As we approach the end of the year, we take a look at the most recent data related to forex trading. examines the latest November data from , highlighting key changes in customer trading patterns.

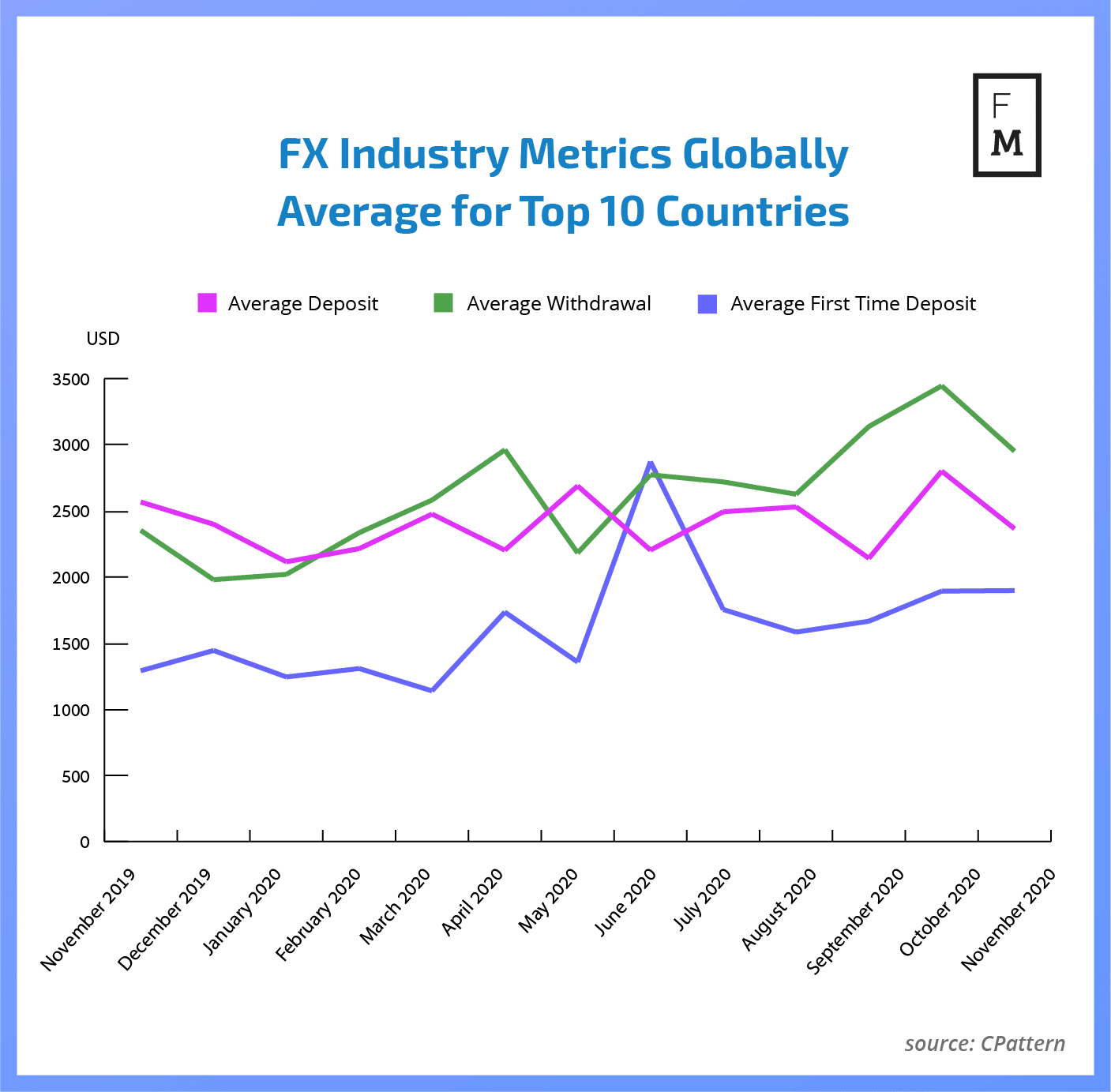

Contrary to our October analysis, this time all three major indicators decreased in value, as the retail forex market slows down before the end of the year. The average size of a single deposit decreased from $2,733.88 to $2,423.14. The average withdrawal value decreased from $3,141.06 to $2,788.60. Finally, the average first-time deposit from new clients saw a slight change, increasing just by $3 to $1,849.03.

