With the blockchain industry rapidly growing. There are businesses and individuals that need to buy/sell large blocks of cryptos. For example, most ICOs only accept cryptocurrencies, so investors often need to buy large volumes of cryptocurrencies in order to secure their place in the deal.

Once an ICO raises funds in Ethereum they need to exchange it to dollars or euros in order to purchase goods, services and hire staff for the business. For instance, Telegram, a messaging app that is looking to raise $2 billion in an ICO this year, may have a difficult time purchasing the infrastructure, paying salaries, or even advertising without fiat.

Cryptocurrency miners may also need to cash out large amounts of cryptocurrencies to pay bills or purchase hardware. Payment processing and exchange companies are other examples of companies which need to exchange large amounts of crypto to fiat.

Common ways to exchange cryptocurrencies to fiat:

The most common way to exchange cryptocurrencies to fiat is through exchanges. Exchanges come in all shapes and sizes, offering a number of different choices to their clients. Most online exchanges offer a list of basic cryptocurrencies, such as Bitcoin, Ethereum, Ripple, and Litecoin, but there are some that may even offer alt-coins or specialty tokens.

The main issue with exchanges is that most of them don’t take fiat deposits. Clients can only fund accounts in cryptos. Some exchanges like Coinbase, Kraken, Gemini do allow for fiat deposits. The issue is that they have strict limitations on exchanging fiat to cryptos and cryptos to fiat.

There is also peer to peer options like Local Bitcoin. Local Bitcoin can be a viable option for smaller transactions. The issue is with bigger transactions, which puts your funds at greater risk.

Limitations with exchanging crypto to fiat

Businesses or individuals looking to make high-volume transactions may encounter a number of hurdles when attempting to do so on traditional exchange platforms. Some of the major exchanges, for instance, may refuse large transactions because of the Anti-Money Laundering (AML) laws in place.

Banking relationships are key in any cryptocurrency to fiat business. Companies will do everything in their power to avoid anything that could put these partnerships at risk. For companies looking to make significant transactions with these exchanges, the process will often take time, building trust through smaller transactions and communication along the way.

Certain venues offer institutional accounts which allow for larger transaction and fiat deposits. But they can take a very long time to set up. For example, it can take you up to 6 months to get an account with an institutional account at venues like Bitfinex and GDAX.

Another limitation traditional exchanges might face in cashing out or selling large amounts of cryptocurrencies is the potential to move the market.

If 10,000 Bitcoin hit an exchange in one transaction, for instance, it could have a significant impact on the price of the coin along multiple exchanges.

Additionally, a typical exchange order book will have different amounts of coin available at different prices. By simply buying or selling on an exchange you will get the volume weighted average price (VWAP) for the amount you want to transact.

If you are not a trader and trying to work a large trade in this fashion it can work against you. You don’t know your true price until the trade is confirmed and it can get expensive. It may be more advantages to have a professional trader work the trade for you.

What do companies making large transactions need?

Companies looking to buy or sell large amounts of cryptocurrencies are looking for the safest and easiest way to do so. When transferring large amounts of fiat, security is a top priority, and high-profile hacks have eroded the confidence in mainstream exchanges.

Customer service also plays a significant role in the process. More often than not, major exchanges lack basic customer support.

The best places to make high-volume traders

There are several places to make high-volume trades, but many may fly under the radar. Many of the top brokers and liquidity providers rarely advertise their service in order to maintain their banking relationships. These services are designed with institutional investors, high-volume traders, and large businesses in mind, and may even have a minimum transaction amount.

