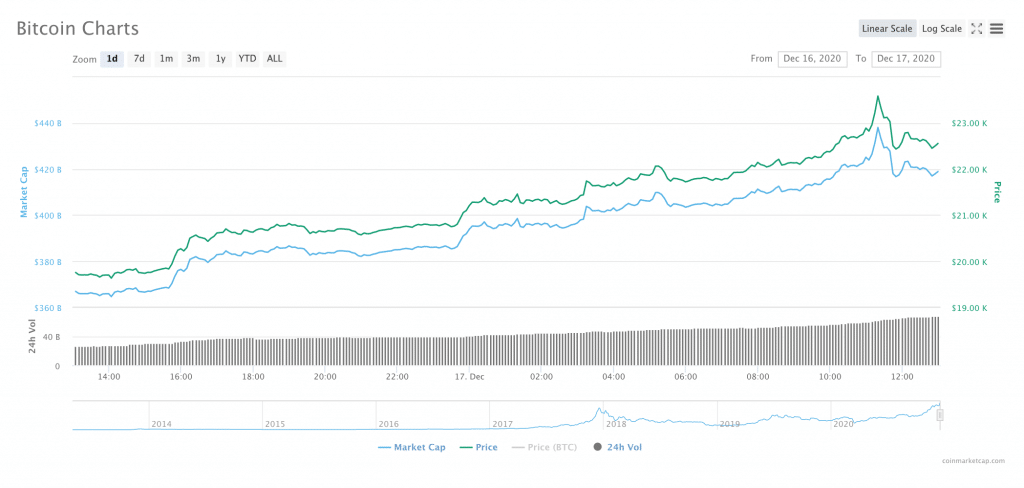

Well folks, the day has finally come: Bitcoin is past $20K.

And not only that, at press time, Bitcoin was more than halfway towards reaching the $25,000 mark, and it does not appear to be slowing down anytime soon (Editor’s note: seriously, it was adding $100 every time I refreshed CoinMarketCap.)

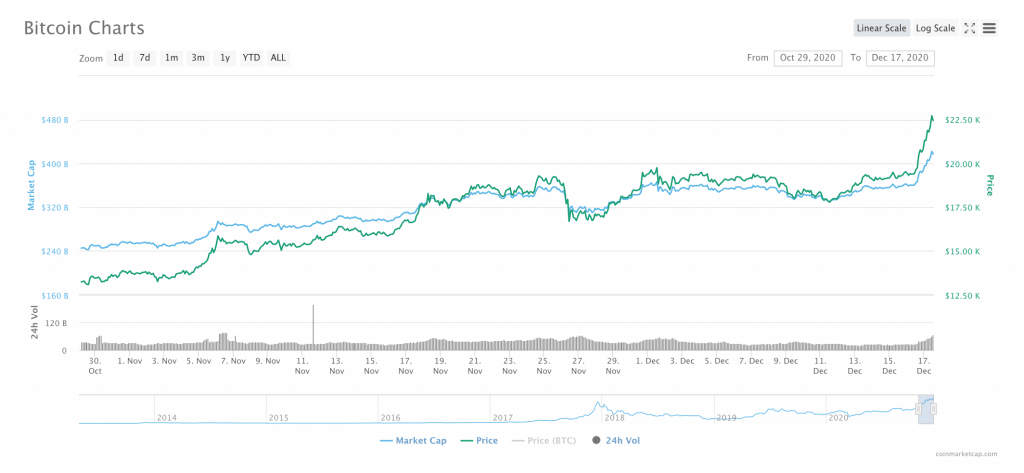

While BTC’s lifespan is still relatively short in the grand scheme of things, it may be safe to say that in a way, this $20K has been a long time in coming, for some, agonizingly long (particularly the last several weeks, when Bitcoin )

“Just a Number”?

Moreover, the $20K milestone is especially significant because of BTC’s price run in late 2017. BTC did not quite have the momentum to break through the $20K ceiling; in fact, $20K seemed to be a sort of turning point for Bitcoin in 2017. The FOMO that was largely driving the rally was not fundamentally strong enough to sustain Bitcoin. (We all know what happened next.)

Now, things have changed. Three years later, it seems that BTC has finally come full-circle from its 2017 boom (and bust.) And while BTC’s journey past $20K may have felt like a long journey to some, BTC’s transition from ‘magic internet money’ to the mainstream world of finance has been remarkably quick.

