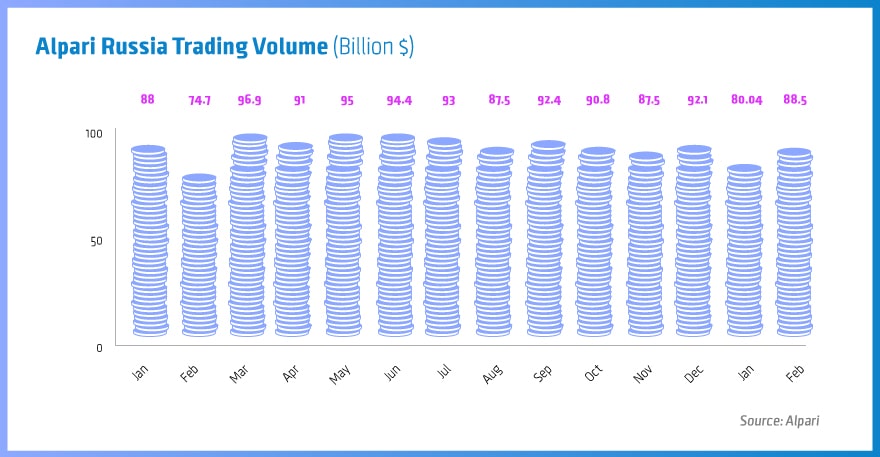

Retail trading foreign exchange broker, Alpari Russia, has announced its turnover results for February 2016. According to an official statement, trading revenues rose to $88.5 billion. Compared to its January metrics, this is an increase of over 11%. The dynamic growth was achieved mainly by the increasing popularity of the USD/JPY and GBP/USD currency pairs.

In connection with the increased volatility of the Japanese yen and the pound sterling in recent weeks, trading on these instruments enjoyed far greater popularity among Alpari’s clients. While revenues from EUR/USD trading tally with the January numbers, GBP/USD activity has increased by 47% month-over-month (MoM) and USD/JPY by 74% compared to the previous settlement period.

The February results are definitely better than those recorded in January, , when the brokerage’s trading volumes were exceeding $90 billion per month. If the upward tendency and market volatility continues also in March, then previous returns should be re-achieved.

It is worth notinf that (AUD/SGD, CHF/SGD, HKD/JPY, SGD/JPY and USD/HKD). Active positions will be maintained until March 31, 2016 – customers have ten days to close them by hand, then it will be done automatically.

Standard and ECN Accounts With Altered Stop Out Levels

Additionally, Alpari Limited announced changes concerning the terms and conditions of ECN and Standard trading accounts, which will be introduced on March 23, 2016. Stop Out Levels in their case will be modified to 20% (Standard) and 60% (ECN).

Stop Out (SO) is the last resort for the trader and his brokerage against negative balances during growing losses. SO orders are activated when the loss in relation to deposited capital exceeds a certain percentage ratio. This results in an immediate closing of the active positions.

Be First to Comment