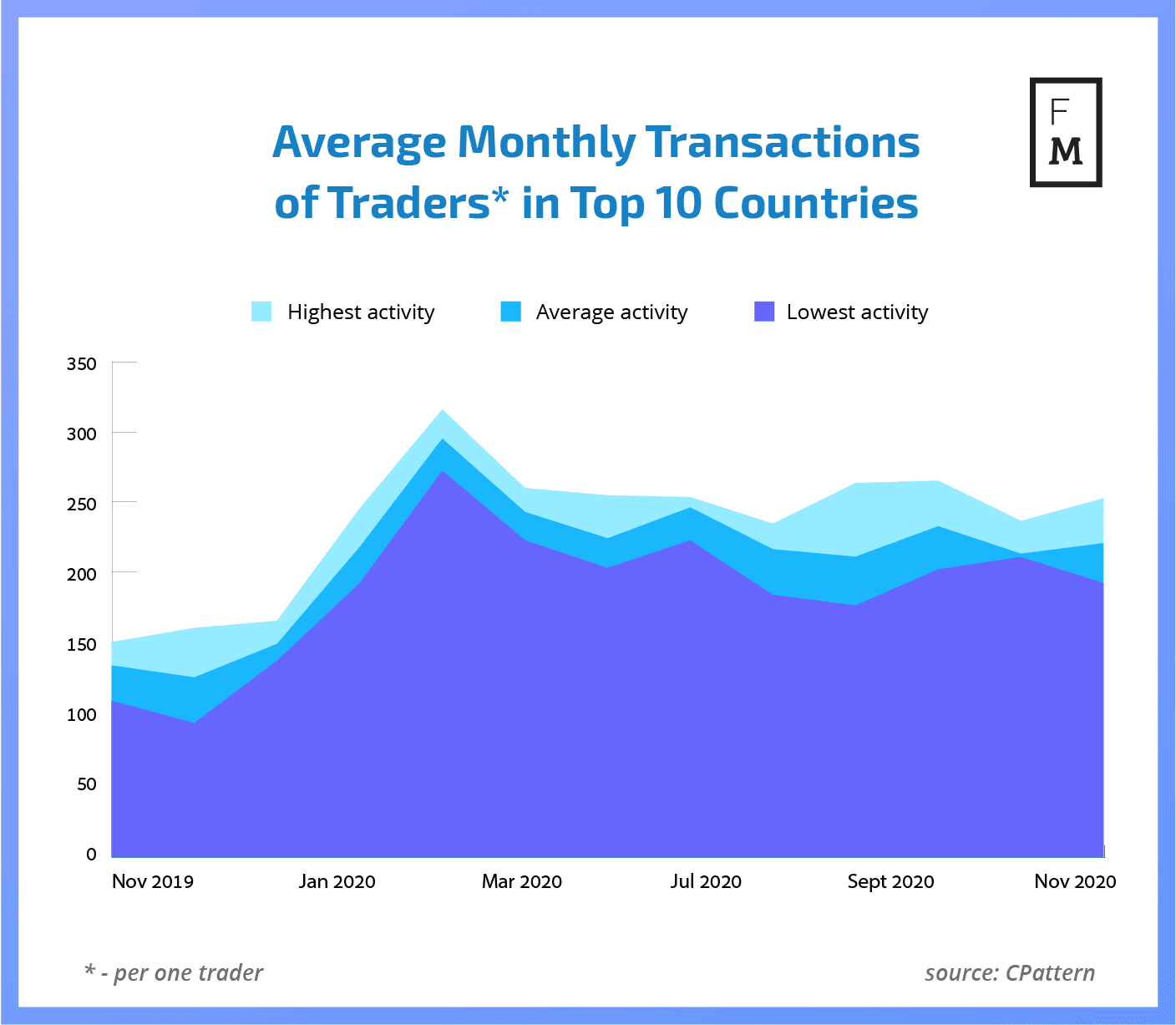

The slowdown was not yet seen in the frequency of trading. The average activity of a single forex trader bumped to 210 transactions monthly, from 203 seen in October. This time, leadership was reclaimed by China where average fx traders made 259 transactions per month. Second place in rank was held by Romania, where the average trader conducted 236 transactions in November. Recently, Romania has been more and more often among the most active countries.

