This is an excerpt. To hear the full interview, click the Soundcloud or Youtube links.

Bancor emerged onto the scene in 2017 with one of the largest ICOs in history, raking in over $153 million. Often,with large ICOs are closely associated with large corporations and making the rich richer.

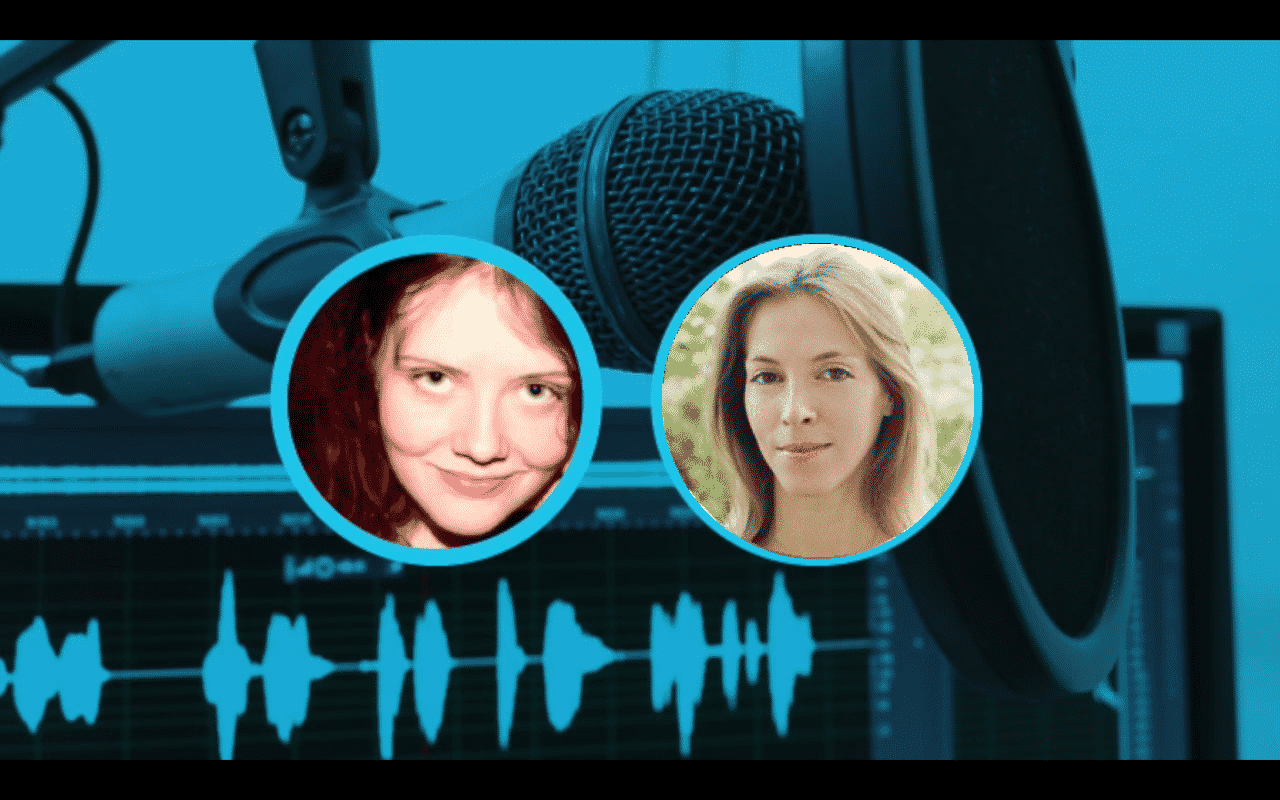

However, Bancor co-founder Galia Benartzi believes that the Bancor protocol can be used to create cryptocurrencies that will empower communities.

Bancor’s ‘Long Tail’: Operating in the Real World

When we asked Galia about how the Bancor can be integrated into systems that exist outside of the blockchain space, she began by explaining the concept of the ‘Long Tail’.

“[It’s] actually a term that comes from internet terminology. It’s a phenomenon which says that when you lower barriers to entry and you open up access, you’ll often find that the Long Tail–meaning not the top hits, but all of the rest combined–will represent more volume.”

For example, “can be volume of views like on Youtube, or volume of sales like on , or volume of traffic, you’ll find that the Long Tail actually represents more volume than the ‘Head.’ If you take, let’s say, the top 10, you’ll find that in the top 10 most viewed video on Youtube, there’s less traffic than the next million combined.”

Galia explained that the decentralized nature of Bancor enables the Long Tail to thrive: “The Long Tail of currencies is hundreds of millions of currencies, and these are regular people creating and using these currencies. This is not limited to a cryptocurrency, or even to a blockchain industry space.”

