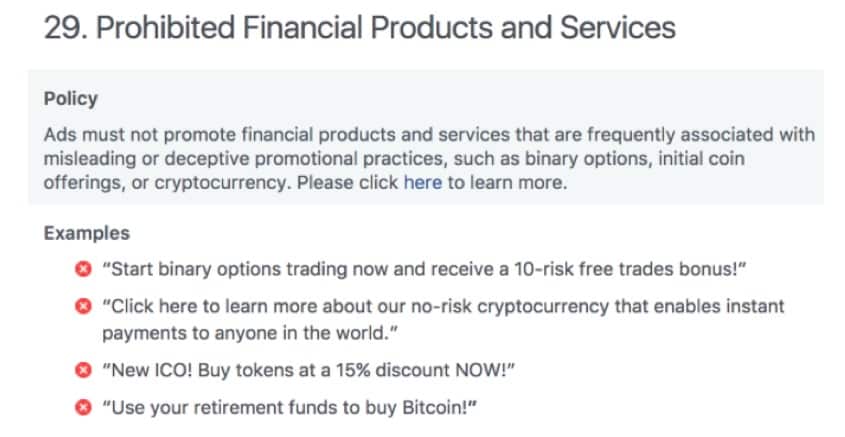

Cryptocurrencies and ICOs are becoming increasingly commonplace within the finance sector, but that doesn’t mean you can promote them freely on social media – far from it! The recent ad bans by digital giants such as Google, Facebook, Twitter, Instagram and Snapchat mean your advertising efforts are being monitored closely and therefore you should not even attempt to break the rules unless you want your accounts to be suspended – and that’s a real pain.

Here’s an outline of Facebook’s new rules and regulations:

So, what can you do?

Well, you can still promote your business without using banned words such as ‘crypto,’ ‘ICO,’ ‘binary’ and other forbidden terms by creating original, sharable content that doesn’t break the rules.

Educational pieces work well, or you could embrace the art of storytelling and engage your target audience without using overly promotional rhetoric. Your social strategy will require plenty of thought, so if you don’t have the time it’s a good idea to use a content agency.

#2 Know the Ins and Outs of MiFID II

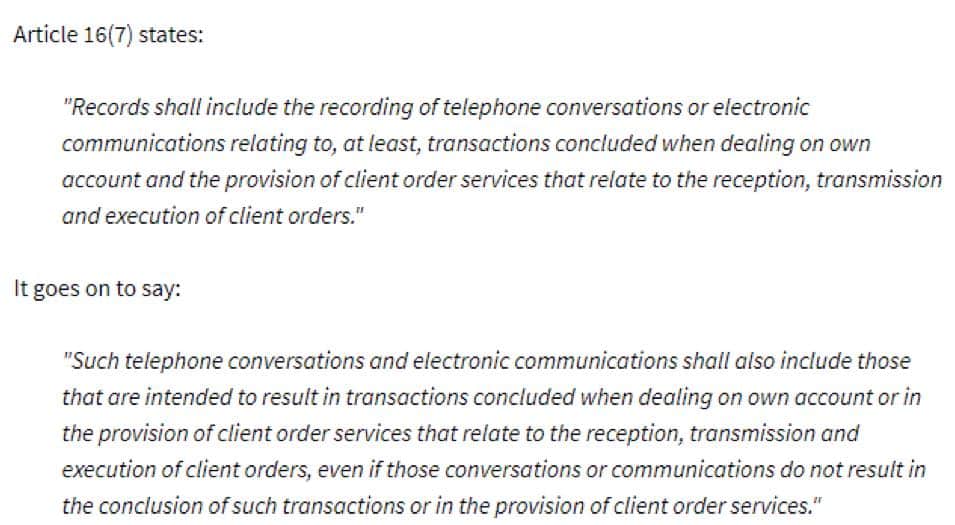

While has been in full swing since January, many companies within the finance sector are still getting to grips with the various regulation updates. This is somewhat understandable as they are very strict and widespread. That said, the rules simply can’t be ignored, so what should you know from a social media perspective?

Well according to Article 16, financial institutions will be required to record all electronic communications so that obviously includes social media activity.