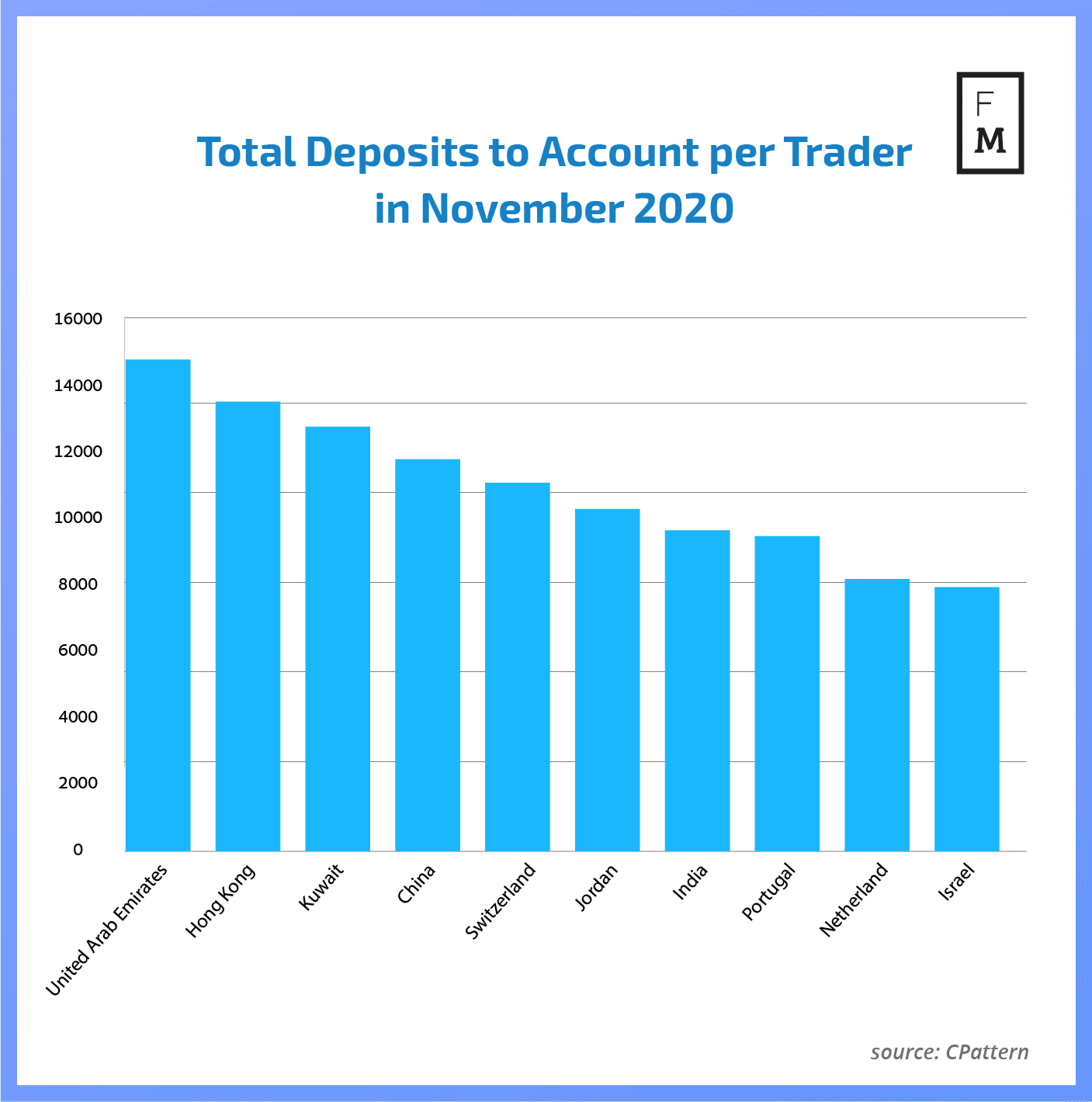

There is no surprise when it comes to the data related to total monthly deposits. The long time leader is back again in the front seat. Traders from the United Arab Emirates were sending on average $15,045 to their forex accounts for the whole month. The October leader, Vietnam, was out of the top 10 this time.

