As the , and as new government regulations are set to come into effect in May, established financial institutions are expanding their exposure to cryptocurrency business.

Want to learn more about Bitcoin in Asia? Bobby Lee, the CEO of BTCC, will be giving the keynote speech at the , register now.

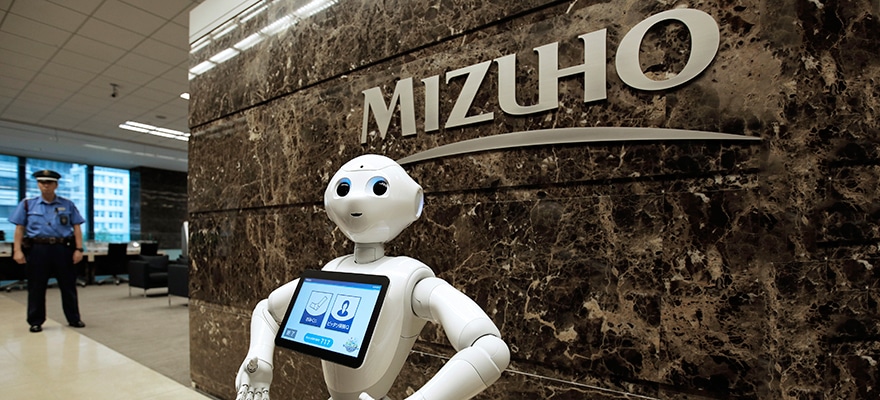

and Sumitomo Mitsui Financial Group have joined a new $1.75 million (¥200 million) funding round for the bitcoin exchange, bitFlyer, according to Japan’s Nikkei news service. They thus joined , the largest bank in Japan, in backing for the country’s leading cryptocurrency trading venue.

The Nikkei explains that BitFlyer’s experience could help Japanese banks provide more secure and cheaper international wire transfers, and make them available around the clock.

Back in April 2016 in funding – the largest round of fundraising by any fintech startup in Japan ever. The firm said then that funds will be used for an acceleration of its cryptocurrency blockchain and services. That injection of capital, worth almost $28 million, was in addition to the $6.5 million it raised in 2015.

Considered as Japan’s biggest bitcoin exchange by trading volumes and valuation, bitFlyer was founded by former Goldman Sachs derivatives trader Yuzo Kano, who reportedly quit his job to do so several months after the collapse of MtGox, which was at one point the world’s largest exchange by volume.

Be First to Comment