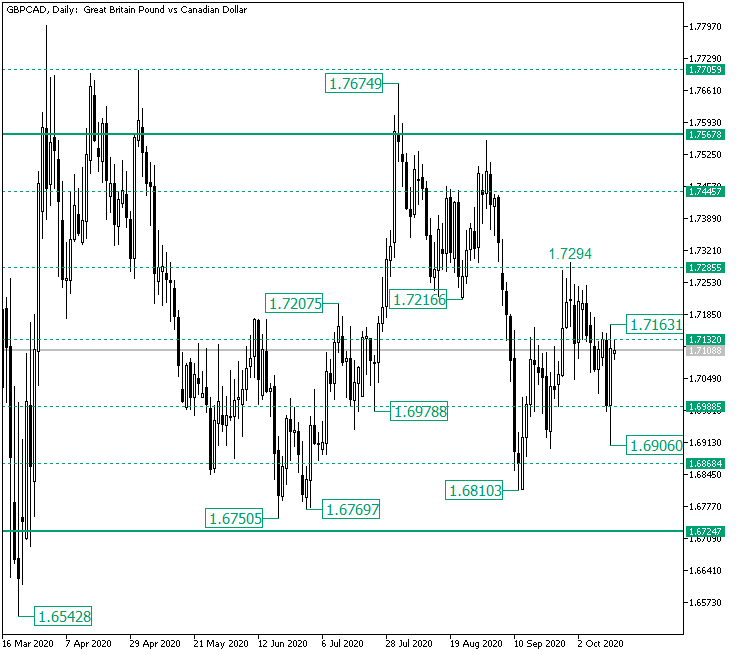

The Great Britain pound versus the Canadian dollar currency pair seems not to let go of the idea of rising.

Long-term perspective

The appreciation that came into being from the low of 1.6542 — after the level of 1.6724 was falsely pierced — managed to extend beyond the 1.7567 resistance level.

However, further rise was limited by the 1.7705 intermediary level. From that point onward, the price was bounded by the 1.6724 (and 1.6868) as support and 1.7567 as resistance.

The last validation of the support took the shape of an increase that started from the 1.6810 low and — as of writing — coined the 1.7294 high.

But the 1.7285 intermediate level seems to be dominated by bears, as it fueled a depreciation strong enough to put the price under the 1.7132 intermediary level.

Nevertheless, after the fall from 1.7132, the price rendered the piercing of 1.6988 — which defined the 1.6906 low — as a false one. As a result, the bulls sent the price back to 1.7132.

If the bulls succeed in validating 1.7132 as support, then they can have an open path to 1.7285. On the flip side, if 1.7132 remains resistance, a new fall may be expected, and 1.6868 could be its target.

Short-term perspective

From the 1.6810 low, the price started an ascending trend, which extended until the 1.7294 high.

From there, an apparent trend change took place, as the intermediary support of1.7094 gave way.

But the firm 1.6965 level kept the bears in check, as it drove the price back above the 1.7094 intermediary level.

So, as long as 1.7094 remains support, 1.7244 is the next objective. On the other hand, if 1.7094 shifts role to resistance, then it may serve as the starting point for a new impulsive swing, targeting 1.6842.

Levels to keep an eye on:

D1: 1.7132 1.7285 1.6868

H4: 1.7094 1.7244 1.6842

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Be First to Comment