She went on to say that formation of currencies through thenetwork could enable easier empowerment of communities. “What we love about the Long Tail of currencies specifically, is this concept of community currencies, or complementary currencies, which is really providing value instruments to groups. Whether they’re in physical proximity like a neighborhood, or a club or anything like that, or just affinity groups like mothers in a certain area, or students in a certain area, giving them tools to collaborate.”

“That’s what money really is,” she said. “It’s a tool that lets us work together–it’s like our shared accounting system. When you can break this down securely, thanks to and cryptography, and allow more groups and networks of people to have their own value instruments.”

Check out Bancor’s new Product showing major milestones through Q2 2019. We can’t wait to build the future with such an incredible team & community.

— Bancor (@Bancor)

Galia went on to say: “You can think of it like the efficiency that you might hope for out of local governments, where the local government knows the people better, and is closer to the issues, and can handle a specific issue within a neighborhood better than the could handle it for you. It really is the same thing with monetary instruments.”

“We have our national moneys, and those are great in some ways for our mass collaboration, but smaller groups can actually collaborate much more efficiently with these custom tools and tokens,” she said. “Whether that’s the tokens we know today, like and Bitcoin, being more usable and accessible, whether that’s services like remittances and payments, and banking services for the unbanked, and even identity services for refugees.”

“There’s no lack of use cases,” she explained, “but it really is the more meta-narrative of allowing groups to collaborate, and to govern their collaboration, including economic collaboration, in a more custom and optimum way than we’ve ever seen before. It really is only the mainstream, the mass adoption of these that is truly interesting.”

How Bancor Works

“Bancor is a decentralized network,” said Galia. In other words, “every token in the network is convertible for every other token in the network. It can buy with any token in the network, and sell for any token in the network. The way that the Bancor protocol enables this is by truly networking tokens to each other.”

For example, “The BNT, the Bancor token, owns a balance of Ether, in what we call its connector. It’s a module within the smart contract. BNT can always be bought by depositing Ether into that balance, and it can always be sold, and withdrawn, and result in a withdrawal of Ether from that balance.”

In practice, the network operates like a vending machine: “You can think of it kind of like a vending machine that holds Bancor and Ether, you can always put in Ether and get out Bancor, or put in Bancor and get out .”

She continued: “Every token in the network has this mechanism to every other token in the network. This is a very simplistic metaphor, but you can think of it like a vending machine that accepts all tokens, and will return to you all tokens.”

“The Bancor protocol essentially standardizes the mathematical formula by which these conversions happen. When you deposit Ether, this mathematical formula calculates how much Bancor you’ll get for that, or vice versa. If you deposit EOS, the mathematical formula will calculate how much Network Token you get for that. It does this for every token in the network continuously.”

Galia explained that token prices on the Bancor network are determined through a ratio mechanism “where every token maintains a constant ratio to every other token..the mechanism will maintain these ratios between the tokens, and that’s how the math produces the price of every token at any given time.”

Liquidity on The Bancor Network

In a landscape where new and blockchain networks are appearing just about every day, it can be difficult to distinguish between real innovation and good marketing of a poor product. When we asked Galia what set Bancor apart in the crypto space, she said that “the Bancor method is a completely new paradigm in exchange–we’ve never before had a system that would allow for the buying and selling of assets, or digital assets, without matching a buyer and a seller.”

Prevent Pump and Dumps with Bancor:

— Bancor (@Bancor)

Before Bancor, in both centralized and , “the very act of converting your tokens from the tokens that you have to the tokens that you want, is finding another party that wants to buy the tokens that you have, and sell you the tokens that you want.”

So, “this matching of buyers and sellers is historically dependent on volume. The more buyers and sellers there are, the more likely you’ll be matched at the price that you want for these conversions or exchanges. In the Bancor network, because of the method that I described, you never need to match a buyer and a seller.”

Galia said that “you no longer have to be a very high-volume or a highly-traded token in order to have liquidity and allow people to buy and sell your token as they see fit.”

“There are no fees in the Bancor network,” she added. Why? “This comes from a few factors. First of all, Bancor is a nonprofit foundation, so it’s a , and it is not looking to build a business on conversion fees, which is kind of the standard business of traditional exchanges. The TGE allows us to build the network, and the value in the network is accrued to the BNT network itself. In order to connect your token to the Bancor network, you do so by staking some BNT, some Bancor token, alongside your own.”

“The more the network is used,” she went on, “the more BNT token becomes valuable over time. This really allows the network not to pass on fees to users. The only fees that users pay in the Bancor network are the Ethereum, the underlying blockchain fees.”

Be First to Comment