To make things even more difficult, communication records must be kept for up to seven years.

So what can you do?

To make things easier, you must know who is handling your social media accounts so that you can monitor and track all activities closesly. Again, if you don’t have time to focus on compliance and are worried about breaking MiFID II requirements, talk

#3 Read Up On ESMA Regulations

As you well know by now, anything you put out into the big bad world can shape the online reputation of your business. Regulatory bodies can and will fine you for your social media actions, so it’s important to take your role seriously and to know all about the latest ESMA regulations which involve capping leverage limits for FX traders.

So what can you do?

Your days of singing and dancing about huge leverage options are well and truly over. Oh yes and all marketing content must clearly display some kind of message about how many people lose money. It’s all about consumer protection. If you’ve any doubts about what you can and can’t say on social media and what you should be adding to your marketing messages, seek a content agency fully clued up in financial compliance.

#4 Get to Grips with GDPR updates

With the new rules coming into play at the end of May, companies in the financial sector must review their data protection policies with regards to social media.

So what can you do?

GDPR makes one thing in particular very clear. You cannot and must not use other people’s data in any way you please. This is a massive no-no and a huge breach of privacy that could land you in deep trouble with regulatory bodies.

So, if you run a poll on social media, don’t just think you can use this information without asking permission and telling consumers exactly what their data will be used for. As the rules apply to data you’ve already collected, you must also make time to contact clients and ensure you have their consent for it to be kept and used for a specific purpose.

Of course, things aren’t easy in the finance sector so you must also prove this consent by taking screenshots of consent emails or filling out and filing consent forms.

How to approach GDPR:

If you have been highly active on social media to date and gathered lots of information, the GDPR updates could mean a lot of hard work. But look on the bright side. It’s a great way to reconnect with clients and remind them of your company.

Also, if you get the thumbs up to use data you can adapt your marketing appraoch accordingly based on what you’ve collected. Social media is not a wild west, compliance free zone. The FCA, CySEC, MiFIDII, ESMA and now GDPR all monitor large channels. You have been warned!

#5 Know What’s Changing On Facebook

Unless you’ve been living under a rock you’ll know that Facebook has been at the centre of a huge data breach with dominating mainstream news. Company founder Mark Zuckerberg was forced to testify to Congress and now the company’s trying its best to close data breach loopholes and stop anything similar from happening in the future.