Indeed, in a statement shared with Finance Magnates, Matteo Dante Perruccio, President International of Wave Financial Group, said that “while $20,000 is just a number, the real story is that it has only taken 12 years for Bitcoin to become a generally accepted financial asset.”

What has caused Bitcoin to have achieved this status as a ‘generally accepted financial asset’? To finally crash through $20,000, and to hurtle past it?

Large Institutions and Hedge Funds Are Betting Big on Bitcoin

Matteo Peruccio pointed to the fact that institutional investors are increasingly “embracing Bitcoin as an efficient inflation hedge and either a substitute for or complement to gold.”

Indeed, “the recent news of Ruffer IC, the prominent investment manager, diversifying into Bitcoin is certainly contributing to this move and will only serve to pave the way for more institutional investment into digital assets,” he said.

A number of other institutional investors have recently made their way into Bitcoin in a very public way.

Indeed, Dan Simerman, Head of Financial Relations at the IOTA Foundation, told Finance Magnates that “institutional demand is finally here.”

“With traditional financial institutions like Guggenheim Partners exploring Bitcoin, it’s clear that the king of digital assets is no longer at risk of ‘going to zero’ and is starting to be treated as a real asset with real value.”

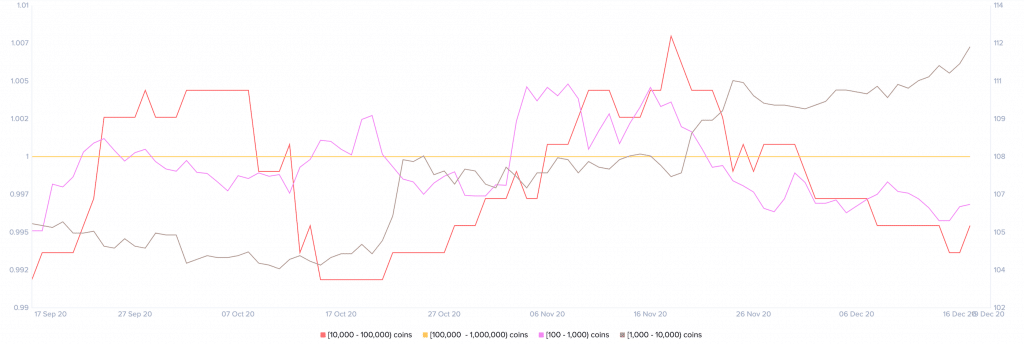

This increased institutional interest in Bitcoin is represented in the number of BTC wallets that contain between 1,000 and 10,000 BTC. Data from Santiment shows an increase from 1,692 such wallets one year ago to 2,193 wallets today; however, there have been decreases in wallets of slightly smaller (100-1,000) and larger (10,000-100,000) sizes.

What is particularly notable about these investments is the fact that many of these institutions seem to be viewing Bitcoin as a hedge against inflation.

“I am not a millennial investing in cryptocurrency,” wrote Jones in a letter to investors, “but a baby boomer who wants to capture the opportunity set while protecting my capital in ever-changing environments.”

Additionally, he said that “the best profit-maximizing strategy is to own the fastest horse,” says Jones. “If I am forced to forecast, my bet will be Bitcoin.”

And Paul Tudor Jones is not the only hedge fund manager who sees Bitcoin this way: a number of other big names in the hedge fund world have recently tossed their hats into the BTC ring, including Guggenheim Partners, MassMutual, Stan Druckenmiller and Ray Dalio.

Furthermore, Wave’s Matteo Peruccio pointed out to Finance Magnates that a recent survey by Bank of America has “indicated that one of the most common trades among hedge funds is to buy Bitcoin and sell the US dollar, which should provide continued support.”

Indeed, “there continues to be a strong argument for Bitcoin being seen as not only a legitimate store of value but an inflation hedge during times of economic uncertainty.”

Retail Investors Are Also Flocking to Bitcoin

And it is not only financial institutions that seem to be looking to BTC as a possible protection against USD inflation.

In addition to the increased institutional interest in Bitcoin, there also seems to be a wave of new retail interest that has hit BTC.

Matt Luongo, Chief Executive of Thesis, the a16z-backed crypto venture firm behind Visa’s first Bitcoin rewards card, pointed out that “there’s no real way to know who exactly is buying bitcoin.”

