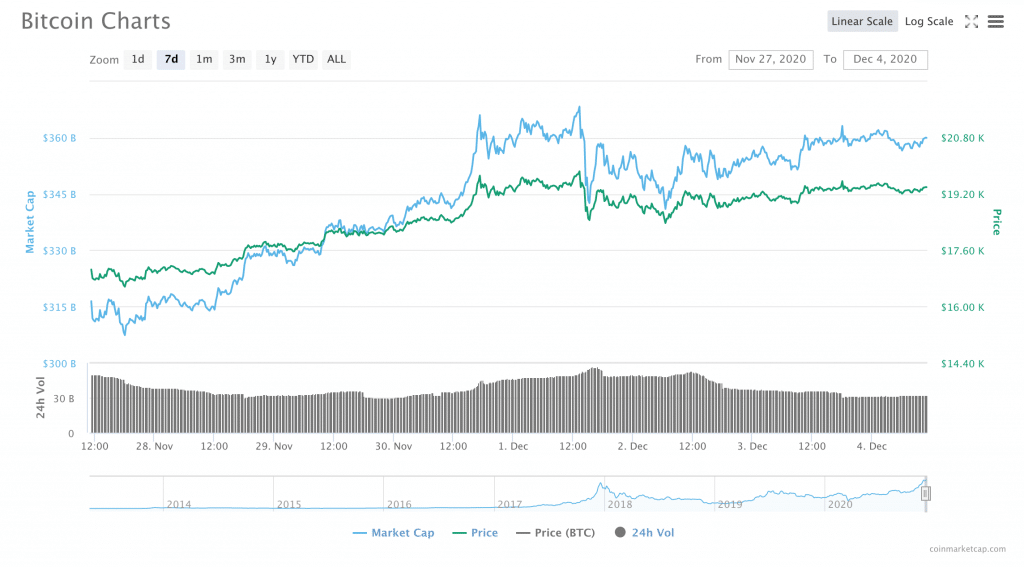

For several weeks, Bitcoin has been inching ever-closer to $20,000.

It’s almost silly: according to data from CoinMarketCap, Bitcoin reached as high as $19,816, so close to $20k that in some regards, it may as well be $20k. And yet, the final push past that magical number still has not quite taken place.

Nonetheless, for the moment, Bitcoin’s position over $19k has held steady since Monday. Before then, BTC has steadily climbed from just under $13,700 a month ago to where it is today, and it does not seem to be showing any signs of slowing down anytime soon.

“I No Longer See Any Structural Concerns That Would Prevent Bitcoin from Surpassing $20K and Reaching Much Loftier Valuations by 2021.”

Therefore, many analysts seem to believe that it is likely that Bitcoin will surpass the $20k mark within the next several weeks.

Indeed, Kadan Stadelmann, Chief Technology Officer at Komodo, told Finance Magnates that he “would not be surprised to see bitcoin going past $20,000 by the end of the year.”

Similarly, Market Strategist and CFA, Alex G. Piré told Finance Magnates that while Bitcoin has not quite managed to top $20k, it is only . Though, there may be some retracements along the way.

In fact, there have already been that have kept Bitcoin from $20k over the last two weeks. “After reaching $19,187 on 11/23, we saw some profit-taking which was to be expected after a strong bull run recovering back to the highs of late 2017,” Piré told Finance Magnates.

In other words, “I no longer see any structural concerns that would prevent Bitcoin from surpassing $20K and reaching much loftier valuations by 2021,” he said.

However, Stadelmann also sees some bumps along the road to $20k. “As BTC approaches $20K, I predict that there will be several corrections along the way,” he said. “Bitcoin has always had a volatile history, so I wouldn’t be surprised to see dips of 30% or so before it rebounds and continues on its path to $20K and beyond.”

But, what is keeping Bitcoin from reaching $20k in the meantime?

Alex Green, Managing Partner of Voor Group, told Finance Magnates that “numerous factors play into crypto pricing.”

