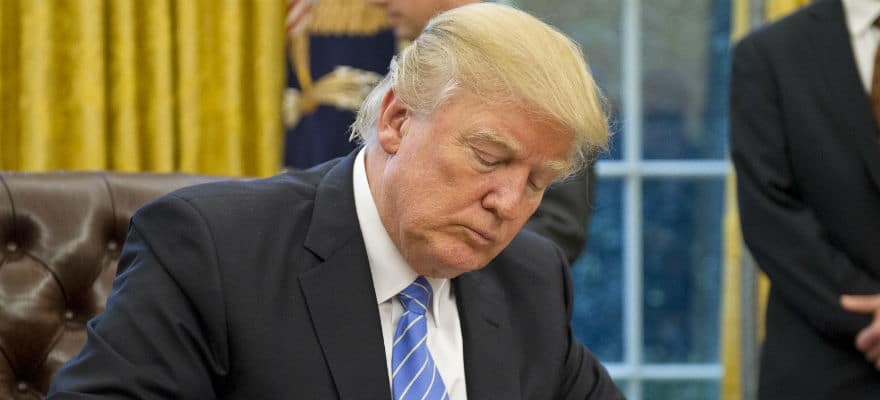

After the White House’s National Economic Council Director made it very clear this morning that the , the President today signed an executive order to review the act that was signed into law by President Barack Obama in 2010.

Donald Trump said the move was necessary because the regulations were too onerous on business and hurting the economy.

“We expect to be cutting a lot out of Dodd-Frank, because frankly I have so many people, friends of mine, that have nice businesses and they can’t borrow money. They just can’t get any money because the banks just won’t let them borrow because of the rules and regulations in Dodd-Frank,” Trump said.

The executive order also includes a review of the ‘Volcker rule’ which imposes on banks prohibition on proprietary trading. Trump will require the Treasury secretary to submit a report on potential regulatory and legislative reforms in 120 days, a White House official added.

Donald Trump is once again . The new president made repealing the Dodd-Frank act, which was drafted in response to the 2008 financial crisis, one of his campaign’s focal points. The call to scrap the law was even heard from Trump before he ran for president, saying that the rules “choke lending and business formation”.

Symbolic action?

The Dodd-Frank act called for, among other things, establishing the Consumer Financial Protection Bureau to oversee consumer financial products such as mortgages. It gave regulators new powers over large non-bank financial companies.

However, the timing of an actual replacement for Dodd-Frank remains unclear as only Congress can rewrite the legislation. But between now and the possible passage of overhauling legislation, Trump could make many changes without involving lawmakers by appointing new regulators and ordering them to ignore most of the Dodd-Frank rules.

Trump also cheered brokers offering retirement advice by imposing a 180-day delay on the implementation of the ‘fiduciary rule’ which orders them to act in the best interests of their clients. Since it was proposed by the Obama administration in 2015, the termination of this rule has been the target of broker-dealers and other financial advisers. Opponents of reform however say that the rule is necessary to protect individuals against potential conflicts of interest that brokers may have when guiding them to invest for the future.

Be First to Comment