Here are some examples of venues that can help you make large crypto transactions:

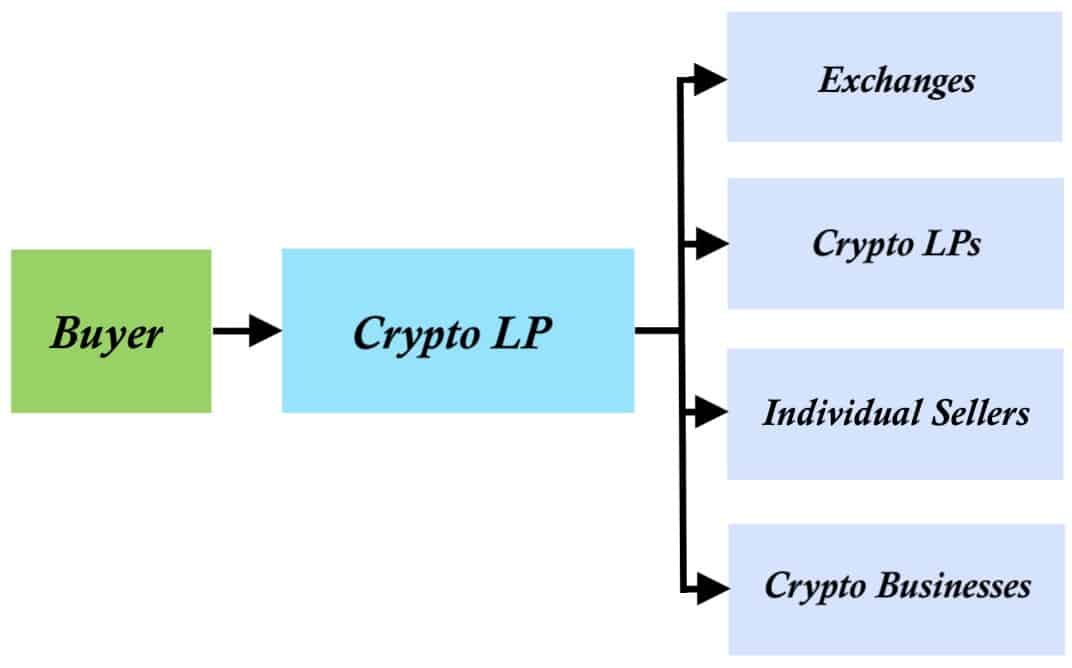

Crypto liquidity providers are available to ensure there is liquidity in the market. If a buyer wants to buy in, there are coins available to purchase, additionally, if the same person wants to sell, there is fiat available to cash out.

Crypto LP’s already have crypto friendly banking relationships in place. Additionally, they have exposure to multiple venues to buy and sell cryptos. Crypto LPs act as dealers connecting buyers with sellers, other crypto LPs or exchanges.

When making a trade with these venues you tell them the amount that you want to trade, and they give you a single price. If you accept the deal they execute your trade. They profit by charging a small commission or markup on the trade typically 0.5-1 percent.

Some FX brokers are starting to offer crypto to fiat and fiat to crypto exchange services. FX brokers work in a similar as crypto LP’s, though may present a unique edge of their own.

Because they have years of experience and connections through trading currencies, they have all the infrastructure in place. This includes security of funds, established relationships with banks and trading desks, and strong customer support.

Many FX brokers are even FCA or ASIC registered which can provide you with an additional level of safety. When dealing with an FX broker you simply open an account the same way you would to trade Forex, fund it in fiat or cryptos and transact them in the same way as you would with a crypto LP.

At Nekstream we have relationships with multiple crypto LP’s and FX brokers that facilitate crypto transactions to get connected email .

Conclusion

For businesses looking to buy and sell high volumes of cryptocurrencies, finding the right option can be difficult. For large trades, businesses will need security, privacy, top notch customer support, and the ability to make very large transactions without impacting markets.

Because most FX brokers and crypto liquidity providers maintain a low profile, it can be difficult for new businesses to locate the right service. Nekstream has the within this growing industry to connect the dots for businesses looking for solutions in the crypto space.

Because most FX brokers and crypto liquidity providers maintain a low profile, it can be difficult for new businesses to locate the right service. Nekstream has the within this growing industry to connect the dots for businesses looking for solutions in the crypto space.

Alex Nekritin is the Managing Director of Nekstream Global, a liquidity and technology consulting company helping brokers, HFT traders and money managers to find proper liquidity and tools for their ventures. Alex has over 10 years of experience in the financial space.

Be First to Comment