“One interesting technical angle explored is the idea that represents a sort of dilutive tax,” he said. “That is, as miners start mining more, they must exchange that bitcoin for fiat denominations in order to pay for energy cost and computing power that is denominated in fiat currency – because of this, , a lagging outflow is seen as miners look to monetize their rewards.”

“This requires an inverse reactionary inflow to keep the price moving upward,” Green explained. “The and subsequent influx probably propped the recent bull run, however, I have a feeling technical pressures around the outflow of miners have caused it to ceiling around the number we have seen for the past weeks.”

David Merry, the Chief Executive of Coin Journal, also pointed to the “PayPal exposure” as an important factor in the Bitcoin price, told Finance Magnates that “Bitcoin has seen a lot of growth since September with investors reacting to the acceptance of cryptocurrencies by PayPal and Square, signifying a general acceptance of cryptocurrencies.”

Retracements on the Road to $20k and Past

Therefore, it may be a while before Bitcoin begins to build solidly past the $20k mark.

“I believe we will see just over $20k, maybe 21,000 – but not $25,000 for at least another couple of months if ever before 2022,” Green told Finance Magnates.

And there is a chance that the retracement could be much bigger than just a few hundred bucks. “If this ceiling holds, and the value is backed down, and we settle between $13-15k, then it will remain there until another inflow event stimulates more mining,” he said.

This could occur “probably somewhere in mid-late 2021 coinciding with changing monetary policy from the Fed,” he said. “The Fed will have to inject more liquidity by then to reach its 2% inflation target, and that event is a potential target for mass inflows due to Bitcoin’s uncorrelated-asset nature.”

”The Demand for Bitcoin Is Here Increasing, and the Price Is Reflective of the Interest from Large Players.”

The rapid rise from around $14,000 to nearly $20,000 this month has certainly caused some analysts to draw comparisons between this rally and the price rally that brought Bitcoin close to $20,000 in late 2017, a rally that resulted in an abrupt market crash.

Stadelmann said that while “we are seeing very similar trends right now to the all-time highs in 2017,” there are some important differences this time around. “This time it is happening in a much more controlled manner which is supported by strong fundamentals,” he explained.

For example, “we are seeing a daily supply deficit for the first time in bitcoin’s history — roughly 900 BTC are mined every day (about 6,300 per week), and institutions like Greyscale, for example, acquired 7,350 BTC during the week of November 23-30th. The demand for bitcoin is here increasing, and the price is reflective of the interest from large players.”

2021 Could Be a Big Year for BTC

Therefore, Stadelmann foresees big things for Bitcoin in the future. “I predict that the next headlines will be about large entities buying and holding satoshis, or fractions of bitcoins, which will be just as impressive as the large amounts of bitcoin they are purchasing now,” he said.

Indeed, “I believe that in 2021 we are set to see a substantial increase in the institutional adoption of bitcoin and cryptocurrencies as well as increased efforts to support the infrastructure that is the foundation of blockchain interoperability,” Stadelmann explained.

“, and I think that investors will continue to look for a hedge against this spending and its subsequent effects on the economy — I believe that they will do so through bitcoin. My prediction is that an increase in institutional interest will spark an emphasis on decentralized exchanges of value as we enter 2021.”

Piré also sees a strong case for BTC moving upward in 2021. “The structural case for BTC is strong with institutional interest from major banks like Goldman Sachs and Citi to name just a few,” he said. Additionally, he pointed to “ease of trading for retail investors” through “platforms like Paypal and Robinhood embracing BTC and other cryptocurrencies should enable BTC to push higher in 2021.”

“From an institutional level, this will drive a large line of research in the topic and exploration of broader use cases for blockchain,” Green explained.

Additionally, “I believe will also start to really define bitcoin itself as a store of wealth and nothing more. It still has the volume and first-mover advantage to keep that seat in alt crypto assets, and I expect to see more institutional excitement, especially in the first of 2021 in the VC space surrounding blockchain-based startups.”

What’s Keeping Bitcoin under $20k?

More from AnalysysMore posts in Analysys »

Be First to Comment