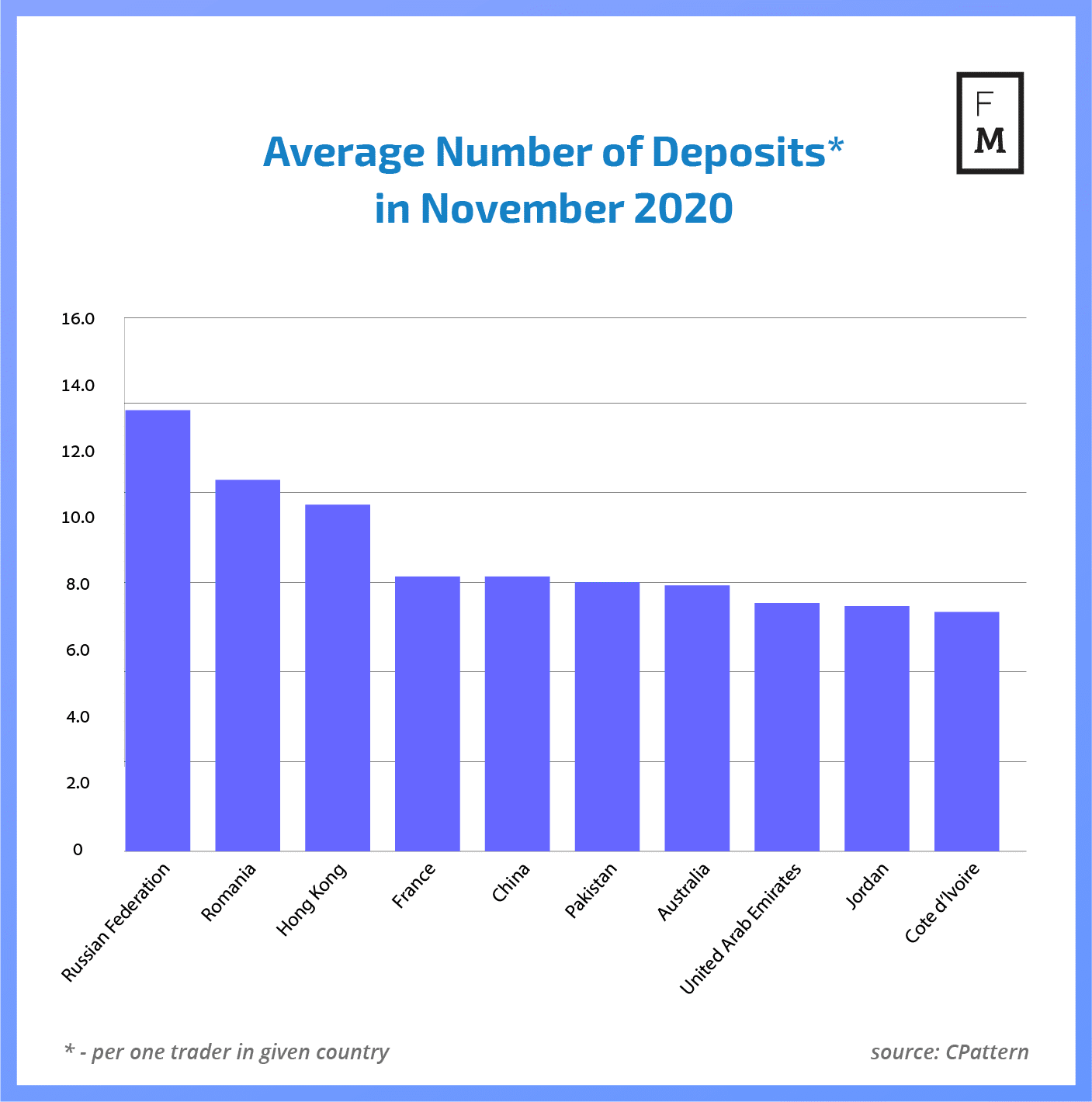

Russian Forex Traders Deposit Most Often

We know which traders deposited more money in November. However, those who deposited the most often were in Russia. The average trader from this country made 13.7 deposits to his trading account. Moreover, second in this rank was Romania with 10.7 deposits.

When it comes to Russia, such activity is not very common. Recently, the local the Forex dealer license of PSB-Forex, the FX subsidiary of Promsvyazbank, nearly four years after the launch of its operations that have been plagued by weak financial performance.

This is the latest publication from the FM Indices, a new cross-industry benchmark. In today’s business world, big-data analysis and access to objective information sources are crucial for success. Unfortunately, until now, it has been challenging and costly, if possible at all, to find any reliable benchmarks for operations in social media, cryptocurrencies, Forex and CFDs trading. To get the bigger picture of the FX/CFD industry in chosen countries, contact our .

Analysis: Forex Traders from UAE Keep Investing Large Sums

More from AnalysysMore posts in Analysys »

Be First to Comment