San Diego-based is the latest P2P lender to announce new funding as the sector remains a for angel and venture fund investors. In an interview with , Ethan Senturia , Co-Founder and CEO of DealStruck, explained that they were taking a long-term approach to the lending business. In that regard, they raised $8.3 million in venture backed equity financing, as well as securing a $50 million credit facility to help them survive through any economic downturns.

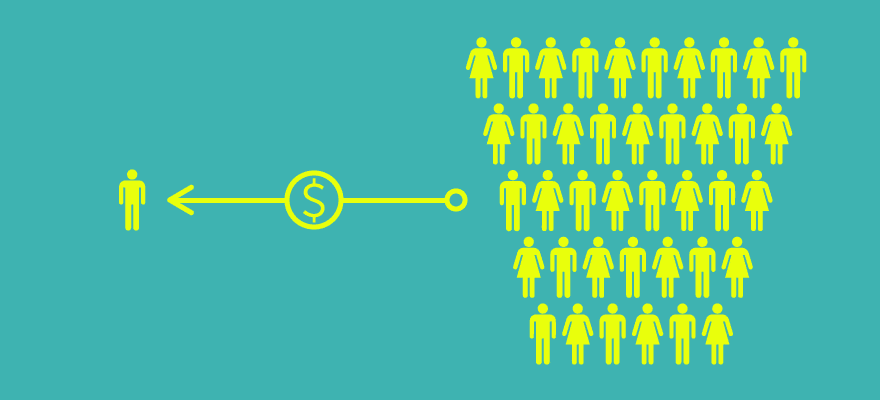

A P2P lender, DealStruck focuses on the small business market, providing short-term loans of between $50,000 to $250,000. Loans are provided through approved high net worth investors who provide funding into the platform. While many other P2P lenders are widening their coverage to support different types of lenders, DealerStruck aims to provide customer value by focusing on the small business sector, regardless of their market.

Explaining their focus to TechCrunch, Senturia said that part of the value proposition they provided to their customers was a team with experience in the lending sector, knowing the needs of borrowers and how to handle different economic climates. On this, Senturia stated, “Throwing a thousand engineers at the problem won’t solve it — it relies on domain expertise, a long history of people who have seen long cycles, and understand how assets perform. While you’re using tech to make intelligent credit decisions, you’re really administrating a lending product, that requires experience. Half our team really comes from commercial lending.”

Be First to Comment