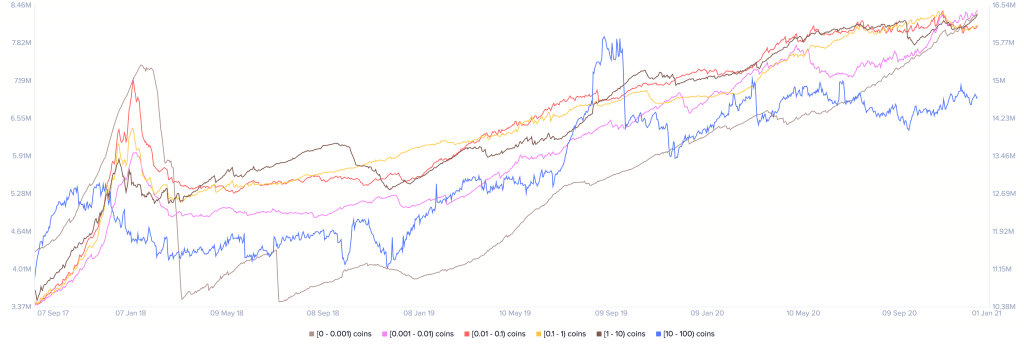

However, “what we can observe is a major spike in new Bitcoin addresses,” he said. “According to Glassnode, the number of new BTC addresses registered per hour hit nearly 25,000 addresses for the first time since January 2018 — the month following Bitcoin’s all-time high of $20,000.”

For example, in November of 2019, there were 670,000 BTC wallets with 1-10 BTC in them, and 7.56 million BTC wallets with 0.001 to 0.01 coins in them. Now, there are 675,5000 wallets with 1-10 BTC and 8.37 million BTC wallets with 0.001 to 0.01 coins.

“From a Tech Adoption Perspective, the Market Has Now Evolved to a Point Where We’re Ready to Use Bitcoin in New Ways.”

Beyond the ‘BTC as store-of-value’ narrative, Bitcoin is significantly more accessible and practical for retail investors than it was a year ago.

This is largely because of that it would be offering its more than 305 million users the option to buy and hold Bitcoin and several other cryptocurrencies, as well as the ability to use BTC to pay for goods and services in PayPal-connected merchants.

But it is not just PayPal that has made Bitcoin more accessible to the average retail investor. Matt Luongo told Finance Magnates that “from a tech adoption perspective, the market has now evolved to a point where we’re ready to use Bitcoin in new ways.”

“You can buy BTC and immediately put it to work (not just wait for the price to go up) in more high-opportunity ecosystems, like the DeFi space that’s happening on Ethereum,” he said.

“People are making money by putting it into alternative peer-to-peer financial applications that offer the same services such as lending and borrowing, for example,” he added. Indeed, companies that offer loans and interest-bearing crypto accounts have recently announced record-breaking amounts of assets under management.

Additionally, “DeFi applications are providing opportunities for people to collateralize, loan, stake their BTC in ways never before possible,” Luongo said.

In other words, retail adoption could be poised to grow even bigger. told Finance Magnates that “we’ve seen retail investors rushing in to convert their cash into crypto, to build their digital asset portfolio and build wealth by earning compounding interest.”

What Could Cause Bitcoin to Fall?

Of course, it is possible that BTC’s upward trajectory could change, in fact, retracements are almost an inevitability.

However, there are also certain forces that could pose more serious threats to Bitcoin over the long-term. Dr. John Edmunds, a financial expert and professor at Babson College, told Finance Magnates that “the most immediate risk to Bitcoin is an ill-considered attempt to tax Bitcoin.”

“It is possible to tax cyber currency income but requires new approaches, not ham-fisted, bumbling attempts,” he said. “It is very easy to scare cyber currency businesses away from any country that is too crude, clumsy or punitive in its treatment of cyber currency.”

However, “unlike the last, the alternative financial system has grown tremendously. We’re beginning to see real, parallel economic activity outside of trading, [as well as] commerce and credit facilities. This growth represents real adoption, and it won’t disappear when the next bubble bursts.”

Where do you think Bitcoin is headed next? Let us know in the comments below.

What Pushed Bitcoin Over $20K, and What’s Next?

More from AnalysysMore posts in Analysys »

Be First to Comment