Following other FX brokers’ decisions to renounce their , the island’s Securities and Exchange Commission today said it has withdrawn the license of Otkritie Capital Cyprus Ltd.

Controlled by Otkritie FC Bank, one of Russia’s largest full-service commercial banks, the brokerage firm decided last summer to wind down the operations of its .

Accordingly, and pursuant to section 24(1)(a) of the Investment Services and Activities and Regulated Markets Law of 2007, the CIF authorisation of Otkritie Capital Cyprus Ltd with number 069/06 has lapsed.

Finance Magnates visited the broker’s website and it seems that Otkritie has already proceeded with changes in its website to remove any references regarding authorization and supervision of the company by CySEC.

offers brokerage services spanning across equity, derivatives, fixed income, foreign exchange and commodities. Founded in 2002, the company was formerly known as Otkritie Securities Limited and rebranded to Otkritie Capital International Limited in June 2014. The firm is headquartered in London with additional offices in Moscow, Limassol and New York.

Its operates a network of regional offices located in more than fifty Russian cities, and is part of a massive financial services group offering a range of banking, investment, pension plan and life insurance solutions.

According to the CySEC regulatory manifest, Otkritie Capital Cyprus has had its CIF authorisation withdrawn on its own request and the surrender of its license was entirely voluntary, not the result of any regulatory action taken by the watchdog.

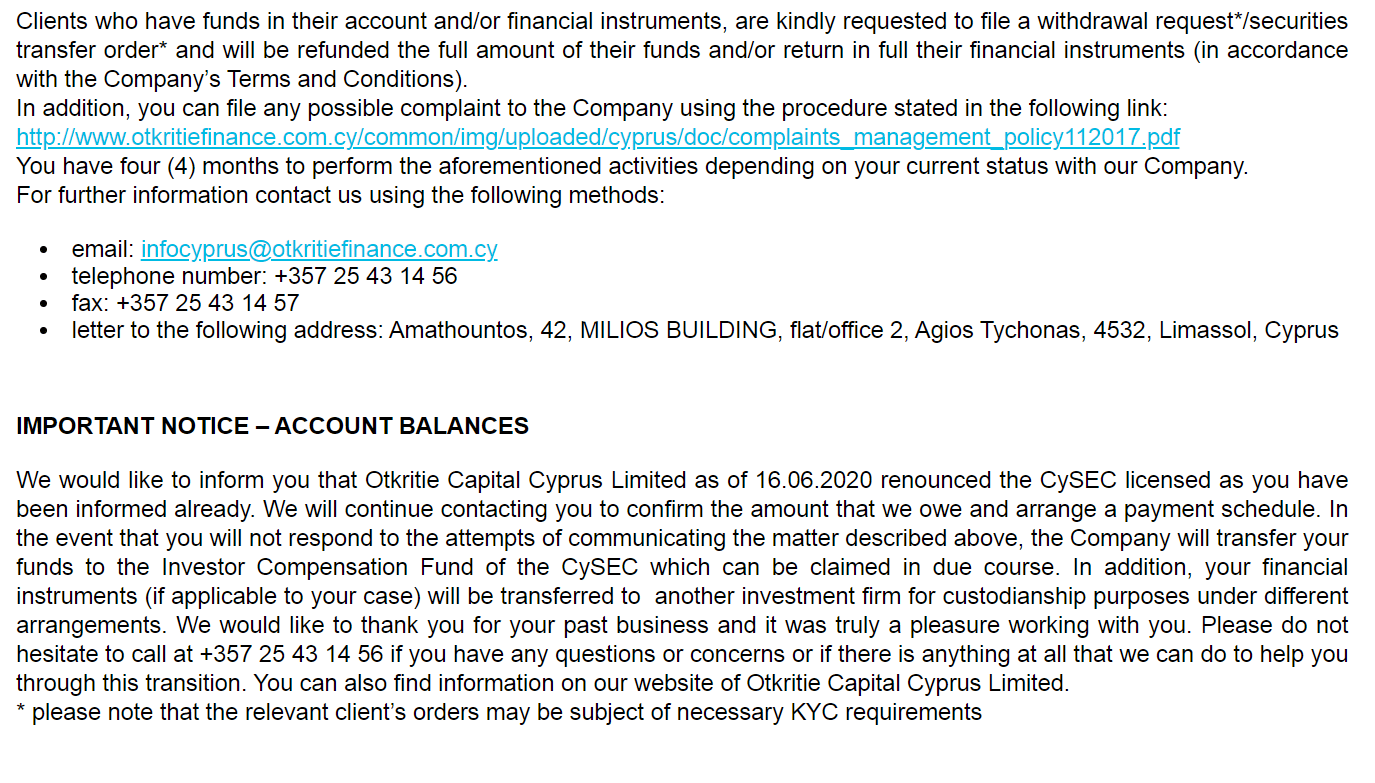

Under the Cypriot regulatory framework, the company must return all outstanding balances to its clients and handle all of their complaints. In addition, Otkritie Capital Cyprus must provide a confirmation from its external auditor that it does not have any pending obligations and must include details of each of the company’s clients, according to the same CySEC announcement.

CySEC Withdraws Authorization of Otkritie Capital Cyprus

More from AnalysysMore posts in Analysys »

Be First to Comment