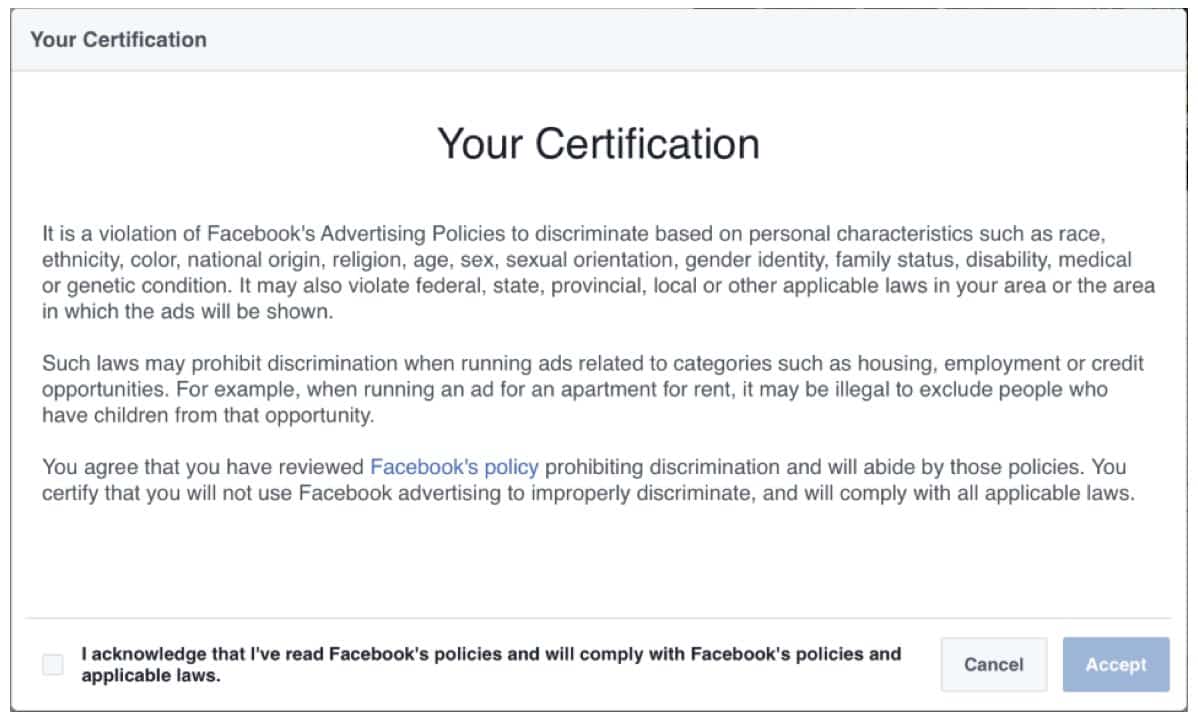

Facebook is planning to roll out a Custom Audiences certification tool which will affect Facebook advertisers who regularly upload CSV files containing data for retargeting. Advertisers will be required to prove that user consent has been obtained and therefore if you’re using a bought list, old sales list, non-opted in data or similar – you need to stop, quickly.

Why? Because Facebook will need absolute proof that all names on your list know their data is being used and if you can’t provide this you won’t be able to use the tool.

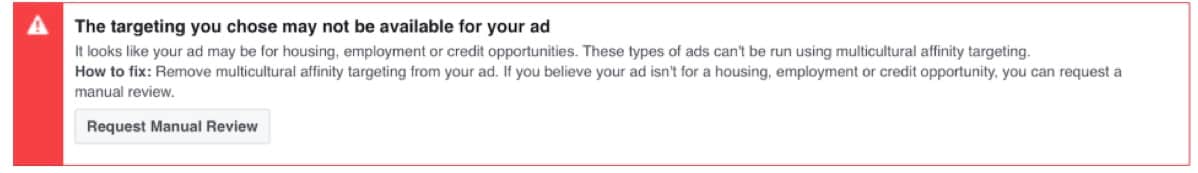

Facebook is also clamping down on discrimination through advertising and data sharing. Indeed, thousands of categories have been removed from exclusion targeting including religion, race and sexual orientation. If you work in the finance sector you may have already seen the following warnings.

Another thing to understand is thatFacebook has .This ad tool previously allowed marketers to target ads using third-party data from data brokers.

So what can you do?

Take immediate action by reviewing the data you’ve been using for retargeting. The fine for breaking the GDPR act is a whopping 20 million Euros, so be sure to know exactly where your data is coming from and to gain user consent. If you have an old data list that you can’t account for, don’t panic. This is particularly common since regulations have never been this tight before, but it is crucial to act promptly.

If you do get a warning from Facebook – keep a record of it and seek legal advice to show that you’re taking regulations seriously and are doing everything in your power to be complaint.

#6 Verify Facebook Admins

While on the subject of Facebook, fake and duplicate accounts are a massive problem for the social media giants. “In the fourth quarter of 2017, we estimate that duplicate accounts may have represented approximately 10 per cent of our worldwide MAUs (Monthly Active Users),” Facebook admitted in their latest annual report.

So, what are they doing about this issue and how will it affect you? Well, admins who manage pages with a large number of followers (the exact number is yet to be confirmed) will need to be verified to make social updates. You should therefore check that your current page admins have working profiles and that the ad account is linked to one of them.

This is also a good opportunity to check that only those authorised have permission to make social updates. This will help to prevent a non-compliant post from slipping through the net. Remember, having some kind of sign-off for social posts is not a bad idea either.

It’s also worth mentioning that GDPR guidelines specifically deal with content posted regardless of which device it comes from, so be sure to monitor staff activity on all gadgets including laptops and mobile phones.

There’s a lot of information there to absorb but to a cut a long story short, you need to be compliant and you need to have consent to use data. Talk to the today about your social strategy and discover easy social media management solutions. Loved this article? Follow us on and for plenty more.

Be First to Comment